A business that consistently shows healthy profits and has a clear path for future earnings is always more attractive to potential buyers. It signals a lower risk and a better return on their investment.

What's Your HVAC Biz Worth In California

What's My HVAC Business Worth In California

Discover how much your HVAC business is worth in California. Learn valuation methods, key financial metrics, and strategies to maximize your company's value.

Thinking about selling your HVAC business in California? It's a big step, and knowing what it's actually worth is key. You've put in the work, built something solid, and now you want to make sure you get a fair deal.

This guide will walk you through how to figure out your company's value, what makes it valuable, and how to get the best possible outcome when you decide it's time to sell.

We'll cover everything from financial health to customer loyalty, and why getting professional help is a smart move.

Let's explore the value of my HVAC business.

Key Takeaways

- Understanding the factors that influence your HVAC business's worth, like financial performance and customer base, is the first step to knowing its value.

- Different valuation methods exist, including looking at income, market sales of similar businesses, and the value of your assets.

- Key financial figures such as EBITDA, net income, and revenue directly impact how much a buyer is willing to pay.

- Building a strong reputation and a loyal customer base can significantly increase your business's attractiveness and value.

- Working with an HVAC professional, business broker or appraiser can provide accurate valuations and help you get the best price.

Table of contents:

- Understanding Your HVAC Business Value

- Methods for Determining HVAC Business Worth

- Financial Metrics That Drive Valuation

- Maximizing Your HVAC Company's Value

- The Importance of Professional Guidance

- Valuation Tools and Calculators

- Strategic Considerations for Sellers

- Wrapping Things Up

- Frequently Asked Questions

Understanding Your HVAC Business Value

When you're thinking about selling an HVAC company, the first big question is: 'What's it actually worth?' Figuring out how to value an HVAC service business isn't always straightforward. It's more than just looking at your bank account; it involves a mix of what you can touch and what you can't. Plus, how well your business has been doing financially plays a huge part. Let's break down what goes into that number.

Key Factors Influencing Business Worth

Several things can bump up or bring down the price tag on your HVAC business. Think about your company's reputation – are you known for quality work and showing up on time? That's gold.

Also, consider how many customers stick with you year after year. A solid base of repeat business shows stability. And don't forget about your team; a skilled and reliable crew is a major asset.

The market you're in matters too; a growing area with lots of demand will naturally command a higher valuation.

Assessing Tangible and Intangible Assets

When we talk about assets, some are easy to see and count, while others are a bit more abstract. Tangible assets are the physical stuff: your service vans, tools, office equipment, and any real estate you own. You can put a price on these. Then there are intangible assets.

This includes things like your company's name and reputation (goodwill), customer lists, established service contracts, and even proprietary software or processes you use. These can be harder to quantify, but are often what buyers are really interested in, especially for selling an HVAC company.

The Role of Financial Performance in Valuation

Your business's financial history is a big driver of its worth. Buyers will look closely at your revenue trends, profit margins, and overall profitability. Consistent growth and strong earnings over several years usually mean a higher valuation.

It's not just about how much money you made last year, but also about the stability and predictability of your income. This financial health is a key indicator when determining how to value an HVAC service business.

Don't have time to read more? Take a shortcut and play the video overview below

Methods for Determining HVAC Business Worth

When it comes to figuring out what your HVAC business in California is actually worth, there isn't just one magic number. Instead, you've got a few different ways to look at it, and each gives you a slightly different picture.

Think of it like checking the value of your house – you might look at what similar homes sold for, what it would cost to rebuild it, or even what rent you could get for it. The same idea applies to your business. Understanding these methods is key to getting a realistic idea of your HVAC business sale price.

The Income Approach to Valuation

This method focuses on what your business can actually earn. Basically, it looks at how much profit your company has made in the past and projects that forward. Buyers are interested in how much cash flow your business can generate for them after they take over.

So, if your business has a solid history of making good money, this approach will likely show a higher value. It's all about the future earning potential.

Leveraging the Market Approach

With the market approach, you're looking at what other, similar HVAC businesses have sold for recently. It's like checking Zillow for houses on your block. You gather data on recent sales of HVAC businesses in California that are comparable to yours in size, services offered, and financial performance. This gives you a benchmark based on real-world transactions. This is often a go-to for estimating HVAC business sale price because it's based on actual market activity.

