CNC Manufacturing Business Valuation in California

CNC manufacturing business valuation in California

Expert guide to CNC manufacturing business valuation in California. Understand key factors, financial metrics, and methodologies for accurate business appraisal.

Figuring out what a CNC manufacturing business in California is actually worth can feel like a puzzle. There are a lot of moving parts, from the machines themselves to the money the company brings in and the people who work there.

This guide aims to break down the process of determining the value of your CNC shop in the Golden State, covering the financial side, market conditions, and what makes your specific business stand out.

Key Takeaways

- The value of a CNC manufacturing business in California depends on many things, including its financial health, market conditions, and unique assets.

- Understanding your shop's revenue, profits, and financial metrics like EBITDA is key to a realistic valuation.

- Different valuation methods exist for valuing a CNC business, such as looking at similar sales, the value of its assets, or future earnings.

- Selling a CNC manufacturing business involves preparing the business, finding the right buyers, and setting up the deal correctly.

- Getting help from experts like

Andrew Rogerson, M&A business brokers and valuation specialists can make the valuation and sale process smoother and more profitable.

Table of Contents

- Understanding CNC Manufacturing Business Valuation in California

- Financial Metrics for CNC Business Valuation

- Valuation Methodologies for CNC Machining Businesses

- Navigating the Sale Process for California CNC Shops

- The Importance of Professional Valuation Services

- Specific Considerations for California CNC Manufacturers

- Wrapping Things Up

- Frequently Asked Questions

Understanding CNC Manufacturing Business Valuation in California

Figuring out what your CNC manufacturing business in California is worth involves looking at several pieces. It’s not just about the machines; it’s about the whole picture. When you want to know how to value a machine shop in California, you need to consider what makes your specific operation stand out.

Key Factors Influencing CNC Shop Valuations

Several things affect the value of a CNC shop. The age and condition of your equipment, for instance, play a big role. Also, the types of clients you serve and the contracts you have in place matter.

A business with long-term, stable clients often commands a higher valuation than one relying on sporadic work. Think about your shop's reputation for quality and on-time delivery; these intangible assets add real worth.

When considering a CNC business appraisal in the Bay Area, these elements are carefully examined.

The Role of Market Conditions in California

California's economic climate significantly impacts business valuations. Factors like the overall health of industries that rely on CNC machining, such as aerospace, automotive, and medical devices, influence demand. Additionally, the competitive landscape within specific regions, like Los Angeles, affects how a manufacturing company worth in Los Angeles is perceived. Understanding these broader market trends is key to accurately estimating the CNC shop's worth in California.

Assessing Intangible Assets in Your Valuation

Beyond physical assets, intangible elements contribute substantially to a CNC business's value. This includes your company's brand reputation, customer lists, proprietary processes, and skilled workforce. A strong management team and well-trained employees are invaluable.

When you're looking at

appraisal services for machine shops in CA, these non-physical assets are often what differentiate a good business from a great one.

Valuing precision manufacturing in CA means recognizing the value of intellectual property and established relationships.

Financial Metrics for CNC Business Valuation

When estimating the CNC business sale price in California, a close look at financial metrics is absolutely necessary. These numbers paint a clear picture of your business's health and its potential for future earnings. Buyers will scrutinize these figures to determine the true worth of your company.

Analyzing Revenue and Profitability Streams

Your CNC business's revenue streams are the lifeblood of its valuation. Rogerson Business Services examines where your income originates, whether from long-term contracts, one-off projects, or specialized services.

Understanding the consistency and diversity of these streams helps buyers gauge risk. Profitability, of course, is paramount. We look beyond just top-line revenue to analyze your gross profit margins and net profit. A consistent track record of strong profitability is a major driver of a higher valuation.

Understanding EBITDA and Its Significance

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, is a widely used metric for comparing the operational performance of different companies. For CNC manufacturers in California, EBITDA provides a standardized way to assess profitability before accounting for financing decisions, tax environments, and non-cash expenses. It helps buyers understand the core earning power of your business. A higher EBITDA generally translates to a higher business valuation.

