Pro Tip: Try a free business valuation if you want to see your options or start thinking about selling your business.

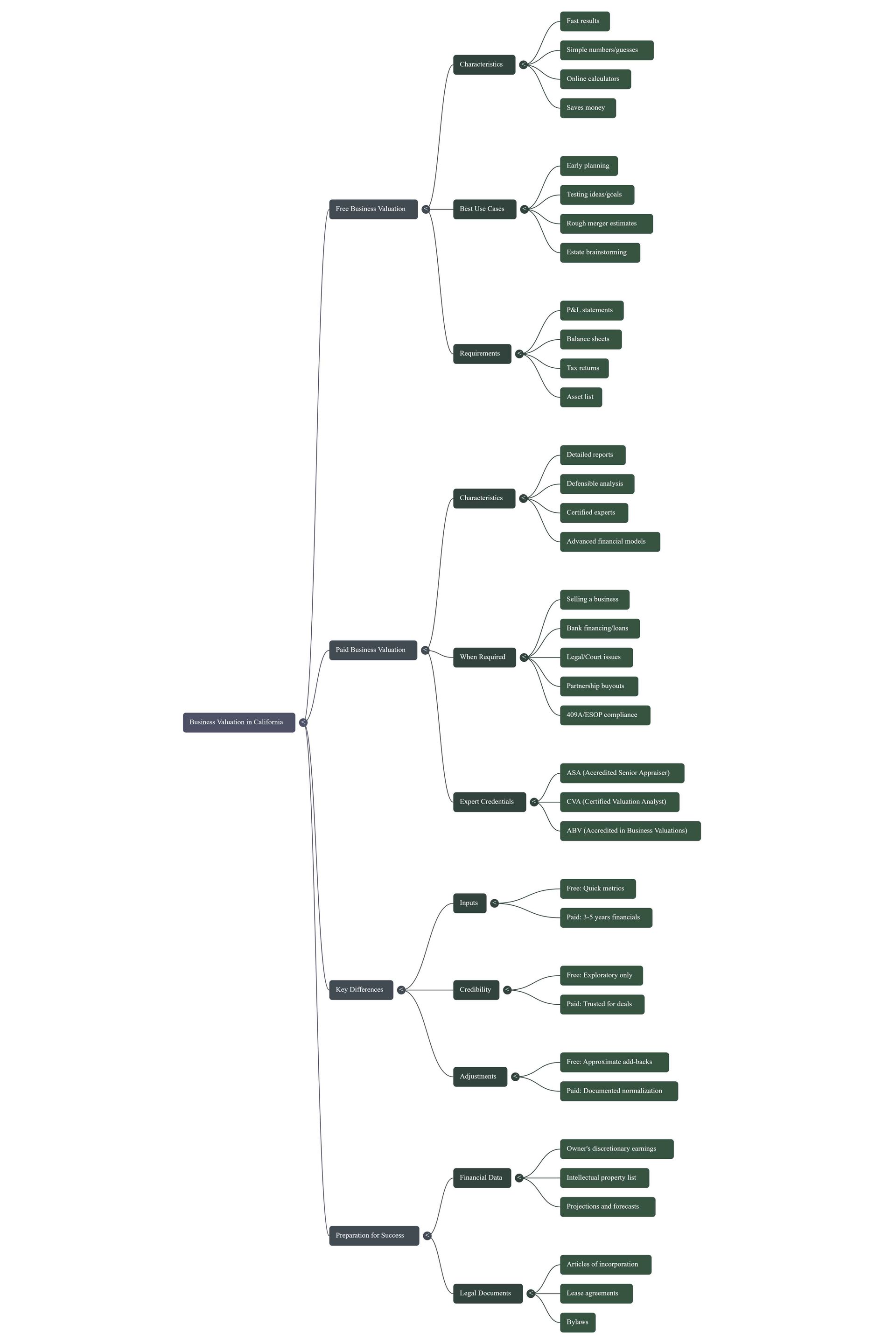

Should You Choose Free or Paid Business Valuation in California

Free or Paid Business Valuation: (Hint) FREE is Costly in California

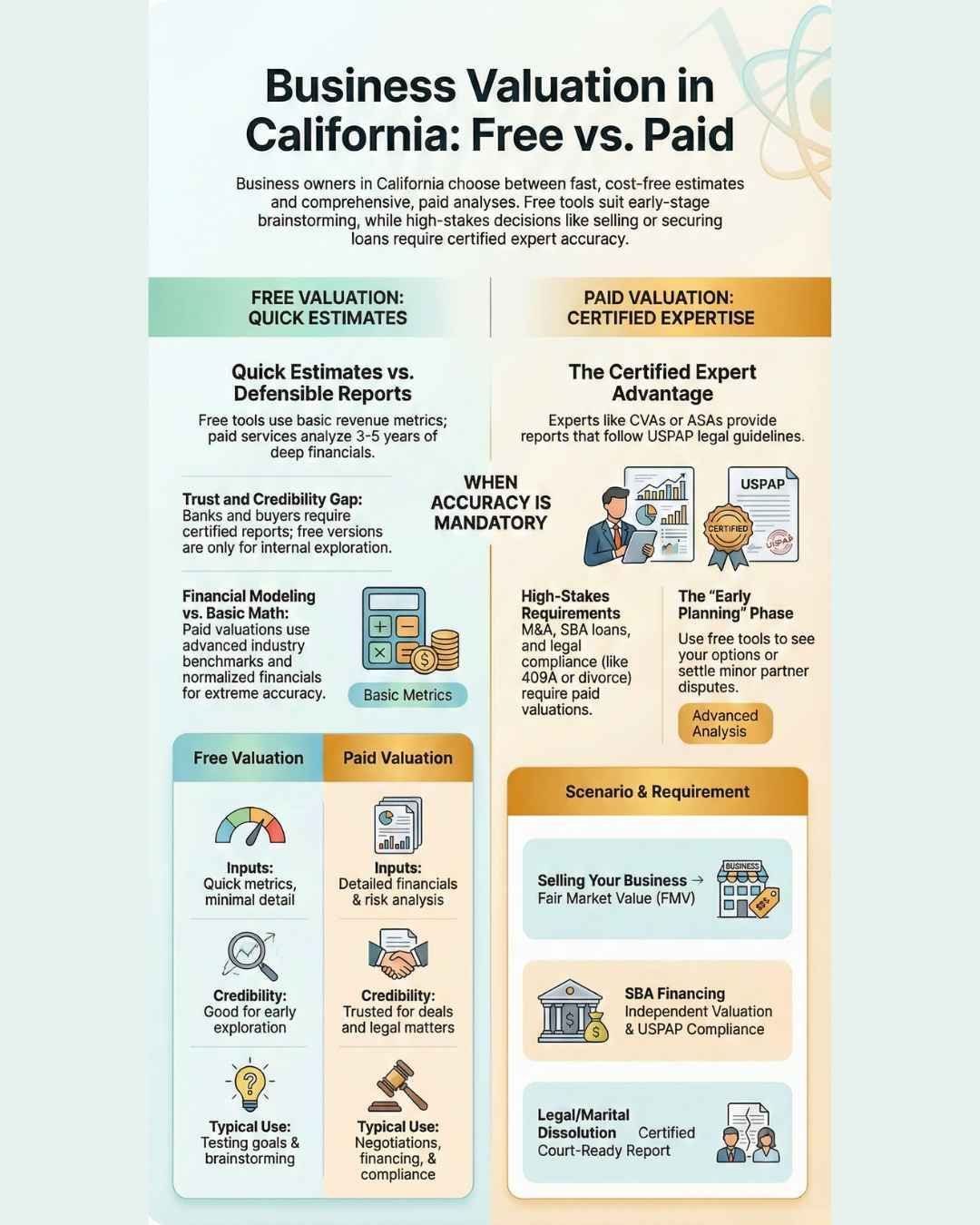

When you want to find out how much my business is worth, you can choose between a free business valuation and a paid business valuation in California. Your decision will depend on your specific needs.

If you want fast results, a free business valuation provides you with simple numbers quickly. However, if you require a careful and trusted valuation for business, such as for mergers and acquisitions, financing, or partner buyouts, you should consider using paid business valuation services that are paid.

Many business owners in California seek valuations for tax planning, succession, or strategic planning. Before making your choice, check out a free business valuation tutorial in 7 steps to learn the basics and evaluate the risks and benefits involved.

Key Takeaways:

- Free business valuations give fast guesses. They are good for early planning or trying out ideas.

- Paid business valuations give detailed reports. These are needed for big choices like selling or getting loans.

- Use free valuations for simple numbers.

- Use paid ones when you need to be exact and trusted.

- Get your documents ready for both free and paid valuations. This helps make them more correct and reliable.

- Picking the right type of valuation can help you avoid big mistakes. It also helps you gain trust from investors.

Table of Contents

Free Business Valuation vs Paid Valuation

What Free Business Valuation Offers

You might want to know your business’s value fast. A free business valuation checklist gives you a quick answer. You can use online calculators or simple tools for this. These tools ask for basic things, like your revenue and profit. They use common ways to figure out value, like the income approach, market approach, or asset approach.

You do not need to collect many documents. Many California business owners in software, e-commerce, healthcare, and food services use these free tools for a rough idea.

