A broker's familiarity with specific industry regulations, like California's contractor licensing, directly impacts the efficiency and legality of your sale process. It ensures that potential buyers are properly vetted and that the transaction proceeds smoothly, avoiding costly delays or complications.

How to Choose The Best HVAC Business Broker in California For Business Sale

Best HVAC Business Broker in California For Business Sale

Choosing the best business broker for HVAC business sales in California? Learn key factors like industry expertise, local market knowledge, and credentials.

Selling your HVAC business in California is a major step. It's not like selling a lemonade stand; this is your livelihood, and you want to make sure you get the best deal possible. That's where a good business broker for HVAC businesses comes in. But not all brokers are created equal, and picking the right one can feel overwhelming.

This guide will help you figure out what to look for so you can find someone who really knows their stuff and can help you sell your business smoothly.

Got burning questions to ask a certified business broker in California?

Key Takeaways

- Look for a business broker who specifically knows the HVAC industry. They'll understand things like contractor licenses and the local market better than a general broker.

- Check if the broker knows California's specific HVAC market and licensing rules. This local knowledge helps set the right price and sell faster.

- Verify the broker's professional background. Certifications and memberships in groups like CABB or IBBA show they're serious about their work and follow rules.

- A broker with a strong network of buyers, lenders, and other pros can bring more options to the table for selling your HVAC business.

- Make sure the broker communicates clearly and often. You need to understand what's happening and feel comfortable asking questions throughout the selling process.

