Business Brokers vs M&A Advisors:

The Ultimate Comparison

Don't Bring a Broker to an M&A Deal.

The biggest mistake business owners make is misidentifying their transaction size. Are you selling a "job" or a "business"? The answer dictates who you hire.

License & CredentialS

CA BRE# 01861204

M&AMI

Master Intermediary

LCBB

Lifetime Broker

CM&AP

M&A Professional

CABB

CA Assoc. Bus. Brokers

M&A Source

Global Association

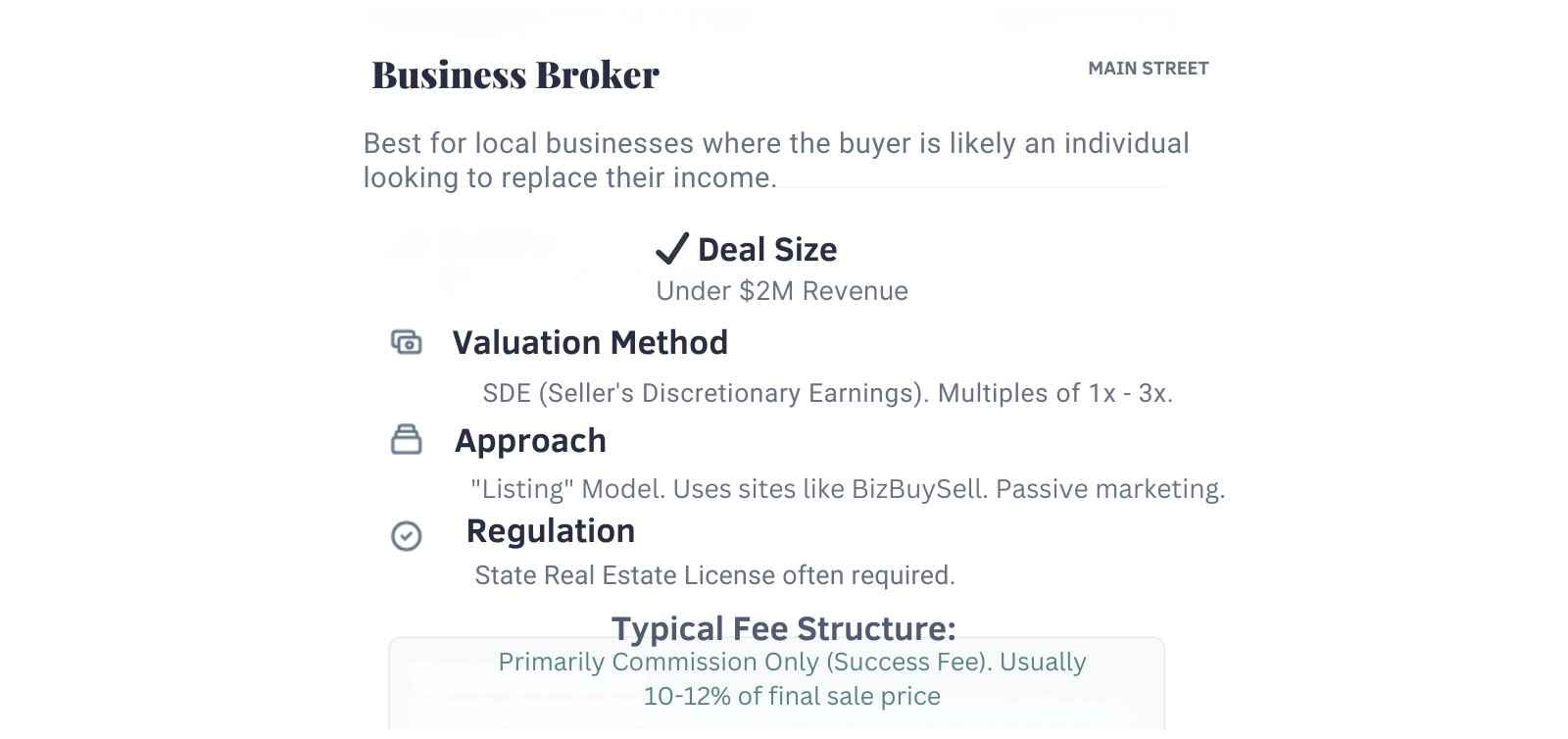

Business Broker

Main Street

Best for local businesses where the buyer is likely an individual looking to replace their income.

