5 Tips: How to Sell a Service Business For the Highest Valuation

How to Sell a Service Business?

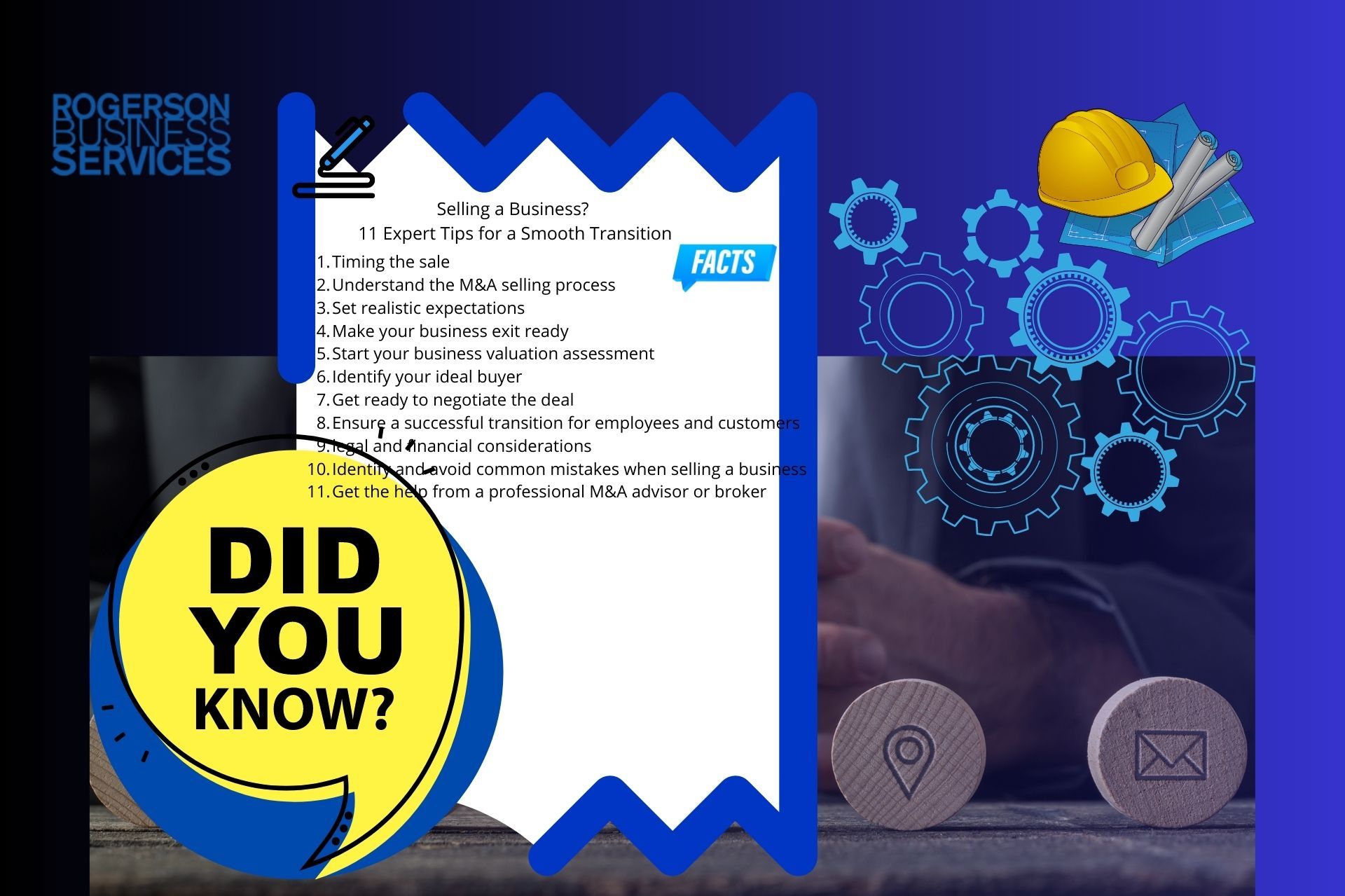

- Step One: Find the reason/s for selling your service business

- Step Two: Find how you can improve business value

- Step Three: Find the 5 key steps to sell a business

- Step Four: Find the 3 ways how an M&A firm can help in selling your business successfully

- Step Five: Find how much taxes will you pay on selling a business

Are you a business owner in California who wants to sell a service business? To learn how to sell a service business, check out our five tips below to begin this process.

Sell a Service Business

Before you decide to sell your service-based business, there are important questions you’ll need to ask yourself, including: ‘why should I sell my company?’ Keep reading to learn about the essential reasons for selling and how to sell a service business.

Tip 1: Find The Reasons for Selling a Service Business

Some basic questions you’ll want to ask yourself before selling a business services company include:

- Is it a smart decision financially to sell my professional service company?

- Are all founders, key investors, and stakeholders in favor of the sale?

- Where will I invest the revenue from the sale?

- Will I need to learn how to sell my professional service company?

There are many reasons to sell a company, and we have gathered the top five reasons below.

First, financial considerations are essential since your company may barely be scraping by, or you may have a large offer that you can’t refuse. Second, selling your business could bring a more accurate valuation where you can determine the motivation of buyers and find ways to make your company better suited for a merger or acquisition.

Third, a common reason to sell a service-based company is due to unforeseen emergencies or crises, including illness, death, family emergencies, divorce, and more. Creating an effective exit strategy can help you properly sell a business in difficult times.

Another top reason why a business owner may sell his or her company is due to becoming tired of risks, according to Entrepreneur. When companies grow bigger, many stop taking risks to avoid doing damage control in case things go wrong.

After a CEO has put in two decades or more into their company, it may be time to retire or time for a change. That is another important reason to sell a service business.

