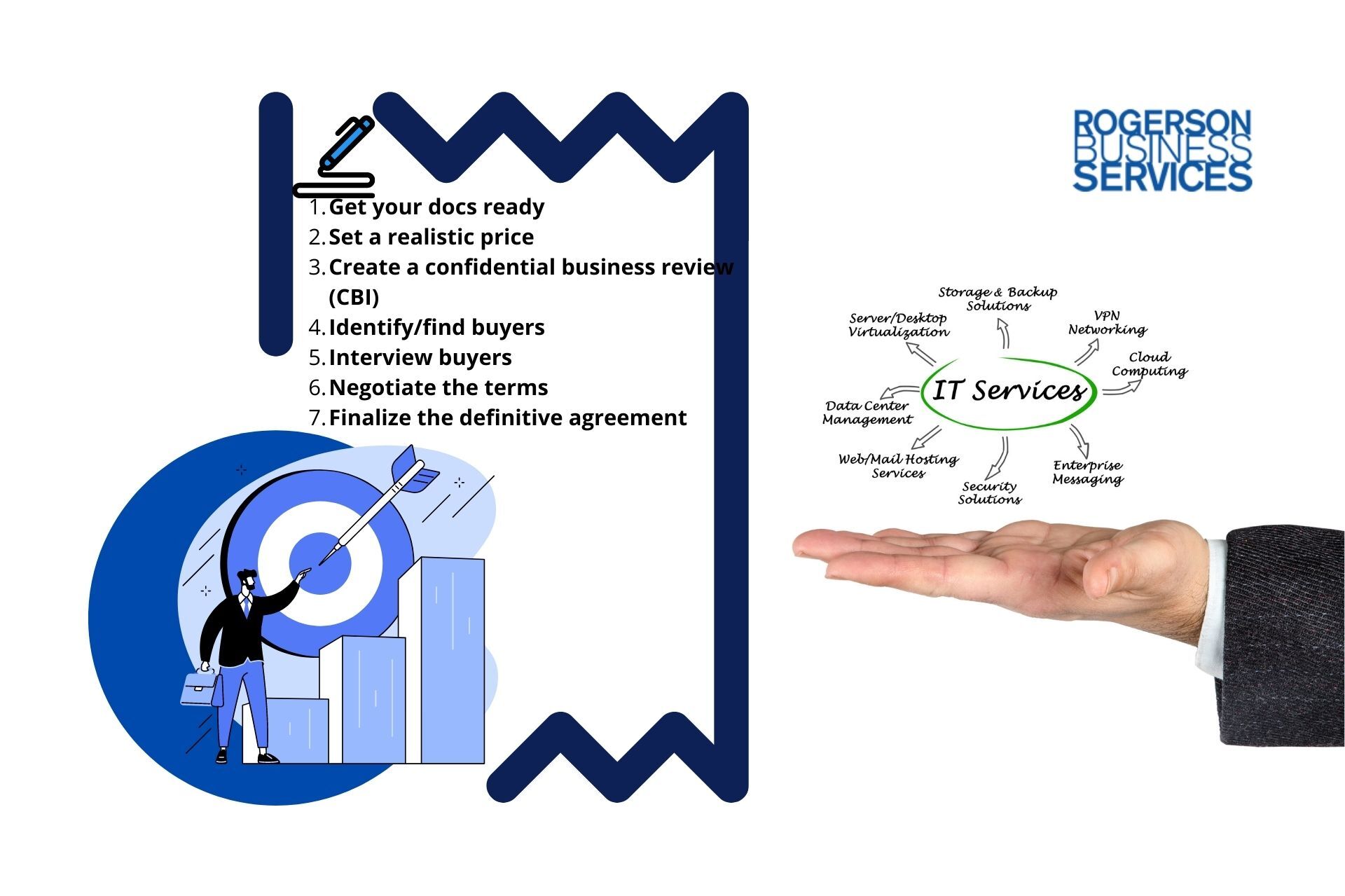

CSP Cloud Business For Sale: 7 Steps To Get Your IT Services Company Sold

CSP Cloud Business For Sale

Ready to retire and list your CSP cloud business for sale? Here are 7 steps to get your IT service company sold on your own terms in California.

- Get your docs ready

- Set a realistic price

- Create a confidential business review (CBI)

- Identify/find buyers

- Interview buyers

- Negotiate the terms

- Finalize the definitive agreement

You have worked hard to create your CSP cloud business and lift it off the ground, and now you’re ready to retire. When you consider selling your business, you’ll want to ensure you get the maximum possible profit. After all, you did a lot of hard work to get it where it is today.