Here are some industries that often use free business valuation services:

Industry Category

- Software & SaaS

- E-Commerce

- Healthcare Services

- Food & Beverage

- Manufacturing

- Distribution / Logistics

- IT Services

- Staffing and Recruiting

- Commercial Services

- Engineering Services

- Other

A free business valuation saves money. You do not pay, and you get a number for early planning or to test your goals. But these tools only give you a general range. They do not check every detail about your business.

What Paid Valuation Includes

If you want a more detailed answer, you should get a paid business valuation service in California. Paid valuations go much deeper than free ones. You work with a professional who asks for your financial statements, tax returns, and business plans.

They look at your assets, forecasts, and even your intellectual property. The expert business valuator, like Andrew Rogerson in California, uses advanced financial models and industry research to find your business’s true value.

Here is what you can expect in a paid valuation report:

- Financial statements from the last 3-5 years

- Tax returns for at least two years

- List of patents, trademarks, and goodwill

- Business forecasts and projections

- Articles of incorporation and bylaws

- Owner’s discretionary earnings

- Photos of facilities and lease agreements

Paid valuations in California are done by certified professionals.

Some common credentials include:

| Credential Type | Description |

|---|---|

| Accredited Senior Appraiser (ASA) | Appraisers with special education and experience |

| Certified Valuation Analyst (CVA) | Experts who provide business valuation services |

| Accredited in Business Valuations (ABV) | CPAs who specialize in business valuation |

If you want to sell your business in California, get a loan, or solve a legal issue, you need a paid valuation. For example,

Andrew Rogerson of Rogerson Business Services is a certified M&A advisor. He helps business owners in California with companies earning $2 to $100 million a year. He knows how to prepare a strong valuation report that buyers, banks, and lawyers trust.

Comparing Depth and Accuracy

Let’s see how free and paid valuations are different:

| Free Valuation | Paid Valuation | |

|---|---|---|

| Inputs | Quick metrics, minimal detail | Detailed financials and risk analysis |

| Adjustments | Approximate add-backs | Normalized financials with documented logic |

| Output | Directional range for planning | Defendable report with clear conclusion |

| Credibility | Good for exploration | Trusted for deals and legal matters |

| Typical Use Cases | Early planning, testing goals | Negotiations, financing, legal compliance |

Paid valuations use financial modeling and industry benchmarks. This makes them more accurate than free methods. Free tools are fast and easy, but they may miss important details. If you use a free business valuation for a big decision, you could have problems. Wrong numbers can cause arguments, tax trouble, or missed chances. Overvaluing or undervaluing your business can hurt your reputation and your money.

Even paid valuations are not perfect. Big companies like Uber and WeWork have seen their values change a lot, even with expensive reports. But a paid valuation from a certified expert gives you the best chance for a fair and trusted result.

Don't have time to read more?

Take a shortcut and play the video overview below

Impact on Business Decisions

Negotiations and Selling

When you talk to buyers, your business valuation choice matters. A free business valuation gives you a fast guess. This is good for early talks or just checking if selling is smart.

But if you get serious, buyers want proof. They will ask for a report from a certified expert.

Paid valuations give you this proof. These reports show your numbers and explain your business strengths. They help you stand by your price.

Andrew Rogerson is a certified M&A advisor. He helps business owners in California with trusted reports. He works with companies that make $2 to $100 million. He knows what buyers want to see.

Financing and Investment

Banks and investors want more than just a number. They need to see

the whole story of your business. Lenders in California have strict rules for business valuations:

| Requirement | Description |

|---|---|

| Independent Valuation | Must come from a qualified source, not the seller. |

| Valuation Purpose | Prepared for the lender’s needs. |

| Asset Valuation | Needs an appraisal if assets are valued above book value. |

| Transaction Type | Must state if it’s an asset or stock purchase. |

| Financing Threshold | Needed if financing is over $250,000 or if buyer and seller are related. |

| Component Valuation | Must break down land, building, equipment, and intangibles. |

| Compliance | Must follow USPAP guidelines. |

Investors also look at your financials, market trends, and competition. They check your management team, too. They want to know if your business can grow and make money. A paid valuation gives them the details they need to trust your numbers.

Legal and Compliance

Legal issues need careful business valuations. Courts and lawyers want reports that follow the rules. You may need a full report, a summary, or just a value calculation. The right choice depends on your case. The law may say you must use fair value or fair market value. Your lawyer tells the appraiser what to include and which date to use.

Statutes and case law set the rules for each situation. If you use a free business valuation for legal issues, you might miss key details and not meet legal standards.

When to Use Free or Paid Valuation

Best Uses for Free Business Valuation

You might ask when a free business valuation is a good idea. It works well for quick checks or early planning. If you want to see how your business compares before talking to buyers or investors, this is helpful.

Here are some times you might pick a free business valuation:

- You want a rough number before a merger or acquisition.

- You need numbers for estate planning or gifting.

- You want to settle a problem with partners or family.

