Navigating California's Unique Legal and Tax Landscape for Business Exits

Unique Legal and Tax Landscape for Business Exits in California

A Strategic Roadmap for a Successful M&A Transaction

Exiting a business in California is a significant milestone, but the state's unique and complex legal and tax environment presents challenges that can jeopardize a successful sale. This article provides a comprehensive overview of the critical pitfalls to avoid.

It introduces a proactive strategic framework to help business owners in the lower-middle market (business value between $3M - $20M) secure the maximum value for their life's work.

By understanding and preparing for:

- California’s specific tax traps,

- non-compete laws, and liability risks,

- you can ensure a smooth and profitable transition,

- protecting both your financial future and your legacy.

Play the voice file above for a deep dive

Table of Contents

Why California is Considered Complex When Exiting a Business

California's unique legal and tax environment demands a specialized strategy.

Including its lack of a preferential capital gains rate and strict non-compete laws, makes a generic M&A plan a dangerous gamble.

How to Exit or Sell a Business in California

Strategic Framework for Exiting a California Business

Exiting a California business requires a specialized approach. At Rogerson Business Services, we focus on protecting your value and legacy through thorough preparation.

Pre-Sale "Audit"

We begin with a pre-sale "audit" to prepare your business for due diligence, identifying potential liabilities to ensure a smoother transaction.

Tax-Efficient Sale

We collaborate with tax experts to minimize your tax burden, helping you understand the implications of asset vs. stock sales and maximizing your take-home value.

Legal Due Diligence

We conduct a detailed review of your corporate documents and contracts to comply with California laws, speeding up the process and showcasing your business’s stability.

Legacy and Security

Our approach ensures a seamless transition that preserves your legacy and secures your family’s future, making your exit a successful conclusion to your career.

What is the Next Step to Secure the Best Business Sale Exit in California

Go to next stepSchedule a confidential, no-obligation consultation with Andrew Rogerson to create your custom California Exit Plan.

This isn't just a meeting; it's the first step toward a smooth, rewarding, and protected exit.

We'll help you understand your options, identify potential risks, and build a strategic roadmap that ensures you get the full value for the business you built.

Your journey deserves a strong and successful finish.

Have more questions?

Key Takeaways

- California's unique legal and tax environment, including its lack of a preferential capital gains rate and strict non-compete laws, makes a generic M&A plan a dangerous gamble.

- A specialized, proactive M&A strategy is essential to address these challenges and protect the value of your business.

- Our proprietary pre-sale audit and strategic timeline provide a clear roadmap and demonstrate a proven approach for a successful exit.

- The first step toward a secure exit is a confidential consultation to create a custom exit plan tailored to California's complexities.

The California Exit Conundrum

A Strategic Roadmap for a Successful M&A Transaction

The Dream vs. The Reality

Exiting a business in California is a significant milestone, but the state's unique and complex legal and tax environment presents challenges that can jeopardize a successful sale. A generic M&A approach often falls short, risking a messy, costly, and complex sale that leaves a significant portion of your hard-earned value on the table.

The Dream

A profitable exit that secures your retirement, protects your legacy, and rewards years of hard work.

The Reality

A complex web of tax traps, strict regulations, and hidden liabilities that can erode your final valuation.

California's Top 4 Exit Traps

A one-size-fits-all M&A strategy is a dangerous gamble in California. The state's unique legal and regulatory environment creates specific pitfalls that can derail a deal or significantly reduce your final payout. Understanding these risks is the first step to mitigating them.

Unseen Tax Traps

Unlike federal law, California taxes capital gains from a business sale at the same high rates as ordinary income, which can significantly reduce your net proceeds.

The "Exit Tax" Reality

Even if you move out of state, the Franchise Tax Board (FTB) can pursue ongoing tax obligations if you maintain significant financial ties to California.

Strict Non-Competes

California's non-compete laws are notoriously strict, with very narrow exceptions for business sales that can be a major deal-breaker for buyers if not handled correctly.

Hidden Liabilities

In an asset sale, sellers remain responsible for issues like employee misclassification, accrued vacation, and potential PAGA claims, which can lead to costly post-closing disputes.

A Strategic Framework for a Protected Exit

A proactive and specialized approach is required to navigate California's complexities. A strategic framework transforms the process from a reactive scramble into a controlled, value-maximizing journey.