Table of contents

- Understanding Industry Specialization For HVAC Business Brokers

- Assessing Local Market Acumen

- HVAC Business Sale Case Study

- Verifying Professional Credentials and Affiliations

- Leveraging a Broker's Professional Network

- Ensuring Transparent and Effective Communication

- Examining a Broker's Transactional Success

- Understanding Broker Compensation Structures

- Building Trust Through Broker Compatibility

- Final Thoughts on Choosing Your HVAC Business Broker

- Frequently Asked Questions

Don't have time to read? Play the video article below

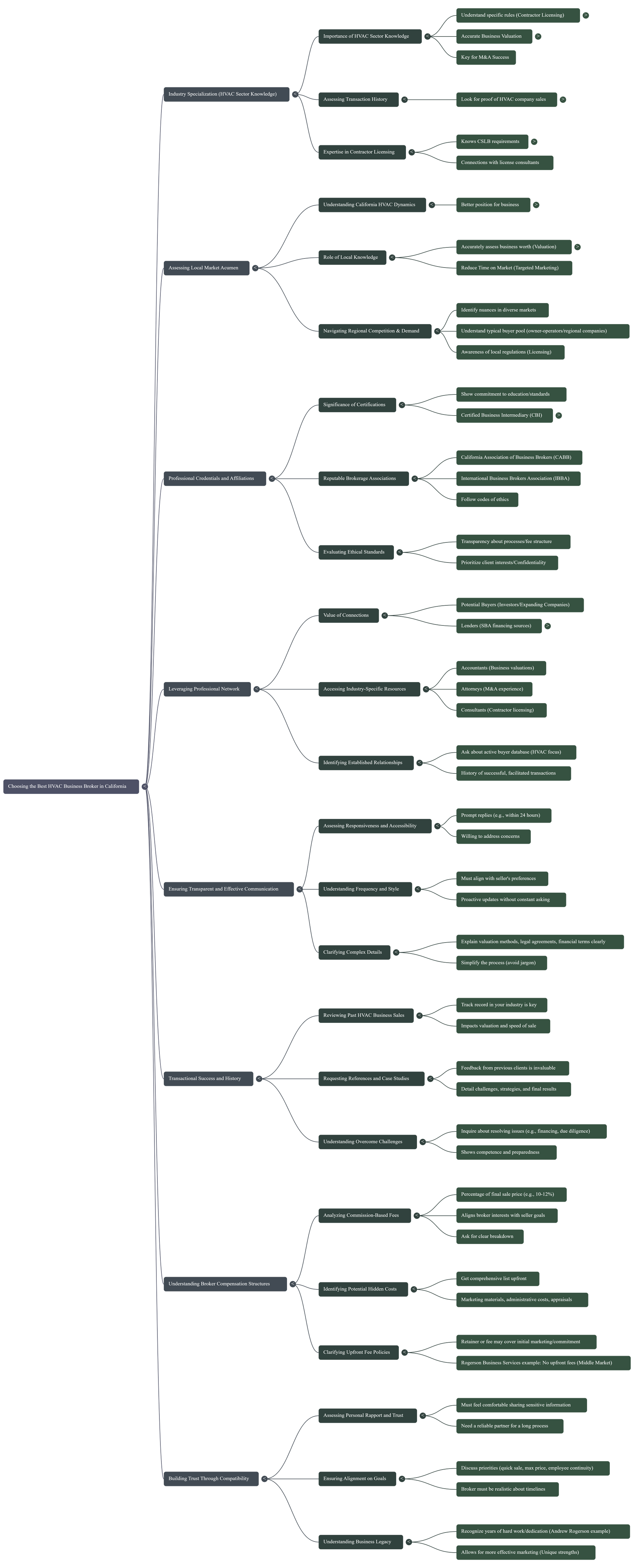

Understanding Industry Specialization For HVAC Business Brokers

When you're looking to sell your HVAC business in California, picking the right business broker matters a lot. It's not like selling a coffee shop; HVAC businesses have their own quirks. You need someone who gets this specific industry. This is where industry specialization comes into play.

The Importance of HVAC Sector Knowledge

Think about it: the HVAC world has specific rules, like contractor licensing in California. A broker who knows this stuff can actually value your business correctly and find buyers who are a good fit. They understand the ins and outs of HVAC operations, not just general business sales.

This specialized knowledge is key to successful mergers and acquisitions for HVAC businesses. It helps in accurately assessing your HVAC business valuation in California and understanding the nuances of the California HVAC industry trends and landscape.

Assessing a Broker's HVAC Transaction History

Look at what kind of businesses a broker like Andrew Rogerson in California has sold before. Have they actually sold HVAC companies? How many? A broker with a solid history in selling HVAC businesses is more likely to know how to handle yours. You want to see proof that they can get deals done in this sector. It's about more than just having a list of sales; it's about understanding the type of sales they've managed.

Evaluating Expertise in Contractor Licensing

This is a big one for HVAC businesses in California. A good

HVAC business broker will know about

CSLB licensing requirements. They should be able to explain how this affects potential buyers and the sale process. If a broker seems unsure about contractor licensing, it's a red flag. They should also have connections with resources that help buyers with licensing, like contractor license consultants.

Assessing Local Market Acumen

Understanding California's HVAC Market Dynamics

When selling your HVAC business in California, understanding the local market is key. This means knowing how things work, specifically in your region, not just generally.

A broker who knows California's HVAC landscape can better position your business. They understand the demand for services, what pricing is typical, and what makes businesses in your area stand out.

This local insight helps set realistic expectations for both the sale price and how long it might take to find a buyer. It's about having a broker who speaks the language of your specific market like Andrew Rogerson who recently sold an HVAC business for $3,520,000 in California.

The Role of Local Knowledge in Valuation and Time on Market

Local market knowledge directly impacts how your business is valued and how quickly it sells. Andrew Rogerson is a qualified business broker familiar with California's HVAC sector, and can accurately assess your business's worth based on current regional trends, competition, and buyer interest.

Andrew knows what buyers are looking for in your specific area and can tailor marketing efforts accordingly. This targeted approach can significantly reduce the time your business spends on the market.

For instance, a broker might know that certain counties have higher demand for specific services, influencing valuation and marketing strategy. This is where a brokerage firm like Rogerson Business Services for the middle market can offer specialized insight.

