Prepare To Sell Your Business

Every business sale or exit requires three things:

- Owner readiness

- Business readiness

- Market readiness

Find out where you at on your journey to selling and exiting your business.

Are You Ready To Sell Now Or Later?

Baby Boomer business owners operate a total of 12 million privately held business in the United States. With this huge life-changing factor to retire, selling and transitioning a business is a reality that needs proper planning and a strategy to exit and sell at its highest valuation.

What Do You Want To Achieve?

What do you, as a retiring baby boomer business owner, hope to achieve in your transition to retirement?

Do you have specific goals in mind that you would like to accomplish before leaving your business behind?

Are there any particular activities or plans that you are looking forward to once your professional role has ended?

How do you envision this new stage in life unfolding?

Where Are You Now In Life?

At what stage in life are you as a retiring Baby Boomer business owner?

Are you assessing your finances and investments to ensure you have enough money saved for retirement, or maybe exploring new opportunities to maintain a sense of purpose and fulfillment?

Perhaps you're considering transitioning to something part-time or volunteering to help give back to the community. Maybe it's a combination of all these things.

Whatever stage you may be in now, it's important to take into account the unique challenges that come with being a Baby Boomer business owner who is nearing retirement age.

With the right planning and preparation, you can make sure that your future is secure and that your golden years will be filled with happiness and fulfillment.

What Is The Trigger Event?

What is the event that will cause you as a baby boomer business owner to begin your retirement?

With the large number of baby boomers reaching retirement age, what specific event will trigger your move away from your business and into retirement?

Are there any external factors that could be causing this shift, such as economic or societal pressures, or is it entirely on you to decide when it's time to let go of your business?

What are some of the implications of this trigger event for other stakeholders in the business, such as employees or investors?

Is there a way that these stakeholders can plan ahead to ensure a smoother transition process?

Define To Win

Retiring baby boomer business owners want to define their wins.

As a soon-to-be-retired baby boomer business owner, you understand the overwhelming feeling of wanting to assess the success of my career and make sure that my hard work has paid off.

It's important to you to measure how far you have come in terms of financial stability, as well as the legacy you have built in terms of family involvement, community impact, and relationships with employees and clients.

To define your wins, you need to take stock of all the tangible accomplishments, such as profit margins, but also intangible successes that can be harder to measure.

Comparing where you was when you first started this journey compared to now helps you feel a sense of accomplishment and pride in what you have been able to achieve through dedication, drive, and determination.

With retirement on the horizon, it's more important than ever for you to evaluate everything that came together for you along this path so that you can consider your time as a business owner a true success.

Road Map To Your Success

Retiring baby boomer business owners in California: when it comes to choosing the right exit for your business, you need to evaluate three key elements – the owner, the company, and the industry landscape.

It's important to define what a successful outcome looks like and measure that against how your business is currently doing and how it stacks up compared to other players in the market.

Doing so helps you understand exactly what needs to be done for an optimal exit strategy.

You'll be looking at variables such as your current financial position, customer base, competitive analysis, technology advancements, product/service offerings, and any unique opportunities that may exist in the marketplace that could benefit you.

Taking into account all these critical components ensures that no two exits are alike and provides you with a comprehensive view of which path will lead to the most rewarding outcome.

Rogerson Business Services Exit Assessment & Business Readiness Report

1.

Take the assessment quiz

2.

We analyze your answers

3.

We send you the readiness report

4.

We guide you taking the next step

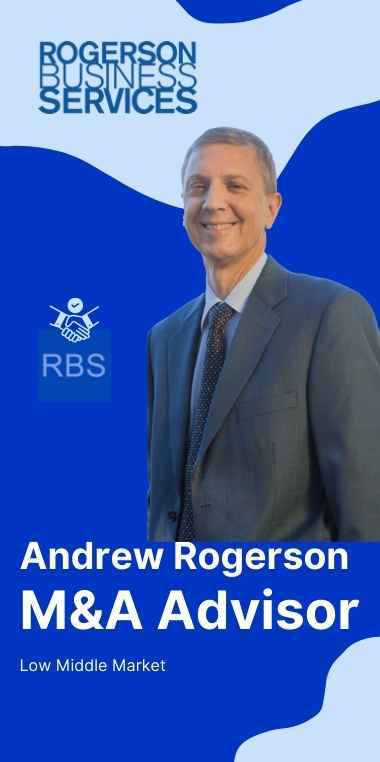

M&A LOWER MIDDLE MARKET ADVISORY

Why Work With Rogerson Business Services?

Business Valuation

Many sellers neglect the business valuation and methodology early in the process, only to become frustrated after the deal has been finalized. Rogerson Business Services can help you understand the value of your business based on different methodologies.

