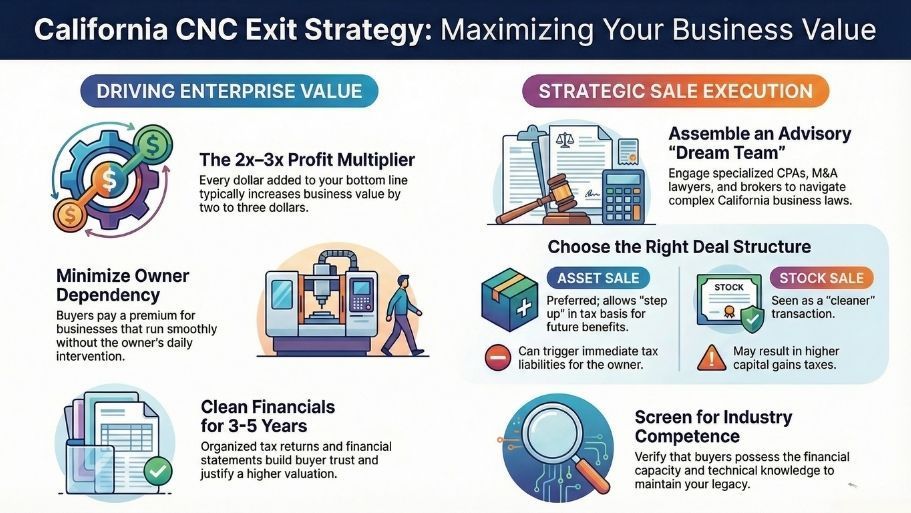

Buyers will look closely at your company's financial performance, specifically net profit, discretionary earnings, sales, and growth. Generally, each dollar added to your bottom line can increase your business's value by two to three dollars. For instance, increasing your bottom line by $20,000 could boost your business's value by $40,000 to $60,000.

