How Much Can I Sell My Business For | Determine Business Worth

How Much Can I Sell My Business For?

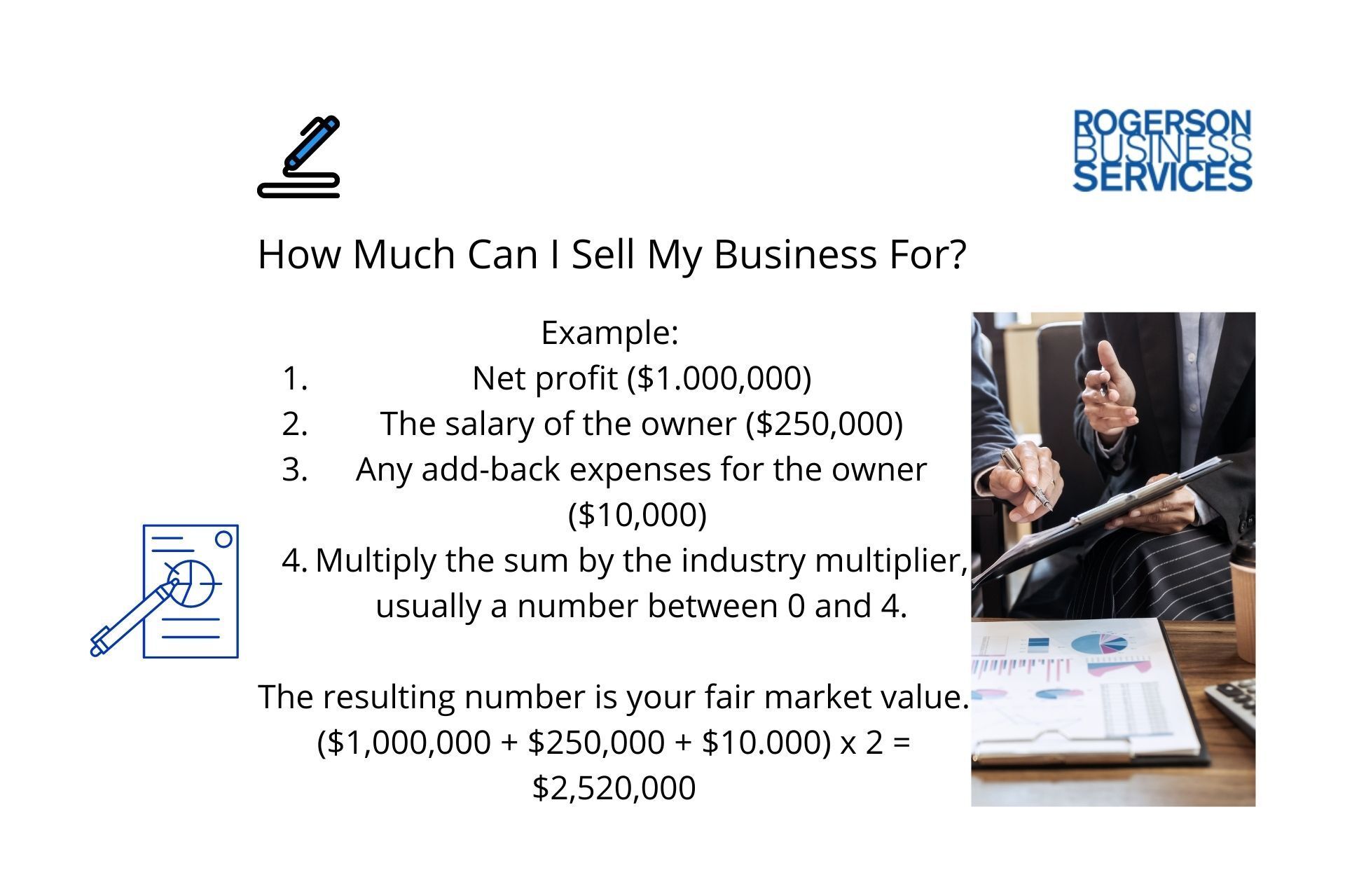

A business in California might sell 2 to 3 times the seller's discretionary earnings. The fair market value is what the business would sell for on the free market. It uses the SDE and the industry multiplier.