Utilizing the Asset Approach

The asset approach is pretty straightforward: it values your business based on the worth of everything it owns. This includes the tangible stuff like your service vans, tools, equipment, and any real estate.

But it also counts the intangible assets, like your brand name, customer lists, and any goodwill you've built up over the years. It's a way to see the floor value of your business – what it's worth even if it stopped operating tomorrow, based on its physical and non-physical assets.

Financial Metrics That Drive Valuation

When it comes to selling your HVAC business with a broker, the numbers tell a big part of the story. Buyers aren't just looking at your service trucks and happy customers; they're digging into your financial statements to see how much money the business actually makes.

Understanding these key financial metrics is like having a cheat sheet for understanding what your company is truly worth.

Analyzing Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA)

Think of EBITDA as a snapshot of your business's operating performance before you account for financing decisions, accounting choices, or tax environments. It's a way to compare the core profitability of different companies, regardless of their debt levels or tax situations.

For HVAC businesses in California, the EBITDA metric is particularly important because it shows how well your core operations are performing. A strong, consistent EBITDA suggests a healthy, well-run business that can generate reliable profits from its day-to-day activities.

Understanding Net Income and Profit Margins

Net income is what's left after all expenses, including taxes and interest, are paid. It's the bottom line, the actual profit your business has earned. Profit margins, on the other hand, tell you how much profit you make for every dollar of revenue.

You'll often see these expressed as gross profit margin (revenue minus cost of goods sold, divided by revenue) and net profit margin (net income divided by revenue).

High profit margins indicate efficiency and strong pricing power. Consistently healthy profit margins are a strong signal to potential buyers that your business is not only generating revenue but is also managing its costs effectively.

The Significance of Revenue and Cost of Sales

Revenue is the total amount of money your business brings in from its services. It's the top line, and while it's important, it's not the whole picture. Cost of Sales (COS) represents the direct costs associated with providing your HVAC services – think parts, materials, and direct labor.

The difference between your revenue and your cost of sales gives you your gross profit. A business with high revenue but also high costs might not be as attractive as a business with slightly lower revenue but much tighter cost control.

Buyers look at this relationship to understand your pricing strategy and operational efficiency.

Here's a quick look at how these might play out:

| Metric | Example A (High Revenue, High COS) | Example B (Moderate Revenue, Low COS) |

|---|---|---|

| Annual Revenue | $1,500,000 | $1,200,000 |

| Cost of Sales | $900,000 | $500,000 |

| Gross Profit | $600,000 | $700,000 |

| Gross Profit Margin | 40% | 58.30% |

In this simplified example, Business B, despite lower revenue, shows a stronger gross profit and a much healthier profit margin, which could make it more appealing to a buyer focused on profitability and efficiency.

What's Your HVAC Business Really Worth?