Navigating Regional Competition and Demand

California's HVAC market is diverse, with different regions having unique competitive landscapes and demand levels. A broker with strong local acumen can identify these nuances. They understand the typical buyer pool in your area, whether they are local owner-operators or larger regional companies.

Furthermore, they are aware of any specific state or local regulations, like contractor licensing, that might affect a sale. This awareness is vital for qualifying potential buyers and ensuring a smooth transaction process.

A broker's ability to navigate these regional specifics can make a significant difference in achieving a successful sale.

From Collapse to Closing

How Expert M&A Advisory Rescued a California HVAC Business Sale

The Brink of Failure

A promising California HVAC business faced a critical challenge: finding the right buyer and successfully closing the deal. After months of effort, the process stalled, leaving the owner with uncertainty and mounting frustration as multiple deals fell apart, wasting valuable time and resources.

The Path to a Stalled Sale

Each failed attempt presented a new roadblock, from valuation disputes to buyer financing issues. This timeline illustrates the challenging journey before an M&A expert intervened.

Deal #1: Valuation Mismatch

The initial offer was strong, but disagreements during due diligence over asset valuation and future earnings potential led to the buyer withdrawing.

Deal #2: Financing Collapse

A second buyer made a compelling offer, but their funding fell through at the last minute, resetting the entire sale process back to square one.

Deal #3: Unfavorable Terms

A third attempt resulted in a deal with complex, seller-unfriendly terms. The high risk and long payout structure made it an unacceptable path forward.

The Advisor's Impact Areas

Rogerson Business Services intervened with a structured approach, focusing on critical areas that were previously overlooked. Their expertise systematically de-risked the sale and rebuilt deal momentum.

A Holistic & Successful Outcome

The final deal was not just about achieving a high price. The advisor's negotiation strategy secured a well-rounded victory, balancing financial return with favorable terms for a smooth, secure exit.

The Proprietary Rescue Process

Instead of simply listing the business again, a multi-stage process was implemented to address core issues and position the company for a successful acquisition.

Stabilize & Re-evaluate

Perform a deep financial analysis to create an irrefutable valuation.

Strategic Marketing

Identify and discreetly approach a curated list of vetted, qualified buyers.

Expert Negotiation

Manage all communications and negotiations to secure optimal terms.

Seamless Closing

Oversee due diligence and final documentation for a smooth closing.

Verifying Professional Credentials and Affiliations

When choosing an HVAC business broker in California, it's important to look beyond just their sales pitch. Verifying their professional credentials and affiliations provides a solid foundation for trust and competence. This step helps ensure you're working with someone who operates with integrity and possesses the necessary qualifications.

The Significance of Industry Certifications

Professional certifications indicate a broker's commitment to ongoing education and adherence to industry standards in gaining professional expertise. For instance, designations like Certified Business Intermediary (CBI) from the International Business Brokers Association (IBBA) require brokers to complete specific coursework, pass an exam, and demonstrate experience in closing deals.

These certifications suggest a broker has invested in developing their skills and knowledge beyond basic business practices.

Recognizing Reputable Brokerage Associations

Membership in respected industry associations is another good indicator. Organizations such as the California Association of Business Brokers (CABB) or the IBBA often have codes of ethics that members must follow.

Belonging to these groups means the broker is part of a professional community that values ethical conduct and best practices. It also often means they have access to standardized forms and ongoing training relevant to business sales.

Evaluating Ethical Standards and Best Practices

Beyond formal credentials, consider how a broker demonstrates ethical behavior. This can be assessed by looking at their public reputation, client testimonials, and how they handle initial inquiries.

A broker who is transparent about their processes, clearly explains their fee structure, and communicates openly is more likely to uphold high ethical standards throughout the sale of your HVAC business.

It's wise to look for brokers who prioritize client interests and maintain confidentiality like

Andrew Rogerson of Rogerson Business Services for the middle market segment.