But selling a business can be daunting, especially for those who haven’t navigated the red tape and requirements involved. We put this comprehensive guide together to help you through the selling process. This step-by-step coverage will identify what you need to focus on to list your CSP cloud business for sale and successfully close the sale in California.

How Do I Sell My Business?

If you're looking to sell your CSP cloud business, the most important thing is to think like a buyer.

- What are the strong selling points of your business?

- What are the qualities of the person you see running this business?

- What risks do you inherit by acquiring this business?

Putting up your business for sale takes a lot of planning. Your answers to these questions will be paramount in figuring out how much you can charge for your business and where you will find potential buyers.

Here is a simple checklist to walk you through this stage:

- Use your network as a starting point.

- Check out businesses similar to yours that have sold.

- See how much they got and how long it took them to sell.

Need more help to know all the documents needed to exit/sell/transition your business? Download this ExitPrep Checklist

From there, you can work on getting your business sale-ready. Generating interest from potential buyers is a matter of familiarizing yourself with every aspect of your business. Here are key steps to help you get started readying your business for sale:

1. Get your ducks in a row

Buyers are more cautious in the modern economic climate. They are more likely to do more research to make sure they’re investing in something that will be viable in the long run. Unorganized finances are a red flag to many buyers, most of whom won’t take the risk if it means they might lose money.

Making sure you have all of your data in order will increase the likelihood that these savvy buyers will complete the sale. This can also help you understand strong points and stay ahead of potential weak spots.

The more time and effort you put into organizing your finances and preparing your business, the more serious potential buyers will take you. That means more profit for you and less hassle for everyone involved. This pre-sale organization can include:

- Having all of your financials in order

- Compiling a list of your current clients and contacts

- Polishing up your company's marketing materials

- Working with a consultant to review financial statements and tax returns from the past three to five years

- Listing inventories and other assets, including intellectual property

You can also streamline the process by developing a concrete document outlining how you run the company. Consider creating an operating manual so potential buyers can see exactly what they’re getting. It will also minimize necessary stay-on time while new management learns the ropes.

2. Set a realistic price

Determining the price you want to sell your business for can be a complex task. For lower middle market businesses, cash flow tends to be the main focus. One way you can estimate how much your business is worth is by taking your annual cash flow and multiplying it by two to five.

For example, if the annual cash flow of your CSP cloud business is $100,000, a good asking price is anywhere between $200,000 and $500,000.

If you’re relatively inexperienced in selling a business, consider hiring a third-party firm for an official valuation. They’ll look over everything you may have missed and estimate the value of your business accurately. A professional valuation will identify assets, inventories, and opportunities that can add credibility to your asking price.

Whether you hire a professional or not, it's important to set a fair and realistic price for both you and the buyer. You can also do some research on similar businesses to yours that have been sold recently and estimate pricing your IT lower middle market business accordingly.

Have you already tried to sell your IT services business on your own, and failed to find a buyer? Get Qualified Buyers

3. Create a sales brochure

A sales brochure or a confidential business review (CBR) puts all of the main selling points of your business in one place.

This can then be distributed amongst your network to reach potential buyers. Your CBR should include all of the pertinent information about your CSP cloud business, such as its history, services offered, client base, and contact information.

It's also a good idea to include testimonials from satisfied clients. This helps establish value by letting future buyers know your business has the potential for long-term viability. A good reputation means more potential clients, which translates to more profits for them and you. Checkout this forum for more insights that you might find helpful.

If you need help with the best way to present your company to potential qualified buyers, you might want to hire an IT business broker or a sell-side advisor to help you develop the best CBR document pushing the way to a successful sale of your MSP business.

4. Identify potential buyers

Once you've created a confidential business review (CBR), start circulating it among potential buyers. Thanks to the internet, there is a myriad of ways to connect with prospective buyers. However, make sure interested buyers sign a non-confidential agreement (NDA) first.

Start with networking with people or organizations who have expressed an interest in acquiring a CSP cloud business in the past. You can also network with other businesses in your industry that might be looking to expand.

If you’re new to the world of business sales, consider working with a business broker. Hiring a lower middle market business broker is not similar to hiring a real estate agent to help you sell your home. Experienced M&A brokers know the ins and outs of marketing a business to get it successfully sold. Also, they’ll have connections to qualified acquirers who are already interested in buying a CSP cloud business.