The Impact of Accounts Receivable and Inventory

Accounts receivable (A/R) and inventory represent working capital tied up in your business. Buyers will carefully assess the age and collectability of your A/R. Outstanding invoices that are significantly past due can reduce the perceived value of your business. Similarly, the value and turnover rate of your inventory are important. Excessive or obsolete inventory can be a red flag. Efficient management of both A/R and inventory demonstrates strong operational control.

Buyers often look for businesses with clean balance sheets. This means minimizing aged receivables and ensuring inventory is current and relevant to your production capabilities. It simplifies the transition and reduces perceived risk for the acquiring party.

Here's a look at how these metrics might be presented:

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Total Revenue | $1,500,000 | $1,750,000 | $2,000,000 |

| Gross Profit Margin | 35% | 38% | 40% |

| EBITDA | $300,000 | $375,000 | $450,000 |

| Accounts Receivable | $250,000 | $280,000 | $300,000 |

| Inventory Value | $150,000 | $160,000 | $170,000 |

Key considerations for your CNC business include:

- Revenue Concentration: Dependence on a few large clients can be a risk. Diversified revenue streams are more attractive.

- Cost Management: Effective control over material, labor, and overhead costs directly impacts profitability.

- Growth Trends: Demonstrating consistent year-over-year revenue and profit growth is highly desirable for potential buyers.

Understanding these financial components is a critical step in

preparing your CNC business for a successful sale. For more insights into the California market, consider the expertise available at

Rogerson Business Services.

Andrew Rogerson is ready to assist you with determining the value of your CNC business in California. Fill the simple form below and get a quick quote for a professional business valuation.

Don't have time to read more?