Leveraging a Broker's Professional Network

A business broker's value extends beyond just listing your HVAC company. A significant part of their role involves tapping into their established connections. A strong network can directly impact the speed and success of your business sale. This network typically includes various professionals who play a part in business transactions.

The Value of Connections with Lenders and Buyers

When you're looking to sell your HVAC business, having a broker who knows the right people is a major advantage. They often have relationships with potential buyers, ranging from individual investors to larger companies looking to expand. This means they can proactively reach out to interested parties, rather than just waiting for inquiries.

Furthermore, a broker familiar with SBA lenders or other financing sources can help streamline the process for buyers, making your business a more attractive acquisition. This can lead to quicker offers and more favorable terms.

Finding a broker like Andrew Rogerson with a wide reach is key to maximizing your options for a successful HVAC business sale in California.

Accessing Industry-Specific Resources

Beyond just buyers and lenders, a good broker maintains connections with other professionals relevant to the HVAC industry.

This might include:

- accountants who specialize in business valuations,

- attorneys experienced in mergers and acquisitions,

- or even consultants who understand contractor licensing requirements in California.

Having these resources readily available means you won't have to search for them yourself, and you can be confident in the quality of advice you receive. These connections can help anticipate and resolve potential issues before they derail the sale.

For instance, a broker with ties to contractor license consultants can ensure all regulatory aspects are handled smoothly.

Identifying Brokers with Established Relationships

When you're interviewing potential brokers, ask them directly about their network.

- How many active buyers do they have in their database for HVAC businesses?

- What types of financial institutions do they regularly work with?

- Do they have relationships with other business brokers who might bring in out-of-state buyers?

A broker who can provide specific examples of how their network has benefited past clients is a strong indicator of their capabilities. Look for brokers who are active in industry associations, as this is often where these valuable relationships are built and maintained.

A

broker who can demonstrate a history of successful transactions like Andrew Rogerson, often facilitated by their network, is the one you want working for you.

Ensuring Transparent and Effective Communication

Clear communication is key when selling your HVAC business. It helps avoid confusion and makes the entire process smoother. You need a broker who keeps you informed and explains things plainly.

Assessing Responsiveness and Accessibility

When you first talk to potential brokers, notice how quickly they get back to you. Do they answer your questions directly? A good broker will be easy to reach and willing to address your concerns promptly. This shows they respect your time and the importance of your sale.

Understanding Communication Frequency and Style

Ask brokers how often they plan to update you and what methods they prefer. Some people like daily emails, others prefer weekly calls. Find a style that works for you. Your broker's communication style must align with your own preferences. This prevents misunderstandings and keeps the relationship productive.

Clarifying Complex Transactional Details

Selling a business involves many intricate steps and documents. Your broker should be able to break down complicated information into understandable terms. They should be able to explain things like valuation methods, legal agreements, and financial terms without using excessive jargon.

If they struggle to explain things clearly, it might be a sign they aren't the best fit for you. You want a partner who can simplify the process, not complicate it further. For guidance on selecting a professional service for your business needs, consider looking into

hire and advisor with Axial.

Here's what to look for:

- Prompt Replies: Do they respond to calls and emails within a reasonable timeframe (e.g., 24 business hours)?

- Clear Explanations: Can they explain financial terms, legal clauses, and market trends in plain language?

- Proactive Updates: Do they provide regular updates on the sale process without you having to constantly ask?

- Accessibility: Are they available during business hours, and do they have a clear process for urgent matters?

Examining a Broker's Transactional Success

When selecting an HVAC business broker in California, a broker's history of successful transactions is a strong indicator of their capability. It's not enough for a broker to claim they can sell your business; they need to demonstrate it. This involves looking at concrete evidence of past deals and how they were managed.

Reviewing Past HVAC Business Sales

It is essential to inquire about potential brokers' experience, particularly in the HVAC industry. A broker who has a track record in your industry understands the unique aspects of HVAC operations, customer bases, and market trends.

This specialized knowledge can significantly impact the valuation and the speed of the sale. Ask for details on the types of HVAC businesses they have represented and the outcomes of those sales.