Proof: The Power of Preparation

Data-driven tools and a clear timeline validate the effectiveness of a specialized approach. By getting ahead of potential issues, you can significantly enhance your negotiating position and final valuation.

California M&A Readiness Score

A comparison of key readiness metrics shows the clear advantage of a proactive, expert-guided approach over a generic one.

The Exit Timeline: Value Creation

A strategic timeline demonstrates how early preparation directly increases deal security and potential business valuation over time.

Your Next Step Toward a Secute Exit

Don't gamble on your legacy. The Complexities of California's legal and tax landscape demand a custom plan. Take control of your future and ensure you receive the full value for the business youve built.

The California Dream vs. The California Reality

You've spent years building your business in California. You poured in sweat, capital, and countless hours to create something of value—a legacy. The California dream of a successful business and a secure retirement is what drove you. Now, as you consider an exit, a different reality looms: the fear of a messy, costly, and complex sale that leaves a significant portion of your hard-earned value on the table.

This anxiety is real and valid. You’ve heard the stories: the deal that fell through because of a last-minute legal snag, or the seller who was shocked by a massive tax bill they didn't anticipate. You want to secure your future, but you're concerned about how California's specific rules might impact your final valuation and potentially jeopardize your financial security.

This is where a generic M&A approach falls short.

California's unique legal and tax environment demands a specialized strategy. In the following sections, we'll explore the specific challenges you face and introduce a strategic framework designed to ensure your business exit is as rewarding and secure as the journey you took to build it. A

well-planned exit isn't just about closing a deal; it's about preserving your legacy.

Why a Generic M&A Plan is a Dangerous Gamble in California

A one-size-fits-all M&A strategy, while tempting, can be a dangerous gamble in California. The state's legal and regulatory environment is unique. Without a plan tailored to its complexities, you risk not only a failed deal but also a significant loss of your final payout. Here are some of the key pitfalls to be aware of:

The Unseen Tax Traps: A High Price on Your Payout

Unlike federal law and the laws of many other states, California's tax code does not have a preferential long-term capital gains rate. This means that the profits from selling your business—whether from the sale of assets or stock—are taxed as ordinary income at your personal state income tax rate.

This can be a substantial hit to your net proceeds, and it's a critical factor that is often overlooked in early-stage planning. For a deeper dive, read our blog post on Is Selling a Business Considered Capital Gains in California?.

The California "Exit Tax" Myth vs. Reality

While the idea of an official "exit tax" is a myth, the reality can be just as painful. If you sell your business and then move out of state, the California Franchise Tax Board (FTB) may still consider you a resident for tax purposes, particularly if you retain significant ties to the state, such as real estate or active business interests. This can create a complex web of tax liability that requires careful navigation to avoid unwanted surprises after the deal has closed.

Navigating Non-Compete Laws: A Deal-Breaking Constraint

California's strict non-compete laws are a major point of consideration for any buyer. While there is a narrow exception that allows a non-compete clause for the sale of a business’s goodwill, this exception is interpreted very narrowly by courts. A non-compete clause that is too broad or not directly tied to the business sale can be deemed unenforceable, which can be a deal-breaker for a buyer seeking to protect their investment. This is a nuanced area that requires expert legal advice to structure the deal correctly.

Liability Lurking in an Asset Sale

In the lower-middle-market (businesses valued between $3m - $20m), an asset sale is often the preferred transaction type for a buyer, as it allows them to acquire the desired business assets while leaving behind most of the seller's liabilities. However, this doesn't mean the seller is free from risk. Liabilities such as accrued vacation time, employee misclassification claims, and other undisclosed legal issues remain the seller's responsibility and must be addressed during due diligence.

A failure to identify and resolve these liabilities—including the risk of a

California Private Attorneys General Act (PAGA) claim—can result in post-closing claims that erode your proceeds and create long-term headaches. For an example of how pre-sale due diligence can save a deal, see our case study on

Selling a Business with Complex Employee Benefit Liabilities.

A Strategic Framework for a Protected California Exit

The complexities of a California business exit require a proactive and specialized approach, not a reactive or generic one. Rogerson Business Services, focusing on the middle market businesses in California, offers a strategic framework designed specifically to protect your value and legacy. Our approach isn't about simply finding a buyer; it's about preparing your business for a bulletproof transaction.