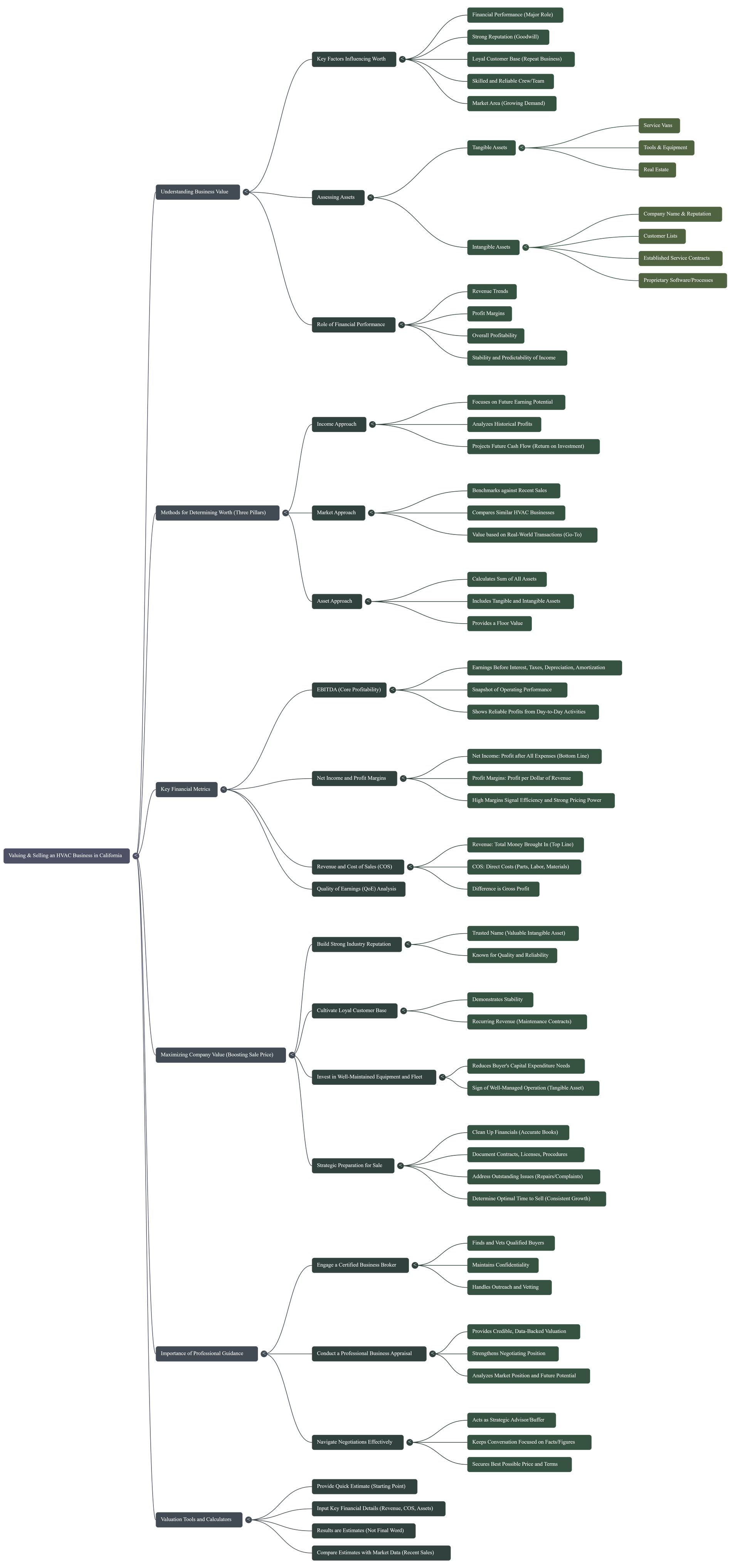

An infographic on the key methods, metrics, and strategies for valuing your California HVAC company before a sale.

The Three Pillars of Valuation

There isn't one "magic number." A comprehensive valuation uses a combination of these three core approaches to establish a realistic and defensible sale price.

Income Approach

This method focuses on future earning potential. It analyzes historical profits to project future cash flow, which is what buyers are most interested in—the return on their investment.

Market Approach

Similar to real estate comps, this approach benchmarks your business against recent sales of comparable HVAC companies in your market, providing a value based on real-world transactions.

Asset Approach

This provides a floor value by calculating the sum of all your assets, including tangible items like vehicles and tools, and intangible assets like your customer list and brand reputation.

A Financial Deep Dive

Buyers perform a 'Quality of Earnings' analysis to understand what your company is truly worth. Healthy, consistent financial metrics are the most compelling part of your story.

Revenue is Vain, Profit is Sane

This chart visualizes a common scenario comparing two hypothetical HVAC businesses. While Business A has higher revenue, its high Cost of Sales (COS) results in lower gross profit. Business B, with more moderate revenue but excellent cost control, is significantly more profitable and efficient.

Key Takeaway:

Buyers prioritize a high Gross Profit Margin. Business B's 58.3% margin makes it a far more attractive acquisition target than Business A's 40%, demonstrating superior operational efficiency.

Boost Your Company's Sale Price

Before you even think about selling, focus on these key areas. Like staging a home, preparing your business can significantly increase its final value and appeal to buyers.

Strong Industry Reputation

A trusted name means a reliable stream of customers and fewer operational headaches. This goodwill is a valuable intangible asset that buyers are willing to pay a premium for.

Loyal Customer Base

Recurring revenue from maintenance contracts and repeat clients demonstrates stability. It proves your business has a sustainable income stream, reducing risk for the new owner.