- You hope to get investors and need simple numbers.

A free business valuation lets you test your goals and see if you are ready for the next step. You do not need to collect many papers. You get answers fast, which is good for brainstorming or early talks.

When Paid Valuation Is Needed

Some situations need a paid valuation. If you need a report for legal or money reasons, you should work with a certified expert like Andrew Rogerson. Paid valuations follow strict rules and give you a trusted answer.

Here are some cases where paid valuations are needed:

| Type of Transaction | Valuation Requirement |

|---|---|

| Estate Planning | Fair Market Value (FMV) |

| Gifting | FMV |

| 409A Compliance | FMV |

| ESOP Compliance | FMV |

| Shareholder Buyouts | FMV |

| Marital Dissolution | FMV |

| Selling Your Business | FMV |

Paid valuations help you get fair prices, avoid mistakes, and follow legal rules. They also help you find risks and rewards during mergers and acquisitions. If you want to sell your business in California, experts like Andrew Rogerson can help you. He knows how to make reports that buyers, banks, and lawyers trust.

Making the Right Choice

Choosing between free and paid valuation depends on your goals.

Ask yourself these questions:

- Do you need a quick guess or a formal report?

- Is your choice low-risk or high-stakes?

- Will you use the valuation for planning or for a legal deal?

You can use tools like

discounted cash flow,

comparable company analysis, or precedent transactions. A decision tree can help you choose the right way. Avoid mistakes like picking the wrong method, missing market trends, or skipping key risks. If you start with a free business valuation, you can switch to a paid one when you need more details.

Preparing for Your Valuation

Getting Ready for Free Valuation

If you want a free business valuation, you do not need every paper. Having some important documents ready will help you get a better answer. You should start with these:

- Profit and loss statements

- Balance sheets

- Business tax returns

- Lease agreements

- Contracts

- List of assets

You can also gather details about owner perks and one-time income or costs. If you have old financial statements or a recent money report, bring those too. These papers help you get a more correct number, even if you use a simple online tool.

Tip: Giving more information helps you get a better estimate.

Preparing for Paid Valuation

If you need a paid valuation, you must be more detailed. Certified experts, like Andrew Rogerson in California, will ask for many documents. Here is what you should collect:

- Three years of tax returns

- Three years of profit and loss statements

- The most recent year-end and month-end balance sheets

- Lease information or market lease rates

- Accounts receivable and accounts payable reports

- Owner’s salary, health benefits, and company vehicles

- Family member salaries and their jobs

- Owner’s 401(k), life insurance, and pension costs

- Other owner benefits and expenses on your P&L and tax returns

You should also look at your financial statements for odd gains or losses. Make sure you fix things that do not happen every year. Check that owner's pay and rent match what is normal in the market.

Moving from Free to Paid

You might start with a free business valuation to get a quick idea. As your needs change, you may need a more official report. If you want to sell, get a loan, or deal with legal issues, it is time to upgrade.

Most business owners switch to a paid service when they need certified results or must follow legal rules. You can make the change by collecting more documents and working with a

certified valuation analystor M&A advisor. This step helps you get a trusted, detailed report that buyers, banks, and lawyers will accept.

You have two paths when you want to know what your business is worth. A free business valuation gives you a quick idea for early planning. For big moves like selling or getting a loan, a paid valuation works best. You get these long-term benefits:

- You see the real market value and avoid costly mistakes.

- You spot risks and make smarter choices.

- You build trust with investors and partners.

Start simple, but prepare well. When things get serious,

reach out to a pro for help.

FAQs For Business Owners in California

What is the main difference between a free and a paid business valuation?

A free valuation gives you a quick estimate. A paid valuation digs deeper and checks all your numbers. You get a report you can trust for big decisions.

When should I use a paid business valuation?

You should use a paid valuation when you want to sell your business, get a loan, or solve legal issues. Paid reports help you show buyers, banks, or lawyers that your numbers are solid.

Who can do a paid business valuation in California?

Certified experts like Andrew Rogerson of Rogerson Business Services can help. He knows how to value and sell businesses earning $2 to $50 million each year.

Can I start with a free valuation and switch to paid later?

Yes! You can try a free tool first. If you need more details or want to move forward with a sale, you can upgrade to a paid valuation anytime.

Hey there! Can we send you a gift?

We just wanted to say hi and thanks for stopping by our little corner of the web. :) we'd love to offer you a cup of coffee/tea, but, alas, this is the Internet.

However, we think you'll love our email newsletter about building value and properly position your company before transition/exit your business ownership.

As a special welcome gift for subscribing, you'll also get our helping and educational guides, tips, tutorials, etc.. for free.

It's filled with the best practices for retiring serial business owners like Dan Gilbert, Larry Ellison, Warren Buffett, and many more.

Just sign up for our emails below.