There are other advantages to hiring a broker as well, such as confidentiality. Brokers can sell your business directly to buyers without needing to post it publicly.

If you prefer to sell your business on your own, you can also use online resources like Mergers & Acquisitions or conduct a Google search on "Sell My IT Services Business" to find interested parties. Online business listing sites have the advantage of being affordable and accessible to a wide variety of potential buyers.

5. Hold informational meetings

If you have several potential buyers interested in your business, consider holding informational meetings with them to give them a more detailed overview of your company and to answer any questions they may have.

By asking the right questions, you’ll be able to determine the buyer’s level of interest in acquiring your IT services business. These meetings can also be an opportunity to determine whether you want to follow through on a transaction with the potential buyer.

Some questions to ask include:

- What is the potential buyer’s timeline for making an offer?

- Do they have experience running a CSP cloud business?

- Have they already secured funding?

If you want to make sure your business ends up in the right hands, you’ll want to make sure your potential buyer has the qualities your looking for. Informational meetings are a great time to make sure that everyone is on the same page to prevent delays down the road.

6. Negotiate terms with interested buyers

Once you've selected an interested buyer, it's time to start negotiating the terms of the Letter of intent (LOI). Generally, this includes the purchase price, the closing date, and any post-sale obligations on behalf of the buyer or seller.

At this stage, it will be helpful to employ the help of a transactional attorney or a deal team that is made of a group of professionals. Here are just some of the key issues to consider when drafting agreements to sell your CSP cloud business:

- Confidentiality

- Type of transaction

- Sales taxes

- Bulk sales law

- Due diligence

- Price adjustments based on performance

- Assets and liabilities

- Hold back to cover adjustments

- Assignment of leases

- Licenses and transfer

- Training before the sale and post-sale consulting

- Non-compete agreements

- Successor liability

With so many things to keep track of, having a professional on-call to handle the legal side of the business agreement can save you a major headache. It will also protect you, as the seller, from hidden costs or abandoned transactions.

7. Finalize the definitive sale agreement

After you’ve prepared your finances and legal documents, you’ll be ready to enjoy the payoff for your effort. Once both parties have agreed on the terms of the sale agreement, finalize everything by drafting a formal contract outlining the specifics of the deal. Once both you and the buyer have read and agree to all of the terms, a definitive sale agreement that you can sign off on it.

You might not be totally in the clear after signing, however. If you agreed to stay on for post-sale consultation, you’ll have to work with new management during the transition period.

And even if you opt to not stay on, you’ll benefit from meeting with a financial advisor after the sale. They can help you find a way to turn the sales proceeds into more money so you can enjoy your retirement, worry-free.

Do you want to know how the selling process actually looks like? Walk me through a sell-side process

Final take

You put a lifetime of work into developing your CSP cloud business, and selling it might be one of the most important decisions you’ll ever make. Doing your research, finding the right buyer, and putting a good team of experts together will help you maximize your profit from selling your business.

In our next article, you'll learn the best way to price your business before putting it up for sale.

Conclusion

Selling your IT managed service provider (MSP) business in the lower middle market in California is a life changing event that requires forethought and careful planning. Before selling your business, know its worth in both tangible and intangible assets. Find a reliable professional representative like a certified business intermediary specialized in M&A deals to manage the process while you continue to maintain your business. The IT broker will do the heavy lifting by marketing to and negotiate with vetted buyers and close for a reasonable price.

See how Rogerson Business Services sold businesses in California by Visiting These Case Studies.

If you have decided to value and then sell your IT services business now or within the next six months, click here to get started with this quick and simple form, so we can understand your pain points better and prioritize your inquiry with RBS Advisors.

Go to the next article: Part of tips to selling an Information Technology Services Company in California series ->

Hey there! Can we send you a gift?

We just wanted to say hi and thanks for stopping by our little corner of the web. :) we'd love to offer you a cup of coffee/tea, but, alas, this is the Internet.

However, we think you'll love our email newsletter about building value and properly position your company before transition/exit your business ownership.

As a special welcome gift for subscribing, you'll also get our helping and educational guides, tips, tutorials, etc.. for free.

It's filled with the best practices for retiring serial business owners like Dan Gilbert, Larry Ellison, Warren Buffett, and many more.

Just sign up for our emails below.