Well-Maintained Fleet & Equipment

Up-to-date, well-cared-for assets reduce the buyer's immediate need for capital expenditure. It’s a tangible sign of a well-managed, efficient operation that directly boosts your asset valuation.

Don't Go It Alone: The Path to a Successful Sale

Engaging professionals provides the expertise, objectivity, and strategic guidance needed to navigate the complex process of selling your business and maximizing your return.

Engage a Business Broker

A broker finds and vets qualified buyers, maintains confidentiality, and allows you to focus on running your business.

Conduct a Professional Appraisal

An appraisal provides a credible, data-backed valuation that strengthens your negotiating position and sets a realistic asking price.

Market the Business

Your broker confidentially markets the opportunity to their network of potential buyers, screening for financial capability and strategic fit.

Navigate Negotiations

Your professional team handles offers and counter-offers, focusing on facts and figures to secure the best possible price and terms for you.

Maximizing Your HVAC Company's Value

When it's time to think about selling your HVAC business in California, you'll want to make sure it's worth as much as possible. It's not just about the equipment you have; it's about the whole package. Think of it like getting your house ready to sell – you clean it up, fix the little things, and make it look its best. Your business deserves the same attention.

Building a Strong Industry Reputation

Your company's name in the community matters. A solid reputation means customers trust you, and that trust translates directly into value. When people know you do good work and stand behind it, they're more likely to call you first. This also means fewer complaints and a smoother operation for you. A good name is worth more than gold in this business. It's about being known for quality and reliability, not just getting the job done.

Cultivating a Loyal Customer Base

Think about your regular customers. The ones who call you every year for maintenance or when something breaks. That repeat business is incredibly valuable. It shows buyers that your company isn't just a one-hit wonder; it has a steady stream of income.

Building these relationships takes time and consistent good service. It means remembering their needs, providing clear communication, and always showing up when you say you will. This loyalty is a big part of what makes your business a stable investment for someone else. It's about creating customers for life, not just for one repair.

Investing in Well-Maintained Equipment and Fleet

Your trucks, your tools, your diagnostic equipment – they're the backbone of your operations. When these are well-maintained, it shows you care about efficiency and preventing costly breakdowns. A buyer will look at your fleet and think, 'Okay, this owner took care of things.' That means they won't have to immediately sink a ton of money into repairs or replacements. It's a sign of good management and foresight.

Keeping your gear in top shape not only helps you day-to-day but also significantly boosts your business's appeal when it's time to sell. It's a tangible asset that speaks volumes about your business practices. You can see how this ties into the

Asset Approach to valuation.

The Importance of Professional Guidance

When it comes to selling your California HVAC business, getting a clear picture of its worth is key. While you know your business inside and out, an outside perspective can make a big difference. This is where professional help comes in. Think of it like needing a specialist for a complex repair; sometimes, you just need someone who does this every day.

Engaging a Certified Business Broker

Trying to sell your business on your own can be a real headache. A certified business broker like Andrew Rogerson of Rogerson Business Services in the lower middle market acts as your advocate.

Business Brokers have the connections to findqualified buyers who are serious about purchasing an HVAC company like yours. Plus, they understand the ins and outs of the market, which helps in setting a realistic price. They handle the initial outreach and vetting, so you can keep your business running smoothly.

This is especially helpful in a market like California, where business valuations can be complex due to various factors. valuing a California business without assets.

The Benefits of Professional Business Appraisals

A professional appraisal goes beyond a simple guess. It's a detailed look at your business's financial health, assets, and market position. This process provides a solid, data-backed number for your business's worth. It helps you understand:

- Your company's financial performance over time.

- The value of your tangible assets, like your fleet and equipment.

- The strength of your intangible assets, such as your brand reputation and customer list.

- How your business stacks up against similar companies in the market.

This detailed report is invaluable, especially when you're talking to potential buyers. It lends credibility to your asking price and can prevent lengthy debates about value.

Selling your business is a major step. Having a professional appraisal gives you the confidence that you're asking for a fair price and that you've considered all aspects of your company's value. It's about making an informed decision, not just a hopeful one.