Deal Size

Under $2M Revenue

Valuation Method

SDE (Seller's Discretionary Earnings). Multiples of 1x - 3x.

Approach

"Listing" Model. Uses sites like BizBuySell. Passive marketing.

Regulation

A state real estate license is often required.

Typical Fee Structure:

Primarily Commission Only (Success Fee). Usually 10-12% of final sale price.

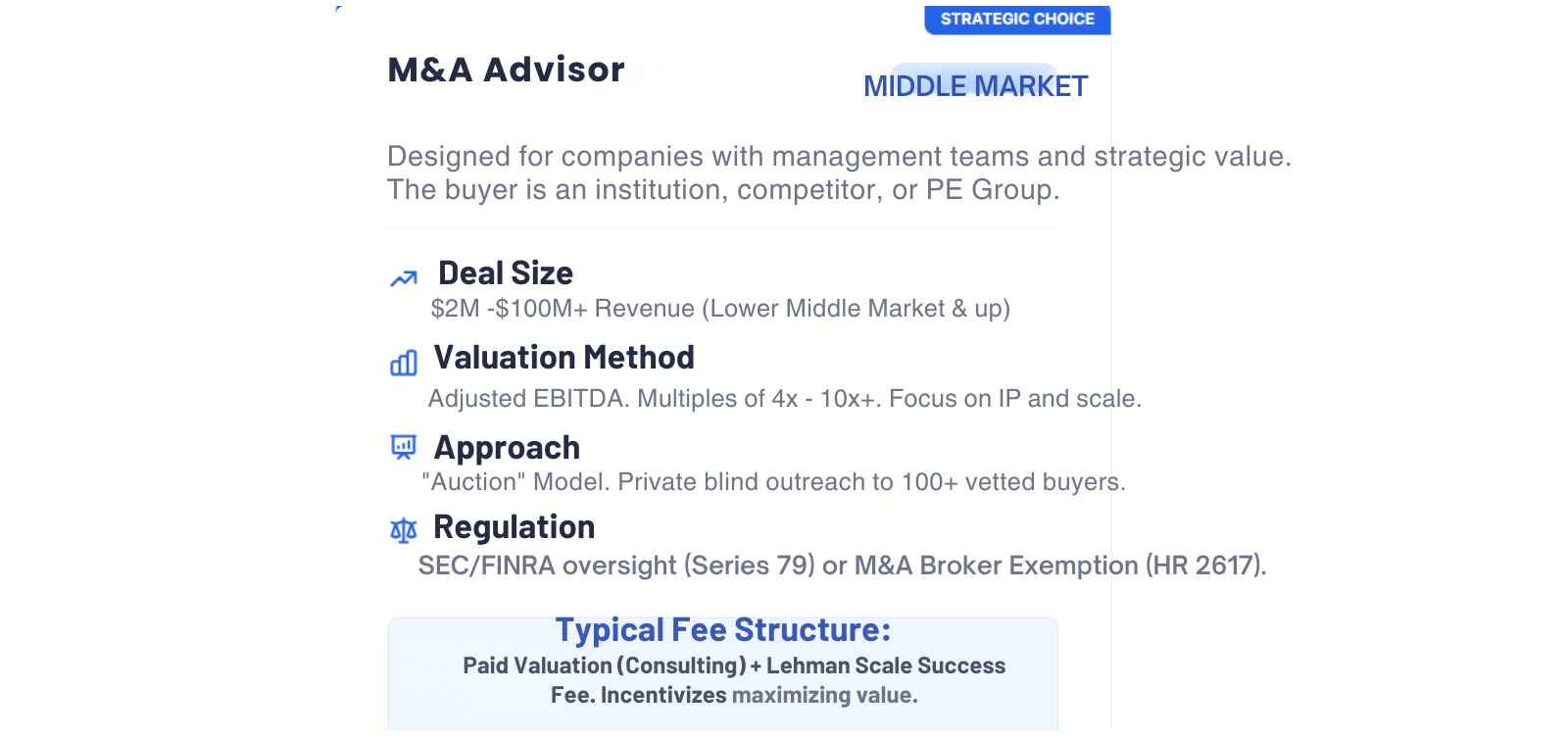

M&A Advisor

Middle Market

Designed for companies with management teams and strategic value. The buyer is an institution, competitor, or PE Group.

Deal Size

$2M - $100M+ Revenue (Lower Middle Market & up)

Valuation Method

Adjusted EBITDA. Multiples of 4x - 10x+. Focus on IP and scale..

Approach

"Auction" Model. Private blind outreach to 100+ vetted buyers.

Regulation

SEC/FINRA oversight (Series 79) or M&A Broker Exemption (HR 2617).x Amortization of Goodwill. In California, a real estate license is required.

Typical Fee Structure:

Paid Valuation (Consulting) + Lehman Scale Success Fee. Incentivizes maximizing value.

Why Do M&A Advisors Charge For Business Valuation?

The "Commission-Only" trap vs. Strategic Investment.

The Passive "Listing" Approach

Business Brokers typically operate on a Success Fee only (Commission). Because they aren't paid until a sale happens, they must minimize the time spent on each client.

- Relies on public websites (BizBuySell).

- Generic "blind" ads.

- Waiting for buyers to come to them.

The Active "Auction" Approach

M&A Advisors charge a business valuation and assessment Fee. This upfront investment funds a team of analysts to prepare your business before going to market.

- Creating a 50+ page Confidential Information Memorandum (CIM).

- Building a bespoke list of 200+ strategic buyers.

- Setting up a secure Virtual Data Room (VDR).