A California-based business owner asking: "how much can I sell my business for?" A business in California might sell two to three times the seller's discretionary earnings. The fair market value is what the business would sell for on the free market. It uses the SDE and the industry multiplier.

Example:

- Net profit ($1,000,000)

- The salary of the owner ($250,000)

- Any add-back expenses for the owner ($10,000)

- Multiply the sum by the industry multiplier, usually a number between 0 and 4.

The resulting number is your fair market value. ($1,000,000 + $250,000 + $10,000) x 2 = $2,520,000

Many factors go into determining how much a business is worth. These 5 methods of valuation can assist in finding out how much you can sell your California-based lower middle market business for.

Here is a post you might be interested to check out: How Much is a $10 Million Business Worth?

Business Valuation Formulas

While not an extensive list, these eight business valuation methods can assist in determining how much the business is worth.

A mergers and acquisitions broker specializing in the lower middle-market businesses can assist with choosing the one that best suits your business’ situation.

- Market value: The simplest calculation and, therefore, the most common valuation method. It takes the current value of the business’ shares and multiplies it by the number of shares that are currently outstanding.

- Asset-based: This method looks at your total net assets and deducts your total liabilities. For businesses that will continue operating during the sale, use the current assets to calculate the value. Companies that cease operations use a liquidation method that includes revenue from selling assets like equipment.

- Capitalization of earnings: Determines the business’s future profitability to give value today. This uses the cash flow, return on investment (ROI), and assumed value.

- Book value: Using your balance sheet, it’s the value of your total shareholder’s net equity, that is, total assets minus liabilities.

- Replacement value: It’s simply the cost it would take to replace everything in the business at present-day values.

- Multiples of earnings: The times revenue method multiplies the average of previous years' revenue with a multiplier unique to their business. If you're asking: "What multiple my California business is worth? We took a deep dive so you are more equipped in this guide.

- Liquidation: Calculated by determining the total value of all assets if you liquidated the business. A suitable method for companies with high assets but perhaps a lower market or income value.

- ROI-based: the ROI method concerns what an investor will receive if they buy into the company. The investor supplies equity in exchange for a percentage return. The calculation is the amount paid divided by the percentage as a decimal.

If an investor buys into XYZ Inc with $10,000 for 25% (0.25), the valuation is: 10,000/0.25 = $40,000. The quick valuation amount would be $40,000.

Determine Fair Market Value

Unlike the valuation of the business, the fair market value is what the California-based lower middle market business would sell for on the free market. It uses the SDE and the industry multiplier.

Example:

- Net profit ($1,000,000)

- The salary of the owner ($250,000)

- Any add-back expenses for the owner ($10,000)

- Multiply the sum by the industry multiplier, usually a number between 0 and 4.

An M&A broker in the lower middle market can help you figure out the multiplier.

The resulting number is your fair market value. ($1,000,000 + $250,000 + $10,000) x 2 = $2,520,000

Times Revenue Method

Also known as the multiples of revenue method, the times revenue calculation uses actual revenue from the past fiscal years and then times it by a set multiplier to calculate the total business worth.

The time revenue method determines a business’ worth by calculating a range of values, including an absolute minimum, known as the floor, and a maximum value known as the ceiling for a business. A lower middle market business can then find a middle-ground for selling with these two values.

The Multiplier

The times revenue method is dependent on using the correct multiplier for your business. However, the multiplier is dependent on a variety of factors which can include:

- The location

- The size of the business

- The industry and current market trends

- Business’ tangible assets like real estate

A business appraiser or valuation consultant can assist with determining the multiplier for your evaluation to ensure you end up with a fair and accurate fair market value.

The average times revenue calculation may include a multiplier that is a factor of one to two or even as high as three to four if the business is poised to grow quickly in the upcoming season.

Service industries or companies with a low forecasted future may use less than one.

Since the calculation focuses on revenue rather than profit, the number could be inaccurate for businesses with high revenue but high costs.

The favored method for young businesses with either very low or drastically changing revenue or are forecasted to do exceptionally well.

Company Valuation Reports

When determining your business’ worth, there are three levels of a report that an advisor can draw up, ranging from a minimum amount of information to a complete, detailed account of the business.

Choosing the correct report for your situation is essential to avoid excluding information without overpaying for detail that isn’t required.

