M&A Advisors vs Investment Bankers:

The Ultimate Comparison

Architect or Auctioneer?

Choose Your Exit Partner.

For business owners between $2M and $100M, choosing between a boutique M&A Advisor like Andrew Rogerson of Rogerson Business Services, and an Institutional Banker isn't just a choice—it's a strategy.

License & CredentialS

CA BRE# 01861204

M&AMI

Master Intermediary

LCBB

Lifetime Broker

CM&AP

M&A Professional

CABB

CA Assoc. Bus. Brokers

M&A Source

Global Association

Investment Banker

Auctioneer

Best for businesses with an annual revenue above $100M, featuring a deal sourcing engine for broad research distribution.

Deal Size

Above $100M Revenue

Valuation Method

Adjusted EBITDA. Focused on (Market Benchmarks) Multiples of 4x - 8x.

Approach

Broad Auction (Maximizing Reach).

Regulation

SEC/FINRA Broker-Dealers (Series 79/63)

Typical Fee Structure:

Large Upfront Retainers + 1% Success

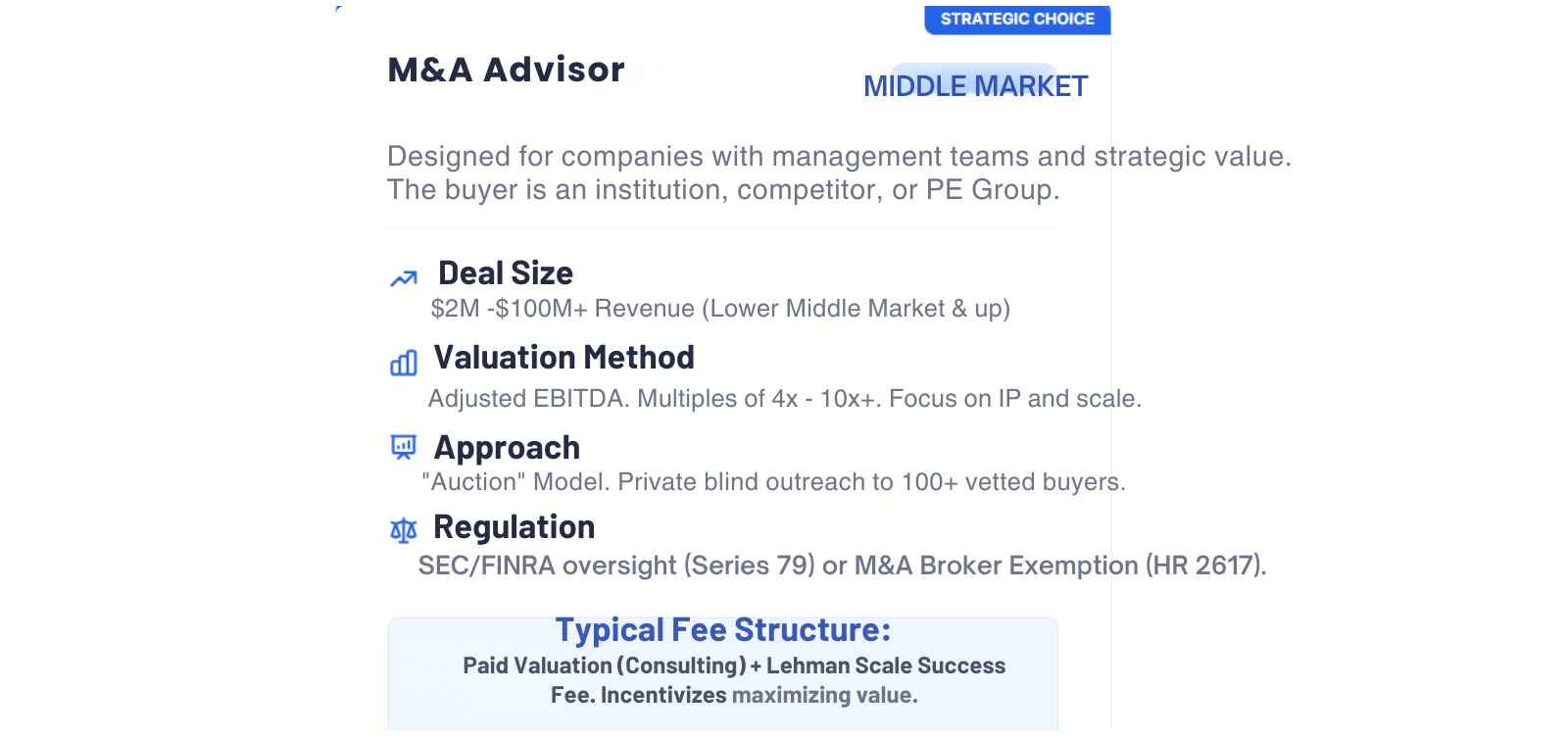

M&A Advisor

Middle Market

Designed for companies with management teams and strategic value. The buyer is an institution, competitor, or PE Group.