- Result: Multiple bids drive the price up, often covering the retainer 5x over.

Comparison Matrix: Business Broker vs. M&A Advisor

Self-Assessment: Which do you need?

| Factor | Business Broker | M&A Advisor |

|---|---|---|

| Your Revenue | Under $2 Million | $2 Million - $100 Million |

| Your Buyer | Individuals / Local | Strategic / Private Equity |

| Company Structure | Owner-Operator (Job) | Management Team (Platform) |

| Confidentiality | Difficult (Public Listings) | Strict (Blind Outreach) |

| Deal Complexity | Asset Sale / Simple | Stock Sale / Rollover Equity / Earnouts |

*Note: The $2M - $25M range is often called the "Lower Middle Market." Depending on complexity, either professional may work, but M&A Advisors typically yield higher multiples.

Still Unsure?

Let's Run the Numbers.

The most expensive thing a business owner will ever "buy" is a free valuation

California Specific Warning

DRE Licensing Enforcement

To value and sell a business in CA, the firm must hold a California Department of Real Estate license. Unlicensed out-of-state "free" tools are illegal in CA.

Board Compliance (CSLB/BAR/ABC)

Free estimates ignore California's complex licensing clearances. Buying a construction or auto repair shop without CSLB/BAR clearance can trigger immediate legal failure.

Negotiate from Strength, Not Guesswork.

"If your business is in California, an out-of-state free business valuation is the fastest way to lose millions in structural errors. We live and breathe CA M&A."

Specialization Matters

Rogerson Business Services handles the Lower Middle Market (Gross Revenue $2M–$100M) with a track record of closing complex transactions across multiple CA sectors.

Request Your Defensible Analysis

For serious business owners ready to exit.

All reports are signed by a licensed principal.