Navigating the Negotiation Process Effectively

Negotiation is where many business owners stumble. It’s easy to get emotional or leave money on the table. A certified business broker or appraiser, like Andrew Rogerson in California, acts as a buffer and a strategic advisor during this phase.

They can:

- Present your business's strengths objectively.

- Handle counter-offers and objections professionally.

- Keep the conversation focused on facts and figures.

- Help you understand the terms of the deal beyond just the price.

Their experience in

closing deals means they know what to look for and how to push for terms that benefit you. Ultimately, professional guidance from a

certified business broker for HVAC companies in California helps ensure you get the best possible outcome for your hard work.

Valuation Tools and Calculators

When it comes to figuring out what your HVAC business is actually worth, you don't have to go it alone. There are some handy tools out there that can give you a solid starting point. Think of them as your first step before you bring in the pros.

How HVAC Business Valuation Calculators Work

These business valuation calculators are designed to give you a quick estimate of your business's value. They typically ask for key financial details. You'll need to input things like your annual revenue, your cost of sales, and maybe even the number of technicians and office staff you have.

Some might also ask about your overhead expenses and the total value of your company's assets. By plugging in this information, the calculator uses formulas to spit out a potential business value. It's a way to get a number based on your financial performance and some industry standards.

Interpreting Calculator Results

So, you've put in your numbers and got a figure. What does it mean? It's important to remember that these calculators provide an estimate. It's not the final word on your business's worth.

Think of it as a ballpark figure. It gives you a baseline to start from, but it doesn't account for every single nuance of your specific operation.

Factors like your company's reputation, customer loyalty, and future growth potential aren't always captured by a simple calculator. That's why understanding why

paid business valuation in California is often a good idea becomes clear.

Comparing Calculator Estimates with Market Data

After you get a number from a calculator, the next smart move is to see how it stacks up against what's actually happening in the market. Look for recent sales of HVAC businesses similar to yours in California.

- Are those businesses in a comparable financial position?

- What were their revenue streams like?

Comparing the calculator's output with real-world sales data can give you a much clearer picture. It helps you see if the calculator's estimate is in the right ballpark or if it's a bit off.

This comparison is a vital step before you even think about talking to potential buyers or getting a formal appraisal.

For instance, understanding the market for pipe, valve, and fitting suppliers can offer context for related service businesses like yours, CMF Global, Inc..

Here’s a simplified look at how some calculators might work:

| Metric | Example Input |

|---|---|

| Annual Revenue | $1,000,000 |

| Cost of Sales | $400,000 |

| Overhead Expenses | $200,000 |

| Value of Company Assets | $300,000 |

| Company Valuation Multiplier | 5X |

Based on these inputs, a basic calculation might look something like this:

- Gross Profit: $1,000,000 (Revenue) - $400,000 (Cost of Sales) = $600,000

- Net Profit: $600,000 (Gross Profit) - $200,000 (Overhead) - $120,000 (Technician Costs) - $60,000 (Office Staff Costs) = $220,000

- Estimated Business Value: ($220,000 (Net Profit) + $300,000 (Assets)) * 5 (Multiplier) = $2,600,000

Remember, this is a simplified example. Real-world valuations involve more detailed analysis.

Strategic Considerations for Sellers

Thinking about selling your HVAC business in California? It's a big step, and getting ready is key to a good outcome. You've put in the work to build this company, so now it's time to make sure you get the best possible return. This means looking at your business from a buyer's perspective and tidying up any loose ends.

Identifying Potential Buyers

Finding the right buyer is more than just finding someone with cash. You want someone who understands the HVAC industry in California and can keep the business thriving. Think about other local HVAC companies looking to expand, or perhaps a larger regional player seeking to enter the California market.

Sometimes, even private equity firms, like Barah Capital Partners, are interested in acquiring established businesses with solid track records. It's about finding a match that respects what you've built and offers a fair deal.

Determining the Optimal Time to Sell

Timing can make a significant difference in your sale price. Generally, selling when your business is performing well, showing consistent growth, and has a strong backlog of work is ideal. Avoid selling during a downturn or right after a major, costly equipment failure.

Consider market conditions too; a strong seller's market, where demand for businesses is high, can lead to better offers. Look at your business's financial trends and the broader economic climate to pick the best moment.