Deal Size

$2M - $100M+ Revenue (Lower Middle Market & up)

Valuation Method

Adjusted EBITDA. Multiples of 4x - 10x+. Focus on IP and scale..

Approach

"Auction" Model. Private blind outreach to 100+ vetted buyers.

Regulation

SEC/FINRA oversight (Series 79) or M&A Broker Exemption (HR 2617). Amortization of Goodwill. In California, a Real Estate License is required.

Typical Fee Structure:

Paid Valuation (Consulting) + Lehman Scale Success Fee. Incentivizes maximizing value.

Comparison Matrix: M&A Advisor vs. Investment Banker

Self-Assessment: Which do you need?

| Criteria | M&A Advisor (Boutique) | Investment Banker (Global) |

|---|---|---|

| Deal Size Range | $2M – $100M | $100M – Billions |

| Fee Structure | Success-heavy / Modified Lehman | Large Upfront Retainers + 1% Success |

| Core Strategy | Strategic Synergy Articulation | Broad Auction / Market Reach |

| Value Prep | 6–24 Months (Hands-on) | 3–6 Months (Transactional) |

Why Do M&A Advisors Charge For Business Valuation?

The "Commission-Only" trap vs. Strategic Investment.

The Passive "Listing" Approach

Business Brokers typically operate on a Success Fee only (Commission). Because they aren't paid until a sale happens, they must minimize the time spent on each client.

- Relies on public websites (BizBuySell).

- Generic "blind" ads.

- Waiting for buyers to come to them.

The Active "Auction" Approach

M&A Advisors charge a business valuation and assessment Fee. This upfront investment funds a team of analysts to prepare your business before going to market.

- Creating a 50+ page Confidential Information Memorandum (CIM).

- Building a bespoke list of 200+ strategic buyers.

- Setting up a secure Virtual Data Room (VDR).

- Result: Multiple bids drive the price up, often covering the retainer 5x over.

*Note: The $2M - $25M range is often called the "Lower Middle Market." Depending on complexity, either professional may work, but M&A Advisors typically yield higher multiples.

The $10M Value Checklist

Get 24 Months Exit Roadmap

Download our proprietary 24-month roadmap to double your multiple before your first meeting with an advisor.

Transaction FAQs

1. Why shouldn't I just use a large Investment Bank for a $50M deal?

At a large bank, a $50M deal is often assigned to junior associates. A boutique M&A advisor provides 100% senior-led execution, which is critical for the "narrative building" required at this size.

2. What is the "Succession Model" for fees?

Unlike bankers who require six-figure monthly retainers, M&A Advisors often work on a success-heavy basis, aligning their paycheck with the final wire transfer at closing.

3. Do M&A Advisors provide Fairness Opinions?

Generally, no. Technical fairness opinions for public shareholders require FINRA-licensed investment bankers. For private sales, strategic advisors focus on valuation defensibility rather than formal regulatory opinions.

4. How does the "QuietAuction" differ from a Broad Auction?

Advisors use a QuietAuction to contact 10-15 highly strategic, culturally aligned buyers. Bankers run a broad engine contacting 100+ bidders to maximize market tension via volume.

5. Is licensing really that important for my exit?

Yes. Especially in California, an improperly licensed advisor can lead to "unwinding" risks where the SEC or state regulators reverse the transaction post-closing.

California Licensing:

State vs. Federal Frameworks

In California, the regulatory landscape is uniquely complex. While Federal law provides the 2023 M&A Broker Exemption, California state laws (DFPI and DRE) still require specific licensing for middle-market intermediaries.

- DRE Mandates: California M&A Advisors often require a Real Estate License to legally facilitate asset and stock sales of entities with tangible assets.

- Federal Status: Traditional bankers must be registered SEC/FINRA Broker-Dealers (Series 79/63), mandatory for public company work or capital raises.

Sellers Beware: Operating with an unlicensed intermediary in California can legally void your success fee obligation and jeopardize the closing.

California Specific Warning

DRE Licensing Enforcement

To value and sell a business in CA, the firm must hold a California Department of Real Estate license. Unlicensed out-of-state "free" tools are illegal in CA.

Board Compliance (CSLB/BAR/ABC)

Free estimates ignore California's complex licensing clearances. Buying a construction or auto repair shop without CSLB/BAR clearance can trigger immediate legal failure.

Negotiate from Strength, Not Guesswork.

"If your business is in California, an out-of-state free business valuation is the fastest way to lose millions in structural errors. We live and breathe CA M&A."

Specialization Matters

Rogerson Business Services handles the Lower Middle Market (Gross Revenue $2M–$100M) with a track record of closing complex transactions across multiple CA sectors.

Request Your Defensible Analysis

For serious business owners ready to exit.

All reports are signed by a licensed principal.

Note: Every business is unique.

We recommend a free structural review to confirm.