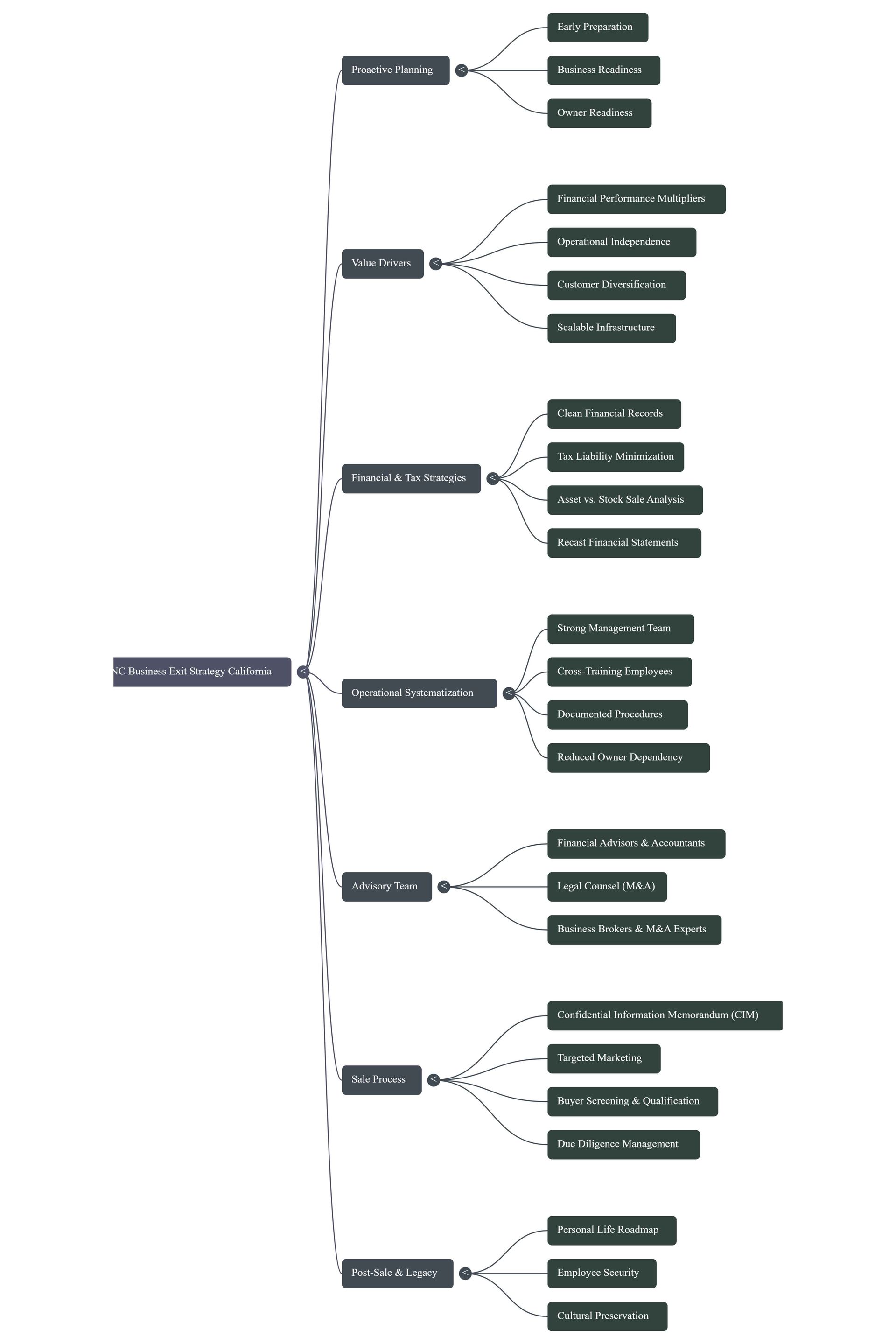

CNC Business Exit Strategy for California Owners

CNC Business Exit Strategy in California

Planning your CNC business exit strategy in California? Learn key steps for valuation, preparation, financial considerations, and building your advisory team for a successful sale

Thinking about transitioning your CNC business in California? It's a big step, and honestly, most owners don't really plan for it until it's too late. You've put in years, maybe decades, building this thing up. Making sure you get the best deal when you finally decide to sell isn't just about luck; it's about smart planning.

This guide is designed to help you develop a comprehensive CNC business exit strategy in California, covering everything from preparing your manufacturing CNC shop to ensuring a smooth transition after the sale.

We'll break down what buyers look for, how to sort out your finances, and why having the right people in your corner makes all the difference.

Key Takeaways

- Start planning your exit from your California CNC business early. Waiting too long makes things harder and can cost you money.

- Make your business less about you. Buyers want to see that the shop can run smoothly even if you're not there every day.

- Get your financial records clean and organized. Good books make your business look more valuable and trustworthy to potential buyers.

- Figure out the tax stuff before you sell. Working with a tax pro can save you a lot of money when the deal is done.

- Build a team of advisors (like accountants and lawyers) who know about selling businesses. They'll help you avoid mistakes and get the best outcome.

Table of Contents

- Understanding Your CNC Business Exit Strategy in California

- Preparing Your California CNC Business for Sale

- Financial and Tax Considerations for Your Exit

- Building Your Advisory Team for a Successful Exit

- Navigating the Sale Process for California CNC Businesses

- Post-Sale Planning and Legacy Considerations

- Wrapping Up Your CNC Business Exit Strategy in California

- Frequently Asked Questions

Understanding Your CNC Business Exit Strategy in California

The Importance of Proactive Exit Planning for CNC Shops

Thinking about selling your CNC business in California? It's a big step, and doing it right means planning ahead. Proactive exit planning for machine shops in CA isn't just about finding a buyer; it's about making your business as attractive and valuable as possible.

This approach helps you get the best return on your years of hard work and investment. Without a solid plan, you might leave money on the table or face unexpected hurdles. A well-thought-out strategy sets the stage for a successful transition.

Key Factors Driving CNC Business Valuation

Several things make your CNC business more appealing to buyers and increase its sale price. These include strong financial performance, clean and organized financial records, and a business that doesn't rely too heavily on you, the owner.

Developing your staff and infrastructure also plays a big part. Buyers look for businesses that can run smoothly without constant owner intervention. Additionally, minimizing customer concentration risk, meaning you don't have too many clients accounting for a large portion of your revenue, is important. A diverse client base shows stability.