A broker who can provide specific examples of successful HVAC business sales demonstrates a clear understanding of the sector.

Requesting Client References and Case Studies

Beyond general experience, direct feedback from previous clients is invaluable. Request references from businesses similar to yours that the broker has represented.

Speaking with these past clients can offer insights into the broker's communication style, negotiation skills, and overall effectiveness. Additionally, ask for case studies that detail specific transactions.

These should outline the challenges faced, the strategies employed by the broker, and the final results. A broker's ability to provide detailed and positive references is a significant sign of their transactional success.

Understanding How Challenges Were Overcome

Every business sale has its hurdles. The true measure of a broker's skill lies in how they navigate and resolve these issues. Inquire about specific challenges encountered in past HVAC business sales and how the broker addressed them. This could include issues with buyer financing, unexpected due diligence findings, or difficult negotiations.

A broker who can articulate clear, effective solutions to complex problems shows a high level of competence. This preparedness is vital for a smooth sale process, especially for businesses with annual revenues between $3 million and $50 million in California, where careful planning is key to a successful outcome.

Selling a business requires this level of detail.

- Past Performance: Look for brokers with a documented history of closing HVAC business deals.

- Client Testimonials: Seek out references and testimonials from previous sellers.

- Problem-Solving: Assess their approach to overcoming common transaction obstacles.

- Industry Focus: Prioritize brokers with specific experience in the HVAC sector.

Understanding Broker Compensation Structures

When you're looking to sell your HVAC business in California, figuring out how a broker gets paid is a big deal. It's not just about the final number; it's about understanding the whole financial picture and making sure you're aligned with your broker.

Analyzing Commission-Based Fees

Most business brokers work on a commission basis. This means their fee (10 to 12 percent) is a percentage of the final sale price of your business. It's a common model because it aligns the broker's interests with yours – they only make a significant amount if they successfully sell your business for a good price.

However, the percentage can vary, and it's important to know what's standard in the industry for HVAC businesses. Some brokers might use a tiered structure, where the percentage decreases as the sale price increases, or vice versa. Always ask for a clear breakdown of how their commission is calculated. Ask Andrew Rogerson for more details.

Identifying Potential Hidden Costs

Beyond the main commission, there can be other costs associated with selling your business through a broker. These might include fees for marketing materials, administrative costs, or expenses for third-party services like appraisals or legal reviews. It's vital to get a comprehensive list of all potential fees upfront.

Some brokers might bundle these into their commission, while others will bill them separately. Make sure you understand what's included and what's not, so there are no surprises when the deal closes.

You want to avoid a situation where the final payout is much less than you expected due to unexpected charges.

Clarifying Upfront Fee Policies

While many brokers prefer a commission-only model, some may ask for an upfront retainer or fee. This is often to cover initial marketing expenses and demonstrate a commitment from both sides. If a broker requires an upfront fee, understand exactly what services that fee covers. Does it include professional photography, video creation, or extensive market research? Some brokers might charge a small upfront fee, while others might have a more substantial retainer.

It's also worth noting that some brokers, like Rogerson Business Services in the Middle Market, do not charge any upfront fees at all, relying solely on the success of the sale. This can be a good indicator of their confidence in selling your business.

Always ask for a clear explanation of their policy on upfront payments and how it impacts the overall commission structure.

This transparency is key to a smooth transaction.

- Commission Percentage: The primary fee, calculated on the sale price.

- Marketing Expenses: Costs for advertising, creating profiles, and reaching potential buyers.

- Administrative Fees: Charges for paperwork, coordination, and other operational tasks.

- Third-Party Costs: Expenses for appraisals, legal consultations, or due diligence support.

Building Trust Through Broker Compatibility

Assessing Personal Rapport and Trust

When selling your California HVAC business, you'll be sharing a lot of sensitive information. It’s important to find a broker you feel genuinely comfortable with. Trust your instincts; this is a long process, and you need someone you can rely on.

