Should I Sell My Business & Retire: 2023 Industrial Machinery Manufacturer In California

Should I Sell My Business And Retire

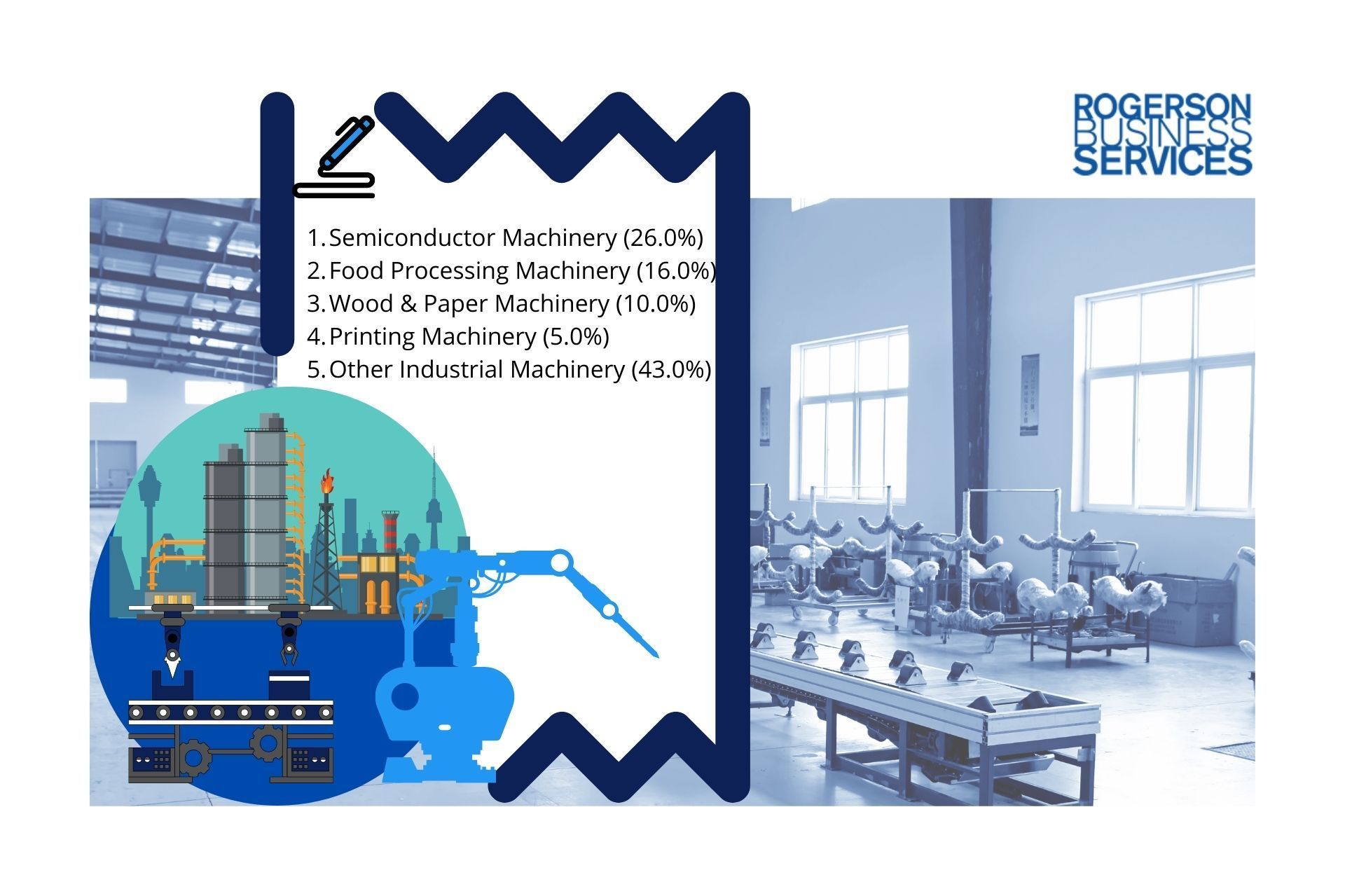

The 2023 market for buying and selling industrial machinery manufacturer companies in California will be particularly favorable for sellers, specifically in certain machinery and industrial industries breakdown by revenue:

- Semiconductor Machinery (26.0%)

- Food Processing Machinery (16.0%)

- Wood & Paper Machinery (10.0%)

- Printing Machinery (5.0%)

- Other Industrial Machinery (43.0%)

In a nutshell, there are 2,900 industrial machinery manufacturers in the United States and 1,073 manufacturers located in the State of California according to Dun & Bradstreet.