Take a shortcut and play the video overview below

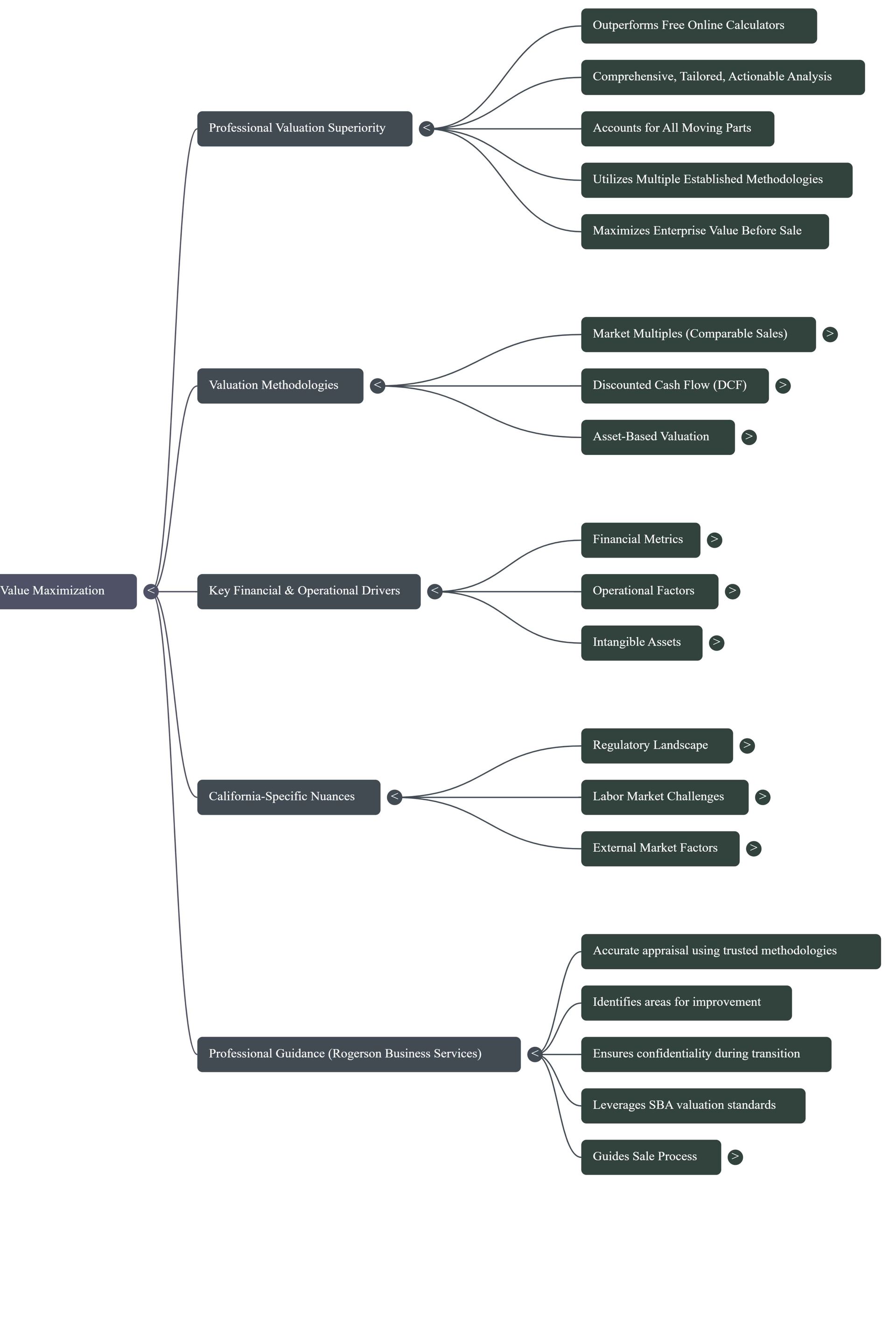

Valuation Methodologies for CNC Machining Businesses

When valuing a CNC machining business in California, several established methodologies come into play. Each approach offers a different lens through which to view the business's worth, and often, a combination provides the most accurate picture. Understanding these methods is key to a successful metals fabrication business valuation guide.

Market Multiples and Comparable Sales Analysis

The market multiples method looks at what similar CNC businesses in California have sold for recently. It involves finding comparable companies that have been sold and then applying a multiple to your business's financial metrics, like revenue or EBITDA.

The challenge here is finding truly comparable sales, as each business has unique characteristics. However, it provides a solid market-based perspective.

- Identify recent sales of CNC shops in California.

- Analyze their financial performance (revenue, EBITDA).

- Determine appropriate multiples based on industry and business size.

- Apply these multiples to your business's financials.

Asset-Based Valuation Approaches

An asset-based valuation focuses on the net value of the company's assets. This includes tangible assets like machinery, equipment, buildings, and inventory, minus any liabilities. For CNC shops, the machinery itself is often a significant asset. This method is particularly relevant if the business has substantial physical assets or if it's not highly profitable, as it establishes a floor value.

This approach is especially useful for businesses with a large amount of specialized equipment.

Discounted Cash Flow Projections

The discounted cash flow (DCF) method projects the business's future cash flows and then discounts them back to their present value. This approach considers the business's earning potential over time. It requires careful forecasting of revenues, expenses, and capital expenditures. For a growing CNC business in California, DCB can highlight its future value.

DCF analysis requires realistic assumptions about future growth and market conditions. Overly optimistic projections can inflate the valuation, while conservative estimates might undervalue the business.

Here's a simplified look at the DCF process:

- Project free cash flows for a specific period (e.g., 5-10 years).

- Estimate a terminal value for the business beyond the projection period.

- Determine an appropriate discount rate reflecting the risk.

- Discount all future cash flows and the terminal value back to the present.

Each of these methodologies provides a different perspective on a CNC machining business's value. A thorough valuation often incorporates insights from all three to arrive at a well-supported conclusion.

Navigating the Sale Process for California CNC Shops

Selling your CNC manufacturing business in California involves several distinct stages. A well-planned approach helps ensure a smoother transaction and a more favorable outcome. This process requires careful preparation, strategic marketing, and diligent negotiation.

Preparing Your Business for Sale

Before you even think about listing your business, you need to get your house in order. This means tidying up your financial records, making sure all your permits and licenses are current, and documenting your operational procedures. Here is more on how to prepare your CNC manufacturing business for sale in California.

Buyers will want to see a clean, well-organized business. A strong emphasis on operational efficiency and documented processes will significantly boost buyer confidence.

Think about what a potential buyer would look for. They'll want to see that the business can run without you being there every minute. This often involves training key employees and delegating responsibilities.