Assessing Owner and Business Readiness for Transition

Before you even think about listing your business, you need to assess readiness. This involves two main areas: owner readiness and business readiness.

Are you, as the owner, mentally, emotionally, and financially prepared to step away? This is a significant personal change. On the business side, is your company structured for a sale?

This means having solid operational systems, a capable team, and clear financial documentation. Buyers want to see a business that is not only profitable but also stable and scalable. A business that can continue to grow after you leave is far more attractive.

Here's a quick checklist for readiness:

- Owner Readiness:

- Emotional preparedness for life after business.

- Financial security to support your post-sale lifestyle.

- Clear vision for your future activities.

- Business Readiness:

- Documented operational procedures.

- Cross-trained and capable employees.

- Clean financial statements and tax returns for the past 3-5 years.

- Diversified customer base.

Preparing your CNC business for sale involves more than just tidying up the shop floor. It requires a strategic look at operations, finances, and your own personal transition. Taking these steps early can significantly impact the final sale price and the overall success of your exit.

Don't have time to read more?

Take a shortcut and play the video overview below

Preparing Your California CNC Business for Sale

Getting your California CNC business ready for sale involves several key steps. Proactive preparation significantly impacts the final sale price and the ease of the transaction. Think of it as getting your shop in top condition before a major inspection. This stage is about making your business as attractive as possible to potential buyers, whether you're selling a CNC shop in California or a broader manufacturing operation.

Minimizing Owner Dependency in Operations

Buyers want to see a business that can run smoothly without the owner's constant presence. This means developing a strong management team and clear operational procedures. Cross-training employees is also a smart move, ensuring that critical tasks don't rest on just one person's shoulders. The goal is to demonstrate that the business's value isn't tied solely to your personal involvement. This makes the California manufacturing business sale process much smoother.

Developing Staff and Infrastructure for Scalability

Look at your current staff and infrastructure. Can they handle increased demand? Investing in training for your team and improving your operational systems can show buyers that the business has room to grow. This includes having solid procedures for everything from quoting jobs to managing production. A well-documented infrastructure suggests a stable and scalable operation, which is a big plus when selling a machine shop in California.

Addressing Customer Concentration Risks

High customer concentration can be a red flag for buyers. If a large portion of your revenue comes from just a few clients, it presents a risk. Work on diversifying your customer base. This could involve expanding into new geographic areas, seeking out new clients, or offering new services. If diversification isn't feasible, focus on strengthening relationships with your key clients. This shows commitment and stability, important factors in California metal fabrication business valuation.

Financial and Tax Considerations for Your Exit

Getting your finances in order is a critical step before selling your California CNC business. Buyers will scrutinize your financial health, so clear and organized records are a must. This includes having up-to-date financial statements and tax returns readily available. Properly documenting the owner's salary and benefits simplifies the buyer's due diligence process.

Organizing Financial Statements and Tax Returns

Review your financial statements and tax returns with your CPA. Ensure that the owner's salary and any owner's benefits or expenses are clearly identified. After an offer is accepted, you will need to prove these expenses to prospective buyers. It becomes a much easier process if these items are easily identified and tracked.

Implementing Tax Strategies to Minimize Sale Impact

Meet with your CPA to plan for taxes on the eventual sale of your business. Developing a tax strategy can lead to substantial savings. There are various strategies to reduce and defer taxes on the sale of your business. If your tax advisor isn't familiar with these, consider seeking out a CPA who specializes in tax planning for business sales. This proactive approach can significantly impact your net proceeds.

Understanding Stock vs. Asset Sale Implications

Buyers often prefer asset sales because they can step up the tax basis of the assets, leading to future tax benefits. However, an asset sale can trigger immediate tax liabilities for the seller. A stock sale, on the other hand, may offer a cleaner transaction for the buyer but can result in higher capital gains taxes for the seller.

Discussing these implications with your advisors is key to choosing the structure that best suits your situation. This decision can have a major impact on your after-tax proceeds from the sale, so it's worth careful consideration. You can find more information on business valuation methods that influence these decisions by clicking on this link: https://www.midmarketbusinesses.com/cnc-manufacturing-business-valuation-in-california

Take a deep dive comparison:

Building Your Advisory Team for a Successful Exit

Selling your California CNC business requires more than just finding a buyer; it demands a strategic approach supported by experienced professionals. As you prepare to transition, assembling the right advisory team becomes paramount. This team acts as your guide, helping you navigate complex financial, legal, and transactional landscapes to achieve the best possible outcome.