Legal Due Diligence

When selling a business, the legal standing of the business determines the smoothness, efficiency, and speed at which the transaction is finalized. M&A Advisors offer a sell-side M&A process backed by the viability of a California Licensed business or transaction attorney. With a licensed California M&A Advisor, you can be certain the legal documents involved in the sell-side M&A process is detailed and accurate.

Business Analysis

To avoid wasting time with unqualified buyers, get help from a trusted, licensed, and accredited California M&A Advisor. An M&A Advisor will vet potential buyers to make sure they're legitimate and are serious about purchasing your business. An M&A Advisor knows the ins and outs of selling a lower middle market business and can also help you get your business in shape to get you the best deal.

Financial Due Diligence

Our service includes deal team professionals to assist you. From financial to legal documents to tax and procedures, we want to make sure you are covered.

If you have your own in-house team of advisors, Rogerson Business Services can help make the M&A sell-side process as easy as possible by offering insights that help the team understand and are in alignment with the same goals as yours.

Definitive Purchase Agreement

The Definitive Purchase Agreement is usually extremely complex. It is easy to overlook the all the terms and legal jargon, but every paragraph is important and duly considered. It is therefore critical to ask questions and ensure you are comfortable with the final set of legal documents you need to sign.

M&A Sell-Side Targeting

Rogerson Business Services provide Mergers & Acquisition M&A Sell-Side Advisory. We zero target off-market, accretive, private equity and strategic buyers with an interest in lower to middle market companies or businesses to maximize incremental growth value.

Ten Reasons to Plan a Business Exit Strategy with

Rogerson Business Services

1. Ethics

Rogerson Business Services are members of the M&A Source, International Business Brokers Association (IBBA) and California Association of Business Brokers (CABB) and adhere to their code of ethics.

2. Confidentiality

Rogerson Business Services assists you professionally in a highly confidential manner to protect your personal and financial details.

3. Vetted businesses for sale

Rogerson Business Services have access to an inventory of businesses including unlisted businesses for sale in California.

4. Facilitator

Rogerson Business Services are specialists in business transitions and understand the need to respect all parties in the transaction. There are many steps to value, sell and buy a business. Rogerson Business Services have successfully navigated these steps many, many times.

5. Valuation

Rogerson Business Services can provide you an opinion of value of a business you wish to sell or buy.

6. Due diligence and escrow

Rogerson Business Services has the knowledge to work through leases, franchise agreements, finance requirements, licensing, California escrow requirement and many other items so the sale of a business is successful.

7. Negotiation

Rogerson Business Services practice win/win negotiation skills. Negotiations are rarely perfect and so a win/win approach is the best way forward.

8. Financing and funding

Rogerson Business Services has professional lenders that can assist with finance to successfully buy a business.

9. Resource

Rogerson Business Services is an active member in the associations of the M&A and Business Broker industry including M&A Source, the International Business Brokers Association (IBBA), California Association of Business Brokers (CABB), International Society of Business Appraisers (ISBA) as well as other professional organizations.

10. Closing and transfer

Rogerson Business Services works with you each step of the way. This includes managing the buying or selling of your business through initial negotiations, due diligence, escrow and the all-important closing.

What People Say About Rogerson Business Services

I know I'm Ready Now To Sell & Exit My Business

Take Me To The Next Step

If you're a retiring baby boomer business owner who is confident in your decision to sell your business and achieve success, then you are well-prepared to take on the journey of accurately valuing and successfully selling your lower middle market business in California.

This process can be complex, but by taking the right steps and having an understanding of the market, you are more likely to have a smoother transition and come away with favorable results.

It is important to plan ahead and do your research so that you know exactly what steps need to be taken in order to ensure that all parties involved remain satisfied throughout the duration of the sale.

Furthermore, it is beneficial to use resources such as business appraisals and valuation reports, which help business owners accurately value their company before putting it up for sale.

Additionally, seeking out professional guidance from experienced individuals or organizations can help business owners gain a better perspective on their situation as they work through this process.

Ultimately, with the right mindset and preparation, you will be able to move through this journey successfully on your own terms, ensuring that you meet all of your goals and obtain satisfying results in the end.

Selling A Business Checklist

Are you ready to retire and sell your business in California? Our comprehensive selling-a-business checklist is essential to ensure that you make it through the process smoothly and successfully. Everything you need to get started is right here – all you have to do is fill out the simple form and download the checklist.

This carefully tailored checklist has been designed specifically for baby boomer business owners, just like you. It contains important information on the key steps of selling a business, such as preparing financial documents, scouting potential buyers, negotiating offers, understanding tax implications, and more. So if peace of mind (and being well prepared) is important to you, this checklist is a must-have tool.

The best part about this list? It's easy to use and made by experts who have experience in the specific nuances of selling businesses in California – so no matter what stage of the process you are in, it will provide guidance on how best to navigate those tricky waters. Don't leave your future up to chance – take control now with our helpful checklist!

Download Checklist

Speed Up Your Exit Success!

Selling a Business Checklist Download Form

Further Reading