Identifying and Qualifying Potential Buyers

Once your business is ready, the next step is finding the right buyer. Buyers generally fall into a few categories:

- Strategic Buyers: These are typically larger companies in the manufacturing sector looking to expand their market share, acquire new technology, or gain access to your customer base. They often have the capital for significant offers.

- Financial Buyers: These are individuals or investment groups looking for a profitable business to own and operate. They focus on the financial returns and operational stability.

- Competitors: Other CNC shops in California might be interested in acquiring your business to eliminate competition or consolidate operations.

Qualifying these buyers is just as important. You need to ensure they have the financial capacity to complete the purchase and a genuine interest in continuing your business's legacy. This often involves signing non-disclosure agreements (NDAs) before sharing sensitive company information.

Structuring Offers and Purchase Agreements

Offers will come in various forms, and understanding them is key. You'll encounter different types of purchase agreements, most commonly:

- Asset Purchase Agreement: The buyer purchases specific assets of the business (equipment, inventory, customer lists, etc.). This is often preferred by buyers as it allows them to avoid inheriting existing liabilities.

- Stock Purchase Agreement: The buyer purchases the shares of the company, effectively taking over the entire legal entity, including all its assets and liabilities.

In California, the choice between an asset sale and a stock sale can have significant tax implications for both the seller and the buyer. It is advisable to consult with legal and tax professionals to determine the most advantageous structure for your specific situation.

Negotiating the terms of the offer, including the price, payment structure, and closing conditions, is a critical phase. A well-drafted definitive purchase agreement, often using standard forms like those from the California Association of Business Brokers (CABB), will outline all these details. This agreement forms the legal foundation for the transaction, and it's where you'll see details about:

- Purchase Price and Payment Terms

- Closing Date

- Representations and Warranties

- Indemnification Clauses

- Contingencies (e.g., financing, due diligence approval)

After an offer is accepted, the

due diligence period begins, where the buyer thoroughly examines your business's financials and operations.

The Importance of Professional Valuation Services

Engaging Experienced Business Brokers

When you decide to sell your California CNC manufacturing business, working with a specialized M&A business broker like Andrew Rogerson of Rogerson Business Services makes a significant difference.

These professionals understand the nuances of the manufacturing sector, particularly in California's dynamic market. They help you present your business accurately, connecting you with buyers who appreciate the value of your operations.

A good broker and advisor can identify potential buyers, screen them for financial readiness, and guide you through initial negotiations. They act as a buffer, keeping the process professional and focused.

Leveraging SBA Valuation Expertise

The Small Business Administration (SBA) has specific requirements for business valuations, especially when financing is involved. Engaging with services that understand SBA standards can streamline the sale process.

These experts can provide a market value analysis using methodologies and software trusted by SBA analysts. This is particularly helpful if you are considering SBA loans for your buyer, as it can increase the likelihood of loan approval at a recommended value.

They often have access to databases of comparable sales, which is vital for establishing a realistic price point for your CNC shop.

Ensuring Confidentiality and Due Diligence

Selling a business involves sensitive information. Professional valuation services and brokers prioritize confidentiality throughout the process. They implement measures to protect your proprietary data while still allowing potential buyers to conduct thorough due diligence.

Still undecided on which valuation path to take? This free vs. paid valuation deep dive will help you make the right decision based on your circumstances.

This involves a structured review of your financials, operations, and customer base. A well-managed due diligence period, facilitated by experienced professionals, builds trust and moves the transaction toward a successful closing. They help manage the flow of information, keeping both parties informed and on track.

Specific Considerations for California CNC Manufacturers

California's Regulatory and Economic Landscape

California presents a unique business environment for CNC manufacturers. The state's strict environmental regulations, for instance, can add compliance costs that impact profitability. Additionally, the state's dynamic economy, while offering opportunities, also brings specific challenges. Understanding how these state-specific factors influence operational costs and market demand is key to an accurate valuation. Buyers will scrutinize how well your business has adapted to California's business climate.

Addressing Labor Costs and Skilled Workforce Availability

Labor is a significant expense for any manufacturing operation, and California is known for its higher wage expectations. The state's minimum wage increases directly affect operating costs. Furthermore, finding and retaining a skilled workforce for CNC operations can be challenging. A business that has a stable, experienced team and effective training programs will likely command a higher valuation. Buyers look for continuity and a reduced risk of operational disruption.