California & US Industrial Machinery Manufacturing Landscape

The average industrial machinery manufacturer has 40 employees and produces about $13 million in annual revenue.

- About 2,900 companies employ 116,000 workers and generate $38 billion in annual revenue.

- 64% of firms have less than 20 employees.

- About 236 facilities are very large, employing 500 or more workers.

- Large companies include Siemens AG, ABB, Honeywell, and General Electric.

Source - Virtual IQ | NAICS 3332, SIC 355

In California, as in the US, an increasing share of industrial machinery manufacturers are owned by small and medium-sized companies accounting for 63 percent.

A recent study showed that the share of industrial machinery manufacturers owned by:

- female entrepreneurs are 11%

- followed by 9.9% veteran owned

- and finally, 7% are owned by minorities.

Thirty-nine percent are classified under a corporate entity.

Send us an email to support@rogersonbusinessservices.com and get the full list of manufacturers sold.

Growth Drives M&A Activity

The machinery industrial manufacturing industry saw steady M&A activity in 2022, with over 8 mergers and acquisitions.

According to Vertical IQ Industrial Machinery Manufacturing Report, sales for the US industrial machinery manufacturers industry are forecast to grow at a 0.89% compounded annual rate from 2022 to 2027, slower than the growth of the overall economy.

In addition, California accounts for the largest concentration of industrial machinery manufacturers in the United States with an estimated 45% of total establishments headquartered in the golden state.

Rogerson Business Services have been brokering manufacturing companies since 2006 in California. We have sold many manufacturing-related businesses in various niches and sectors. Most recently, we sold a $36 million manufacturing company deal in 2021.

Get A Copy Of The Full-34-Pages-Industiral-Machinery-Manufacturers-Industry-Report: DOWNLOAD

The market is bullish in California, but certain factors can influence this market environment.

Let’s dive in…

Selling Your Business in 2023

Selling your business in 2023 depends on the industry and market factors. Here are 5 factors that determine now is the right time to sell your company in the manufacturing industry and retire.

One: Interest Rates

The industrial machinery manufacturing industry is an attractive investment for private equity firms, strategic buyers, and acquirers alike.

With now marking a great time to sell your lower middle market industrial machinery manufacturer in the second quarter, the sale of your business in 2023 could be the perfect opportunity: current interest rates make it particularly attractive to strategic buyers, but not so much to private equity.

In light of recent Fed action towards keeping high rates elevated long-term - this looks like an opportune moment! Selling your manufacturing business now is the perfect economic time to make you laugh all the way to the bank.

Two: Interested Strategic Buyers

California is home to some of the most sought-after strategic buyers in the industrial machinery industry, like:

- Food Processing Machinery

- Semiconductor Machinery

- Wood & Paper Machinery

- Printing Machinery

The recent acquisition of California Expanded Metal Products Co., Inc. (CEMCO) by JFE Shoji America Holdings, Inc. has been met with excitement and optimism in the steel framing industry.

As a strategic buyer, JFE Shoji America Holdings recognized the significant value that CEMCO brings to their organization and are eager to explore the opportunities this acquisition presents.

With CEMCO's established distribution network and customer base, JFE Shoji America Holdings is looking to expand its presence in the North American market and strengthen its position in the steel framing industry.

By acquiring CEMCO's expertise and capabilities, they are looking to enhance their competitiveness and provide even greater value to their customers.

The decision to acquire CEMCO was based on several key factors. One of the most important factors was the ability to leverage the synergies between the two companies. By combining their strengths and capabilities, JFE Shoji America Holdings and CEMCO can enhance their value proposition for customers and drive sustainable growth for the organization.