The Rogerson Business Services Pre-Sale "Audit"

Our process begins long before a potential buyer is ever in the picture. We conduct a comprehensive pre-sale "audit" that meticulously prepares your business for the rigorous scrutiny of due diligence. This multi-phase strategy uncovers and addresses potential liabilities, ensuring a smoother, faster, and more profitable transaction. This proactive preparation is the key to avoiding last-minute dealbreakers and maintaining control throughout the M&A sell-side process.

Optimizing for a Tax-Efficient Sale

We work with a network of trusted tax and legal professionals to structure the transaction in a way that minimizes your tax burden. For example, we advise on the different tax consequences of an asset sale vs. a stock sale and help with the strategic allocation of the purchase price to maximize your take-home value. This is a critical step in a state where capital gains are taxed as ordinary income.

Our expertise helps you navigate this complex landscape, ensuring you don't lose a significant portion of your sale price to the state. We have helped numerous business owners do this, including the client in our Case Study on a Tax-Efficient Exit Strategy for a Manufacturing Business.

Proactive Legal Due Diligence

A buyer’s legal team will scrutinize every detail of your business. We get ahead of this by performing a thorough legal due diligence review of your corporate documents, contracts, and intellectual property.

This ensures that all legal ducks are in a row, from employee contracts to vendor agreements, which not only speeds up the transaction but also demonstrates the health and stability of your business.

This is especially important given California's strict non-compete laws and other employment regulations. By proactively addressing these issues, we help you avoid a situation where a buyer's concerns over potential legal liabilities derail the deal.

Beyond the Transaction: Legacy and Financial Security

Our solution goes beyond the numbers.

A well-prepared exit is not just about the final check; it's about a seamless transition that preserves your legacy and secures your family's future. By taking a strategic, long-term view, we ensure that your exit is a capstone to your career, not a source of future anxiety. This comprehensive approach is what sets us apart and is the reason our clients can confidently move on to their next chapter.

Validating Our Specialized Approach

The true value of a specialized M&A approach lies not in its promise but in its ability to deliver tangible results. At Rogerson Business Services, serving businesses valued between $3M - $20 M in California, our framework is built on a foundation of data, strategic tools, and a track record of success. We don't just talk about the problems; we provide the solutions.

The California M&A Readiness Checklist

Our proprietary California M&A Readiness Checklist is a powerful tool designed to give you a clear, objective assessment of your business's preparedness for a sale. This checklist, a key part of our pre-sale audit, highlights potential risks and opportunities long before a buyer ever enters the picture.

| Legal/Tax Item | Your Current Status (Checklist) | Rogerson's Value-Add |

|---|---|---|

| Business Formation Documents in Order | ☐ | We ensure all corporate records are meticulously organized and compliant with California law. |

| All Employee Contracts are Compliant with CA Law | ☐ | We review all employment agreements to identify and resolve any potential liabilities. |

| Tax Strategy for a Sale Has Been Developed | ☐ | We partner with tax professionals to model various scenarios and identify a tax-efficient deal structure. |

| All IP and Contracts Are Documented | ☐ | We prepare all legal documents to ensure a smooth due diligence process and protect your intellectual property. |

This checklist provides a clear roadmap, allowing you to self-assess your readiness while simultaneously showing where our expertise is crucial for a successful outcome.