The Impact of Trade Policies on Valuations

Global and national trade policies can create uncertainty for manufacturers. Tariffs, import/export restrictions, and international trade agreements can affect the cost of raw materials and the competitiveness of finished goods. For a California-based CNC business, these policies can influence supply chain stability and market access. A buyer will assess how your business has managed these trade-related risks and whether it has diversified its supply chain or customer base to mitigate potential impacts.

Buyers often look for businesses that demonstrate resilience. This means showing how your CNC operation has successfully navigated past economic shifts and regulatory changes. A history of adaptability is a strong indicator of future performance and, therefore, a higher valuation.

Here are some common considerations for California CNC manufacturers:

- Regulatory Compliance: Adherence to state and local environmental, safety, and labor laws.

- Supply Chain Management: Strategies for sourcing materials and managing logistics within California and beyond.

- Workforce Development: Programs for training and retaining skilled machinists and technicians.

- Market Diversification: Efforts to serve various industries to reduce reliance on any single sector.

- Technological Adoption: Investment in modern CNC equipment and software to maintain a competitive edge.

For CNC makers in California, there are unique things to think about. These can include special rules or market conditions that affect your business. Understanding these specific points is key to success.

Want to learn more about how these factors could impact your company's value or sale?

Send a free inquiry today for expert insights tailored to your situation.

Wrapping Things Up

So, figuring out what your CNC shop in California is actually worth can feel like a puzzle. There are a lot of moving parts, from the machines themselves to how well the business runs day-to-day. It's not just about the equipment; it's about the whole operation, the customers you have, and what the market looks like right now.

Getting a solid valuation means looking at all these things carefully. It helps you know where you stand, whether you're thinking about selling, bringing on partners, or just want a clear picture of your company's value.

It’s a smart move to

get professional help with this, especially in a place like California with its own set of rules and a busy market. Knowing your worth is the first step to making good decisions for your business's future.

Frequently Asked Questions

What makes a CNC manufacturing business in California valuable?

Several things make a CNC shop valuable. This includes how much money it makes, how much profit it earns, and the quality of its equipment. The skills of its workers and its reputation in the industry also play a big part. The overall economy in California and the demand for manufactured parts are important, too.

How is the value of a CNC business calculated?

The value is often found by looking at its financial records, like how much money it brings in and its profits. Experts also use something called EBITDA, which is a way to measure how much money the business makes from its operations. They might also look at how much the company's equipment and other assets are worth.

Are there different ways to figure out the worth of a CNC shop?

Yes, there are a few common methods. One way is to compare your business to similar ones that have recently been sold. Another is to add up the value of all the company's assets, like machines and buildings. A third way is to predict how much money the business will make in the future and calculate its current worth based on that.

What are some special things to think about when selling a CNC business in California?

California has specific rules and economic conditions that can affect a sale. Things like the cost of labor and finding skilled workers are big factors. Also, rules about trade and tariffs can impact how much a business is worth. It's important to understand these local issues.

Why should I get help from experts when valuing my CNC business?

Experts, like business brokers or appraisers, have experience and know the market well. They use special tools and data to give you a more accurate idea of your business's worth. They can also help you understand complex financial details and guide you through the selling process, making it smoother and potentially getting you a better price.

What is EBITDA and why is it important for my CNC business valuation?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It's a way to measure a company's operating performance. For CNC businesses, it helps buyers see how much money the shop is making from its core operations, without being affected by things like how the business is financed or how it accounts for its equipment's age.

Hey there! Can we send you a gift?

We just wanted to say hi and thanks for stopping by our little corner of the web. :) we'd love to offer you a cup of coffee/tea, but, alas, this is the Internet.

However, we think you'll love our email newsletter about building value and properly position your company before transition/exit your business ownership.

As a special welcome gift for subscribing, you'll also get our helping and educational guides, tips, tutorials, etc.. for free.

It's filled with the best practices for retiring serial business owners like Dan Gilbert, Larry Ellison, Warren Buffett, and many more.

Just sign up for our emails below.