In addition, JFE Shoji America Holdings is committed to developing new businesses and exploring opportunities to diversify its product portfolio.

With CEMCO's products being used in a variety of applications, including commercial and residential construction, infrastructure, and industrial applications, the acquisition provides JFE Shoji America Holdings with the opportunity to expand its reach into new markets and create new growth opportunities.

Overall, the acquisition of CEMCO by JFE Shoji America Holdings is a strategic move that is expected to provide significant benefits to both organizations. It is an exciting time in the steel framing industry, as companies like JFE Shoji America Holdings continue to explore new opportunities for growth and expansion.

Another acquisition in the ever-evolving industrial machinery manufacturing industry, there has been a recent acquisition that resembles a strategic buyer perspective in California. This acquisition has garnered significant attention due to the potential benefits it presents to the acquiring company, Afinitas.

The decision to acquire Haala Industries was not made lightly. It was based on a careful and thorough analysis of the strengths and opportunities of both companies. Afinitas recognized the potential for synergies between the two companies and seized the opportunity to expand its product offerings and strengthen its position in the market.

The acquisition of Haala Industries is expected to enable Afinitas to enhance its value proposition for customers and create new growth opportunities for the organization.

With the addition of Haala Industries' expertise and capabilities, Afinitas is now even better positioned to continue its leadership in the industrial machinery production or manufacturing for the construction concrete industry and provide even greater value to its customers.

As an M&A advisor, I am confident that this acquisition is a strategic move that will deliver significant benefits to both organizations.

The successful integration of Haala Industries into Afinitas will unlock many opportunities for growth and value creation. Both companies are committed to working together to achieve these goals.

The recent acquisitions in the industrial machinery manufacturing industry in California indicate that strategic buyers are bullish in their pursuit of companies in this sector.

The following are the major key factors that summarize why strategic buyers are interested in acquiring industrial machinery manufacturers in California:

- Synergy potential: Strategic buyers are interested in companies that have the potential to create synergies with their existing operations. The acquisitions of Haala Industries and CEMCO by Afinitas and JFE Shoji America Holdings, respectively, are both examples of acquisitions that offer significant synergy potential.

- Product expansion: Acquiring companies with complementary products and capabilities can help strategic buyers expand their product offerings and strengthen their position in the market. This is evident in the decision by Afinitas to acquire Haala Industries, which will enable them to enhance their value proposition for customers and create new growth opportunities.

- Market positioning: Acquiring companies in the same industry can help strategic buyers improve their position in the market. The acquisition of CEMCO by JFE Shoji America Holdings will enable the company to enhance its market positioning and better serve its customers.

- Expertise and capabilities: Acquiring companies with specific expertise and capabilities can help strategic buyers improve their operational efficiency and competitiveness. The addition of Haala Industries' expertise and capabilities will enable Afinitas to continue its leadership in the concrete industry and provide even greater value to its customers.

- Growth opportunities: Strategic buyers are interested in companies that offer growth opportunities. The acquisitions of Haala Industries and CEMCO by Afinitas and JFE Shoji America Holdings, respectively, are both expected to create new growth opportunities for the acquiring companies.

In conclusion, the recent acquisitions in the industrial manufacturing sector indicate that strategic buyers are bullish in their pursuit of companies in this sector.

The above factors demonstrate why strategic buyers are interested in acquiring industrial machinery manufacturers in California and the potential benefits that such acquisitions can bring.

Three: Capital

Seize the moment to leverage excellent business prospects with ample capital accessible.

Preqin, a leading provider of data and insights on the alternative assets industry, has released its 2023 Private Equity Outlook report.

The report provides an in-depth analysis of the private equity market and predicts trends that are likely to shape the industry in the coming year.

According to the report, the private equity market is expected to continue to grow in 2023, with record amounts of capital available for investment.

The report highlights that the largest private equity firms are expected to continue to dominate the market, while smaller firms are expected to face increasing competition and pressure to differentiate themselves.