Preparing for a Successful Business Transaction

Getting your ducks in a row is crucial for a smooth sale. This involves several steps:

- Clean Up Your Financials: Make sure your books are accurate and up-to-date. Buyers will scrutinize these, so having clear, organized financial statements is a must.

- Document Everything: Have all your contracts, licenses, permits, and operational procedures documented. This shows a well-run business.

- Address Any Issues: Fix any outstanding problems, whether it's equipment needing repair or customer complaints that haven't been resolved.

- Get a Professional Valuation: Understand your business's worth before you start talking to buyers. This gives you a solid baseline for negotiations.

Here's a quick look at what buyers often look for:

| Factor | Importance | Notes |

|---|---|---|

| Consistent Profitability | High | Demonstrates a stable income stream. |

| Strong Customer Base | High | Indicates recurring revenue and loyalty. |

| Trained Technicians | Medium | Shows operational capability and quality. |

| Well-Maintained Assets | Medium | Reduces immediate capital expenditure needs. |

| Good Reputation | High | Builds trust and attracts new business. |

When thinking about selling your business, it's smart to consider the best moves to make. This includes understanding how to get your company ready for the market and what steps lead to a successful sale.

Thinking ahead can make a big difference in the final outcome. Want to learn more about how to get the best value for your business?

Contact us today to find out how we can help you navigate the selling process smoothly.

Wrapping Things Up

So, figuring out what your HVAC business is actually worth in California isn't just a quick guess. It's a mix of looking at your numbers – like how much money you're making and what your equipment is worth – and also considering things that are harder to put a price on, like your company's good name and how loyal your customers are.

Tools can give you a starting point, sure, but to really know the value, especially if you're thinking about selling, talking to someone who does this for a living, like Andrew Rogerson, a certified business broker in California, is probably the smartest move.

They can help you see the whole picture and make sure you get a fair deal when the time comes to move on.

Frequently Asked Questions

What makes an HVAC business valuable in California?

The worth of an HVAC business in California depends on several things. This includes how much money it makes, how many customers it has, the quality of its equipment and vehicles, and its overall reputation in the community. A business that consistently makes good profits and has happy customers is usually worth more.

How can I figure out how much my HVAC business is worth?

You can estimate your business's worth using a few methods. One way is to look at what similar businesses have sold for (Market Approach). Another is to see how much money the business is expected to make in the future (Income Approach). You can also add up the value of all the company's belongings, like tools and trucks (Asset Approach). Using online calculators can give you a starting point, but a professional appraisal is often best.

What financial numbers are most important when valuing my business?

Key financial numbers include your earnings before interest, taxes, depreciation, and paying off loans (EBITDA), which shows how much cash the business generates. Your net income, or the actual profit after all costs, and your profit margins are also very important. The total amount of money the business brings in (revenue) and how much it costs to provide your services (cost of sales) are also looked at closely.

How can I make my HVAC business worth more before selling?

To increase your business's value, focus on building a great reputation for good work and reliability. Make sure your customers are happy and likely to come back. Keeping your equipment and company vehicles in good shape also shows buyers that you've taken care of the business. A strong team of trained workers is also a big plus.

Should I hire someone to help me value and sell my HVAC business?

Yes, it's highly recommended. A professional business broker who knows the HVAC industry can help you get a more accurate valuation. They can also help you find the right buyers, handle negotiations, and make sure the selling process goes smoothly. They have experience that can help you get the best possible price.

What's the difference between using a calculator and a professional appraisal?

An online calculator can give you a quick idea of your business's worth based on the numbers you enter. However, it's a general estimate. A professional appraisal is much more detailed. An expert will look at not just your finances but also things like your market position, customer loyalty, and future potential, giving you a more precise and reliable valuation.

Hey there! Can we send you a gift?

We just wanted to say hi and thanks for stopping by our little corner of the web. :) we'd love to offer you a cup of coffee/tea, but, alas, this is the Internet.

However, we think you'll love our email newsletter about building value and properly position your company before transition/exit your business ownership.

As a special welcome gift for subscribing, you'll also get our helping and educational guides, tips, tutorials, etc.. for free.

It's filled with the best practices for retiring serial business owners like Dan Gilbert, Larry Ellison, Warren Buffett, and many more.

Just sign up for our emails below.