Look for a broker who listens more than they talk, and who seems to understand your perspective. A good rapport makes difficult conversations easier and the entire experience less stressful. It's about finding a partner, not just a service provider.

Ensuring Alignment on Goals and Expectations

Before committing, have an open discussion about what you hope to achieve with the sale. Do you prioritize a quick sale, maximizing price, or ensuring the business continues with its current employees?

A broker should clearly outline their strategy and how it aligns with your objectives. They should be realistic about timelines and potential outcomes, avoiding overly optimistic promises. Understanding each other's goals from the start prevents future misunderstandings.

Finding a Broker Who Understands Your Business Legacy

Your HVAC business is more than just a financial asset; it represents years of hard work, dedication, and a legacy you've built. A great broker like Andrew Rogerson will recognize this. They should show interest in the history of your company, its impact on the community, and your personal journey.

This deeper understanding allows them to market your business more effectively, highlighting its unique strengths and value beyond the balance sheet. They should care about what happens to your business in California and its employees after the sale, not just the transaction itself. This is where a brokerage firm like Rogerson Business Services in the Middle Market can make a difference, focusing on personalized solutions.

Finding the right partner is key when selling your business. We help youconnect with brokers who understand your industry and goals, making the process smoother and more successful.

Ready to find your perfect match?

Contact us today to learn more about how we can help you achieve your business sale objectives.

Final Thoughts on Choosing Your HVAC Business Broker

So, picking the right person to help sell your HVAC business is a pretty big deal.

It's not just about finding someone who knows about sales; you need someone who really gets the HVAC world, including all the California-specific stuff like licensing. Think about their experience, how well they know the local market, and if they seem professional and trustworthy. Don't forget to ask about how they plan to market your business and what their fees look like.

Ultimately, you want to work with someone you feel comfortable with and who you believe will genuinely look out for your best interests. Taking the time to find that right fit can make a huge difference in how smoothly the sale goes and what you end up getting for your business.

Good luck out there!

Frequently Asked Questions

Why is it important for a business broker to know about the HVAC industry?

HVAC businesses are special. They have their own rules, like needing specific licenses in California. A broker who understands this can figure out what your business is really worth, find the right buyers, and help with all the paperwork. They know the ins and outs, which general brokers might miss.

How can I tell if a broker understands the California market for HVAC businesses?

You should ask them about the local competition, what prices are like, and what makes HVAC businesses in your area unique. A good broker will know about California's specific licensing rules for contractors, like the C-20 license, and how that affects sales.

What professional groups should a business broker belong to?

Look for brokers who are part of well-known groups like the California Association of Business Brokers (CABB) or the International Business Brokers Association (IBBA). Being a member often means they follow a code of ethics and have received extra training.

How does a broker's network help sell my HVAC business?

A broker with a good network has connections to people who might buy your business, like investors, and also to experts like lenders and licensing consultants. This can help find more potential buyers and get you the best deal.

What should I look for in a broker's past sales record?

You should ask for examples of HVAC businesses they've sold before. It's also a good idea to ask for references from past clients. This shows you they have a history of successfully helping businesses like yours.

How do business brokers get paid, and are there hidden costs?

Most brokers charge a fee based on the final sale price of your business, like a commission. It's important to ask them to explain their fees clearly and to find out if there are any upfront costs or other expenses you'll need to pay during the sale process.

Hey there! Can we send you a gift?

We just wanted to say hi and thanks for stopping by our little corner of the web. :) we'd love to offer you a cup of coffee/tea, but, alas, this is the Internet.

However, we think you'll love our email newsletter about building value and properly position your company before transition/exit your business ownership.

As a special welcome gift for subscribing, you'll also get our helping and educational guides, tips, tutorials, etc.. for free.

It's filled with the best practices for retiring serial business owners like Dan Gilbert, Larry Ellison, Warren Buffett, and many more.

Just sign up for our emails below.