The Role of Financial Advisors and Accountants

Financial advisors and accountants are foundational to your exit strategy. They help organize your business's financial health, making it transparent and attractive to potential buyers. Accountants will meticulously prepare your financial statements and tax returns, identifying areas for improvement and ensuring accuracy. This financial clarity is non-negotiable for a successful sale. Financial advisors, on the other hand, focus on the broader financial implications of the sale, including tax strategies and wealth management post-transition. They help you understand how different sale structures, like stock versus asset sales, impact your net proceeds.

Engaging Legal Counsel for Transactional Support

Legal counsel plays a critical role in protecting your interests throughout the sale process. Attorneys specializing in mergers and acquisitions (M&A) will draft and review all legal documents, from non-disclosure agreements to the final purchase agreement. They ensure compliance with California's specific business laws and regulations, mitigating potential legal risks. Their involvement is key to structuring a deal that is both legally sound and favorable to you.

Leveraging Business Brokers and M&A Experts

Business brokers and M&A advisors bring specialized market knowledge and a network of potential buyers. They help in valuing your CNC business, preparing marketing materials, and managing buyer interactions. These professionals understand the nuances of the manufacturing sector in California and can identify buyers who are a good fit for your company's operations and culture. They often manage the negotiation process, allowing you to focus on running your business during this critical period.

We created a comparison side-by-side matrix to help you choose the right help:

Successfully selling your California CNC business involves a structured approach, moving from initial marketing to the final closing. This phase requires careful attention to detail and strategic execution to attract the right buyers and secure a favorable deal.

Creating a Comprehensive Offering Memorandum

Your business's prospectus, often called a Confidential Information Memorandum (CIM), is a critical marketing document. It presents a detailed overview of your company to potential buyers after they sign a Non-Disclosure Agreement (NDA). The CIM typically includes a synopsis of your services, recast financial statements, company information, equipment lists, and staffing details (with names redacted).

A well-prepared CIM helps buyers understand your business's value and potential, making it easier for them to decide whether to proceed. This document is your chance to make a strong first impression and highlight what makes your CNC operation unique and attractive in the highly competitive manufacturing California market.

Targeted Marketing to Qualified Buyers

Effective marketing goes beyond simply listing your business for sale. It involves creating compelling advertisements with appealing headlines and informative copy that encourage prospective buyers to inquire further. We invest in advertising to ensure your business stands out on business-for-sale websites, appearing at the top rather than being lost among generic listings.

Furthermore, email marketing blasts to a database of interested buyers, including those specifically looking for manufacturing firms, help reach a targeted audience. This focused approach increases the likelihood of connecting with serious buyers who have the financial capacity and industry interest to acquire your CNC business.

Buyer Screening and Qualification for Manufacturing Firms

Verifying a buyer's competence and their ability to complete the transaction is paramount, especially in the manufacturing sector. Many inquiries may come in for manufacturing firms, but not all buyers possess the necessary industry knowledge or financial backing to close a deal.

We carefully analyze prospective purchasers, assessing their financial qualifications and their capability to operate the business successfully. This screening process helps identify buyers who are most likely to close and who will maintain the business's operational integrity and employee job security.

Identifying buyers with a proven track record in manufacturing or a strong understanding of the CNC industry significantly increases the probability of a successful sale. We facilitate initial meetings to pre-screen buyers, followed by meetings with you and the potential buyer to discuss business specifics. This due diligence on the buyer side is as important as the due diligence they will perform on your business. You can find resources for business advisors who understand these processes at

Rogerson Business Services for companies with an annual revenue from $2M to $100M located in California.

Post-Sale Planning and Legacy Considerations

Developing a Personal Plan for Life After Business

After dedicating years to your CNC business, the transition to life after sale can feel disorienting. Many California owners find that a lack of personal planning leads to regret. It is vital to create a roadmap for your post-business life.