1. Calculation

The least-detailed valuation report includes a valuation of the business's shares, interest, and assets. It contains calculations to show this value but doesn’t corroborate the information and relies on the truthful presentation of the necessary information.

This report is best for small to medium-size businesses for tax purposes or passing a business from parent to child. Companies involved as part of a family dispute may only require a calculation report if the parties involved are already familiar with the business.

It may not have enough information to satisfy a buyer if you’re selling the lower middle market business in California to an outside party.

2. Estimate

A report that offers more information than a calculation report but less than a comprehensive, it details everything that a calculation report offers, plus analysis and corroborates the numbers.

Medium to large-sized businesses may use this report for:

- Tax purposes

- Litigation

- Sale of the business, especially a sale between shareholders

A small or very new business in California may find this report useful, but a business with a legacy may wish to obtain more information to ensure as high of a market valuation as possible.

3. Comprehensive

This is the most detailed valuation report that includes everything from an estimate report to a further detailed analysis of the market trends, industry, and factors that may further influence the value.

The report aims to provide a well-rounded snapshot of the business, both past, and future, to reinforce the seller’s claims.

It’s a good choice for selling a lower middle market business to middle-market companies outside the family since it paints the whole picture for potential buyers.

The added costs may not be worth it for very small and new businesses in the Golden State that don’t have as much information for the M&A broker to assess.

Hire an M&A Advisor

Hiring an M&A Advisor or broker can be the difference between a reasonable valuation and a not-so-great one.

Valuing a business is not easy, especially for the busy business owner. Advisors have made it their career to provide the reports and advice necessary to assign the correct number to your business.

Ensure you have the best information by hiring an M&A advisor, and allow them to use their knowledge to consider the factors to increase the value of your business.

Final Take: Maximize Business Value Before Selling

Valuing and Selling a business in California can be overwhelming to any retiring baby boomer business owner in California. Determining the value of the business, its assets, and operations is also a critical task. To ensure you are getting the most out of your enterprise, you must partner with an M&A Advisor to guide you through the sell-side M&A process. Your business has come a long way, so make sure you maximize the value of your business before selling it successfully.

If you are a retiring business owner looking to exit your lower middle market business in California, here are five tips to get you started:

1. Don't wait until the last minute to start planning your exit. The process of selling a lower middle market business can take a long time, so it's important to start early.

2. Have a clear idea of what you want to get out of the sale. Know your goals and what you're willing to negotiate.

3. Choose the right type of buyer. Not all buyers are created equal, so do your research and find the right one for your business.

4. Be prepared for a lot of due diligence. M&A buy-side due diligence is when buyers will want to know everything about your business, so be ready to provide documentation and answer questions.

5. Be flexible with the terms and conditions of the deal. It's important to be open to negotiation to get the best possible deal for your business.

Rogerson Business Services, also known as, California's lower middle market business broker is a sell-side M&A advisory firm that has closed hundreds of lower middle-market deals in California. We are dedicated to helping our clients maximize value and achieve their desired outcomes.

We have a deep understanding of the Californian market and an extensive network of buyers, which allows us to get the best possible price for our clients. We also provide comprehensive support throughout the entire process, from initial valuation to post-closing integration.

Our hands-on approach and commitment to our client's success set us apart from other firms in the industry. If you consider selling your lower middle market business, we would be honored to help you navigate the process and realize your goals.

If you have decided to value and then sell your lower middle market business or still not ready, get started here, or call toll-free 1-844-414-9600

and leave a voice message with your question and get it answered within 24 hours. The deal team is spearheaded by Andrew Rogerson, Certified M&A Advisor, he will personally review and understand your pain point/s and prioritize your inquiry with Rogerson Business Services, RBS Advisors

Go to the next article: Part of business valuation to answer what's my company worth series ->

Or, get a free assessment - no strings attached! Fill out the form below and submit.

Hey there! Can we send you a gift?

We just wanted to say hi and thanks for stopping by our little corner of the web. :) we'd love to offer you a cup of coffee/tea, but, alas, this is the Internet.

However, we think you'll love our email newsletter about building value and properly position your company before transition/exit your business ownership.

As a special welcome gift for subscribing, you'll also get our helping and educational guides, tips, tutorials, etc.. for free.

It's filled with the best practices for retiring serial business owners like Dan Gilbert, Larry Ellison, Warren Buffett, and many more.

Just sign up for our emails below.