The report also notes that there is likely to be continued demand for private equity investments, particularly from institutional investors such as pension funds and sovereign wealth funds.

However, the report cautions that investors may become more selective in their investments, focusing on funds that have a proven track record of delivering strong returns.

In terms of investment strategies, the report predicts that private equity firms will continue to pursue a variety of approaches, including buyouts, growth capital, and distressed investments.

The report notes that there is likely to be a continued focus on investments in the technology and healthcare sectors, which have been strong performers in recent years.

The report also highlights the increasing importance of environmental, social, and governance (ESG) factors in the private equity industry.

According to the report, investors are increasingly focused on the ESG performance of the companies in which they invest, and private equity firms are responding by incorporating ESG considerations into their investment processes.

Overall, the Preqin 2023 Private Equity Outlook report suggests that the private equity market will continue to be strong in the coming year, with increasing amounts of capital available for investment and continued demand from investors.

The report also highlights the importance of differentiation, selective investment, and ESG considerations for private equity firms seeking to succeed in the current market.

It's clear from the enormous amount of cash held in S&P 500 entities and private equity funds that there's a strong desire to invest in well-established businesses over the next year.

The impressive sum, which adds up to almost $3.7 trillion, is a clear indication that small business owners can feel confident about attracting potential buyers when the time comes to sell.

By focusing on preparing their business for sale, these owners can take advantage of this optimistic market trend and potentially secure a great deal.

Whether you're looking for growth or an exit strategy in 2023, a forward-thinking industrial machinery manufacturer that keeps its financials impeccably organized can provide strong valuation metrics and ensure success!

Warren Buffett would approve.

Four: California Capital Gains Tax

California acknowledges the complexities that taxes may entail.

As a lower middle market manufacturing owner in California, you should know that the capital gains tax laws have changed recently, and the good news is that there are now opportunities to reduce your tax liability.

The California Department of Tax and Fee Administration (CDTFA) now offers a new option that allows business owners to defer their capital gains tax by investing in Qualified Opportunity Zones (QOZs).

By taking advantage of this option, business owners can reinvest their profits into areas that need it most and potentially reduce their tax liability at the same time.

Additionally, the Tax Cuts and Jobs Act (TCJA) offers further potential benefits for business owners. For example, the Section 199A deduction can provide significant tax savings for eligible businesses, while the doubling of the estate tax exemption can be a game-changer for those looking to transfer wealth to future generations.

Overall, while capital gains tax can be a concern for many business owners, there are now several options available that can help reduce the burden. By staying informed and seeking the advice of qualified professionals, business owners can navigate these changes and potentially reap significant benefits.

Five: When To Sell Your Business

Industrial and machinery manufacturers in California have the opportunity to make strategic decisions that could lead to tremendous growth in the coming years.

While waiting until 2028 may provide the optimal exit or capital raise opportunity, those nearing retirement should carefully consider their readiness to do so.

Business owners have a choice to make – wait for the market to rebound in 5-10 years, or take advantage of potential growth now by assessing the market conditions of early 2023.

With appropriate strategizing and planning, business owners can position themselves for valuations that maximize profits later down the road.

Despite some potential challenges, such as timing and economic cycles, there is a reason for optimism in the buy-sell market.

Rogerson Business Services has defied expectations and continued to thrive, setting an impressive trend of growth for years ahead.

The 2022 business trading climate was fueled by several factors that are expected to continue in 2023, presenting an exciting opportunity for industrial and machinery manufacturers in California to capitalize on the market conditions and achieve tremendous success.

Selling a Manufacturing Business in 2023 is the Right Time, Why?

As the "baby boomer" generation reaches its golden years, there's a significant shift in the business world that's creating a buzz. With M&A transactions set to soar in 2023, Rogerson Business Services is anticipating a windfall of cash flow multiples that will entice more sellers to exit the buy-sell market.

Even the Oracle of Omaha himself, Warren Buffett, is giving his nod of approval to this prime opportunity. He believes that it's the perfect time for transitioning business owners to capitalize on these favorable conditions and reap the rewards of their years of hard work.