This plan should address your financial needs, personal interests, and social connections. Consider what activities will bring you fulfillment and how you will maintain a sense of purpose. This proactive approach helps prevent a void and ensures a satisfying next chapter.

Ensuring a Smooth Transition for Employees

Your employees are the backbone of your CNC operation. A well-managed transition respects their contributions and secures their future. Communicate openly about the sale and the new owner's plans. Work with the buyer to establish clear roles and responsibilities for the existing team.

Cross-training initiatives, previously implemented for business scalability, now benefit employees by broadening their skill sets for the new environment. This thoughtful approach minimizes disruption and retains valuable talent.

Preserving Your Legacy Through a Successful Sale

Your legacy extends beyond the sale price. It encompasses the impact your business has had on the industry, your community, and your employees. A successful sale, where the business continues to thrive under new ownership, is a testament to your leadership. Consider how you want your business to be remembered. This might involve ensuring the company culture is maintained or that its contributions to the California manufacturing sector continue. A well-executed exit strategy solidifies your business's positive and lasting impact.

Thinking about what happens after you sell your business is super important. It's not just about the sale itself, but also about making sure everything is set up for the future, both for you and for the business. This includes planning for your own next steps and considering how the business will continue on.

Don't leave these crucial details to chance.

Start your preparation today to learn how to plan for a smooth transition and secure your business's future.

Wrapping Up Your CNC Business Exit Strategy in California

So, we've gone over a lot of ground about getting your California CNC business ready for sale. It might seem like a lot, but remember, planning ahead is the name of the game. Think of it like getting your shop organized before a big job – the better prepared you are, the smoother the process will be. Don't try to do it all yourself, though.

Bringing in the right people, like accountants and advisors who know the ins and outs of selling businesses, can make a huge difference. They've seen it all before and can help you avoid common pitfalls. Ultimately, a well-thought-out exit strategy isn't just about selling your business; it's about securing your future and making sure all the hard work you've put in pays off.

Start thinking about it now, and you'll be in a much better position when the time comes.

FAQs CNC Business Owners Ask in California

Why is it important to plan my CNC business exit early in California?

Planning your exit early is like preparing for a big trip. It helps you make sure your business is in the best shape possible when it's time to sell. This means you can likely get more money for it and have a smoother sale process. It's better to get things in order now than to rush when you're ready to leave.

What makes my CNC business valuable to buyers in California?

Buyers look at a few key things. They want to see that your business makes good money and has clear, organized financial records. They also like it when the business doesn't depend too much on you, the owner, to run smoothly. Having good systems in place and a steady group of customers also adds value.

How can I make my CNC business less dependent on me?

To make your business less reliant on you, focus on training your employees well. Give them more responsibilities and encourage them to learn different jobs. Also, create clear instructions and systems for how things are done every day. This way, the business can keep running smoothly even when you're not there.

What are the main financial and tax things to consider when selling my CNC business in California?

You'll need to have your financial records and tax papers neat and easy to understand. It's smart to talk to a tax expert about how to lower the taxes you'll owe on the sale. Also, understanding whether you'll sell the business's assets or its stock is important, as this affects taxes differently.

Who should be on my team to help me sell my CNC business?

You'll want a team of experts. This includes a financial advisor to help with money matters, an accountant to sort out taxes, and a lawyer to handle the legal parts of the sale. A business broker or M&A expert can also help find buyers and manage the selling process.

What happens after I sell my CNC business?

After the sale, it's important to have a plan for your own life. Think about what you want to do next. Also, make sure the transition is smooth for your employees, so they know what to expect. A good sale leaves a positive mark and ensures your business's future is secure.

Hey there! Can we send you a gift?

We just wanted to say hi and thanks for stopping by our little corner of the web. :) we'd love to offer you a cup of coffee/tea, but, alas, this is the Internet.

However, we think you'll love our email newsletter about building value and properly position your company before transition/exit your business ownership.

As a special welcome gift for subscribing, you'll also get our helping and educational guides, tips, tutorials, etc.. for free.

It's filled with the best practices for retiring serial business owners like Dan Gilbert, Larry Ellison, Warren Buffett, and many more.

Just sign up for our emails below.