How to Increase Business Value

It’s not easy to sell business service companies and entrepreneurs will need to work on growing the business value of the company they’ve put so much time and effort into.

By growing your business and selling when it has the highest value, you will gain the highest revenue and have an excellent exit strategy. There’s no time like today to plan your business’s exit strategy.

Below, we detail the key ways you can improve the value of your professional services business.

Tip 2: How You Can Improve Business Value

There are several steps you’ll need to take to improve business value. First, you’ll want to work with an outside advisor who is experienced in selling businesses and can conduct a professional valuation of your company.

The next step is to find ways to increase your profits. If your business is barely getting by, then it won’t garner you many good offers. When learning how to sell a company, you’ll want to make sure your business is profitable. To do so, you’ll also need to boost sales numbers and decrease expenses.

You’ll also want to keep investing in your business by upgrading new equipment and improving your processes or expanding hiring. All these methods will help boost the value of your business.

Selling a Professional Service Company

Now we will dive into how to sell a company. If you have a mid-market business for sale, we have five great tips for you to sell an entity in the business services market.

Tip 3: The Top Five Key Points for Selling a Business Services Company

Do you have any middle-market companies for sale? If so, the first tip we have for you is to properly evaluate your business. Figure out the value of your company by using a professional valuation service. With the right evaluation, this can increase the price of your company.

If you have lower middle market businesses for sale, the second tip we’ve got for you is to create a cautiously worded business summary and plan. During the process of selling a business, you’ll want to avoid providing too much information about your company in case the sale falls through.

Are you still wondering, “how do I sell my company?” Our third tip is to gather all your company legal documentation, including licenses or permits. Check what the business laws of California are and gather all financial paperwork and plans.

Next, you should market and list your company by using a summary sheet with key benefits for an acquisition. Our last tip is to let your potential buyers take time to complete the due diligence of your company so that their final decision is definite.

Advisory Firm for Merger & Acquisition in Business Services Industry

How do you sell a business services company in California? The biggest advice you should take when learning how to sell a business in California is to hire a merger & acquisition (M&A) advisory firm.

An advisory firm for a merger & acquisition in the business services industry can help you decide when it is time to end business ownership and sell your company.

Tip 4: The Top Three Ways a Merger and Acquisition Advisory Agency Can Help Sell a Business

A business services merger and acquisition need careful planning before you list your company for sale. Are you wondering, “How can M&A advisors help sell my business?” There are three ways that an M&A advisory firm can help.

First, an M&A advisory firm will garner the documentation needed for selling professional services companies. They will also complete a business valuation. Second, these advisors will find potential buyers as well as interview them to identify the best choice.

The third way an M&A advisory agency can help you is to complete the financial paperwork after an offer is put forward and ensure the sale is concluded.

Selling Your Company

Tip 5: When selling a service business, there are specific tax implications to consider

As a business owner, you’ll want to get a fair price, and there’s an important thing to consider when selling a service business in California: you may not need to pay a capital gains tax.

However, the only way to avoid paying a capital gains tax is to trade your company for other business assets, which is known as a 1031 exchange. As long as you sell your assets and gain new ones within 45 days, you can avoid the capital gains tax.

If you’d rather pursue a standard sale agreement, you’ll want to get your business appraised. This will help you better understand the amount of capital gains taxes from your sale.

With assistance from an M&A advisory firm, you can sell your service business at its highest valuation.

If you are a retiring business owner looking to exit your lower middle market service business in California, here are six tips to get you started:

1. Don't wait until the last minute to start planning your exit. The process of selling a lower middle market service business can take a long time, so it's important to start early.

2. Have a clear idea of what you want to get out of the sale. Know your goals and what you're willing to negotiate.

3. Know what's your company's worth. This is an essential step to take when planning to sell your service business company in California.

4. Choose the right type of buyer. Not all buyers are created equal, so do your research and find the right one for your business.

5. Be prepared for a lot of due diligence. M&A buy-side due diligence is when buyers will want to know everything about your business, so be ready to provide documentation and answer questions.

6. Be flexible with the terms and conditions of the deal. It's important to be open to negotiation to get the best possible deal for your business.

Rogerson Business Services, also known as, California's lower middle market business broker is a sell-side M&A advisory firm that has closed hundreds of lower middle-market deals in California. We are dedicated to helping our clients maximize value and achieve their desired outcomes.

We have a deep understanding of the Californian market and an extensive network of buyers, which allows us to get the best possible price for our clients. We also provide comprehensive support throughout the entire process, from initial valuation to post-closing integration.

Our hands-on approach and commitment to our client's success set us apart from other firms in the industry. If you consider selling your lower middle market service business, we would be honored to help you navigate the process and realize your goals.

If you have decided to value and then sell your lower middle market service company or still not ready, get started here, or call toll-free 1-844-414-9600 and leave a voice message with your question and get it answered within 24 hours. The deal team is spearheaded by Andrew Rogerson, Certified M&A Advisor, he will personally review and understand your pain point/s and prioritize your inquiry with Rogerson Business Services, RBS Advisor

Go to the next article: Part of tips to selling business services company in California series ->

More Tips to Help Sell a Lower Middle Market Business Services Company

Hey there! Can we send you a gift?

We just wanted to say hi and thanks for stopping by our little corner of the web. :) we'd love to offer you a cup of coffee/tea, but, alas, this is the Internet.

However, we think you'll love our email newsletter about building value and properly position your company before transition/exit your business ownership.

As a special welcome gift for subscribing, you'll also get our helping and educational guides, tips, tutorials, etc.. for free.

It's filled with the best practices for retiring serial business owners like Dan Gilbert, Larry Ellison, Warren Buffett, and many more.

Just sign up for our emails below.