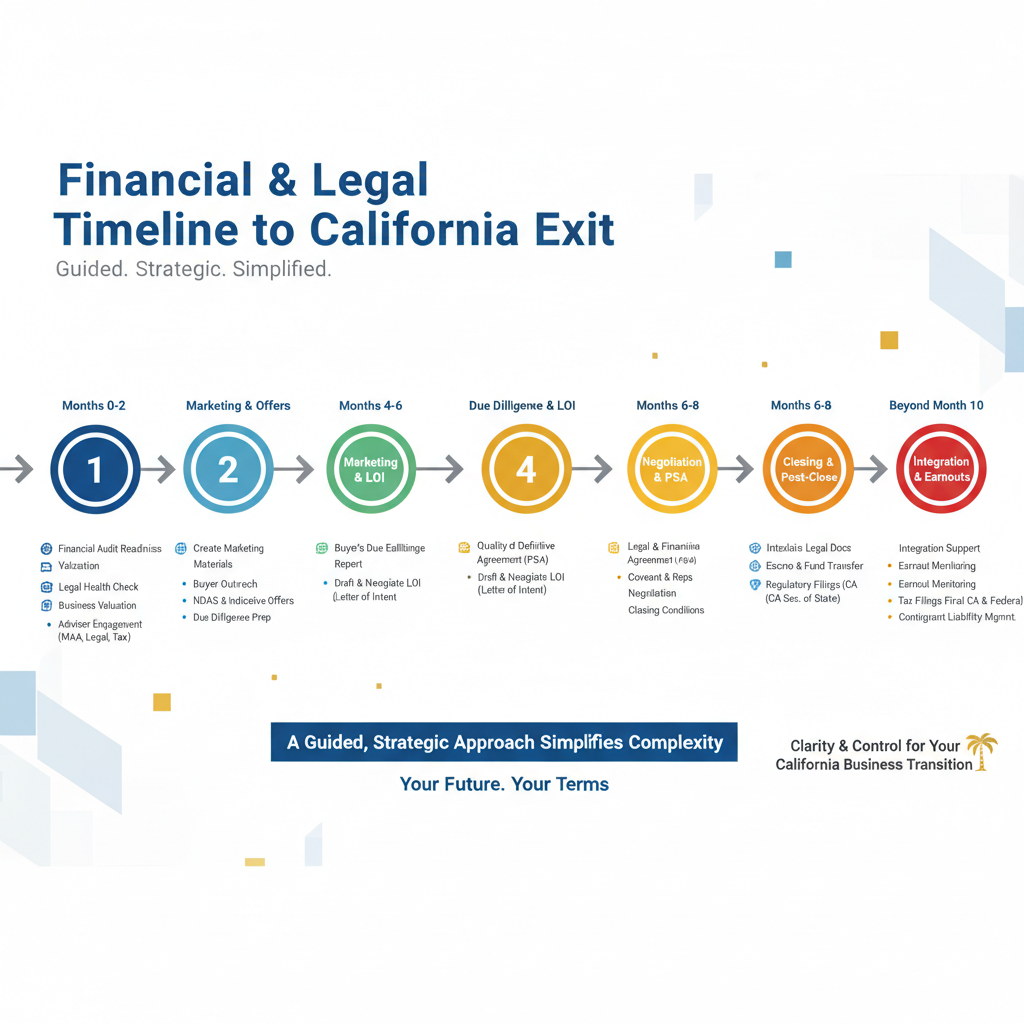

The Financial & Legal Timeline to a California Exit

Navigating a business sale can feel overwhelming, but a strategic timeline can bring clarity and control. Our Financial & Legal Timeline to a California Exit infographic visually simplifies the complex legal and financial process, showing key milestones and the corresponding tasks. This visual representation underscores the need for a guided, strategic approach.

Our approach, validated by the success stories of our clients, is about more than just a sale. It's about a well-planned and protected exit that maximizes your value and minimizes your risk. For an in-depth look at how we've helped clients achieve their goals, please review our case studies at https://www.midmarketbusinesses.com/case-studies. For example, our case study on the sale of a logistics business highlights how a proactive legal and tax strategy resulted in a higher-than-expected valuation.

Your Next Step Toward a Secure Exit

Don't let the complexities of California's legal and tax landscape become a roadblock to your future. Your business is the culmination of your life's work, and its exit deserves a plan that protects every bit of its value. Waiting for a buyer to appear before preparing your business is a dangerous gamble that can result in a significant loss of your final payout.

Take control of your future and your financial security. Don't leave your legacy to chance.

Schedule a confidential, no-obligation consultation with Andrew Rogerson to create your custom California Exit Plan.

This isn't just a meeting; it's the first step toward a smooth, rewarding, and protected exit. We'll help you understand your options, identify potential risks, and build a strategic roadmap that ensures you get the full value for the business you built. Your journey deserves a strong and successful finish.

Hey there! Can we send you a gift?

We just wanted to say hi and thanks for stopping by our little corner of the web. :) we'd love to offer you a cup of coffee/tea, but, alas, this is the Internet.

However, we think you'll love our email newsletter about building value and properly position your company before transition/exit your business ownership.

As a special welcome gift for subscribing, you'll also get our helping and educational guides, tips, tutorials, etc.. for free.

It's filled with the best practices for retiring serial business owners like Dan Gilbert, Larry Ellison, Warren Buffett, and many more.

Just sign up for our emails below.