Excitingly, Rogerson Business Services predicts that the 2023 buy-sell landscape in California's industrial machinery manufacturing industry will be nothing short of an attractive playground for buyers, sellers, and investors alike.

Retiring manufacturing company owners can expect a smooth and efficient deal process with generous cash flow multiples as a reward for their dedication to success.

As Warren Buffett famously says, "Price is what you pay; value is what you get." So, if you're a business owner looking to sell, now is the time to take advantage of this incredible opportunity to secure maximum value for your life's work.

And if you're a buyer or investor, get ready to be blown away by the excellent deals and potential returns that await you in the buy-sell market.

California’s GDP is Over $4.1 Trillion

California, the Golden State, has set itself on a path to becoming the world's fourth-largest economy!

This remarkable achievement is due to the state's unwavering commitment to innovation and sustainability, making California a leader in several industries, including technology, healthcare, and renewable energy.

According to Bloomberg, California is projected to have a gross domestic product of over $4.1 trillion by the end of 2022, surpassing countries like Germany and the United Kingdom.

Here are some key highlights:

- California is expected to become the world's fourth-largest economy, according to Bloomberg.

- This is due to California's diverse industries, such as technology, entertainment, agriculture, and renewable energy, which have helped the state grow economically.

- Governor Gavin Newsom has emphasized the importance of investing in these industries to maintain and enhance California's economic growth.

- The state's economic success has also been attributed to its ability to attract top talent and entrepreneurs.

- However, challenges such as high housing costs, income inequality, and climate change must be addressed to sustain this growth.

- Despite these challenges, California's potential for continued economic success remains high, and its position as a global economic leader is expected to strengthen in the coming years.

The industrial machinery manufacturing industry is a critical sector of the economy that produces equipment, machinery, and components used in manufacturing, construction, and other industries.

This industry comprises a diverse group of businesses that manufacture products ranging from large-scale machinery to small components.

In recent years, the industrial machinery manufacturing industry has faced challenges such as increasing competition, rising raw material costs, and shifting consumer demand.

Despite these challenges, the industry remains an attractive target for investors and strategic buyers due to its potential for growth and innovation.

One key trend in the industrial machinery manufacturing industry is the increasing use of technology and automation.

Companies are investing heavily in advanced manufacturing technologies such as:

- robotics,

- artificial intelligence,

- and the internet of things to improve efficiency and productivity.

Another trend is the shift towards sustainability and environmental responsibility.

Companies are developing products and processes that minimize waste and reduce energy consumption, in response to changing customer demands and regulations.

The industrial machinery manufacturing industry is also influenced by global economic conditions and trade policies. Changes in tariffs, currency exchange rates, and political stability can impact the industry's growth and profitability.

Overall, the industrial machinery manufacturing industry offers significant opportunities for investors and strategic buyers.

The key factors that make this industry attractive include its potential for growth and innovation, increasing use of advanced manufacturing technologies, and the growing emphasis on sustainability and environmental responsibility.

In today's highly competitive market, manufacturers must focus on maximizing their value by taking various factors into account.

From controlling costs related to labor, raw materials, transportation, and production processes to understanding consumer habits and preferences, manufacturers must continually innovate and improve their quality control to stay ahead of the curve.

Expanding into new markets, customers, and partnerships is another way for companies to stay ahead of the competition. However, manufacturers must prioritize digital transformation while ensuring compliance with existing regulations to remain efficient and competitive.

Moreover, strategic buyers will be seeking companies with an international presence or those that can help them expand into global markets, making it essential for manufacturers to consider their international presence.

To survive in today's ever-evolving market, manufacturers must consider these elements and work to create a robust business model that prioritizes innovation, quality control, and efficient digital transformation.

Ultimately, this will enable manufacturers in California to remain viable and profitable in the long term.

“While critics often say California’s best days are behind us, reality proves otherwise – our economic growth and job gains continue to fuel the nation’s economy,” said Governor Newsom. “California’s values and entrepreneurial spirit have powered this ascent to becoming the 4th biggest economy in the world, and we’ll continue doubling down on industries of the future, like renewables and clean energy. I feel tremendous pride in California’s resilience, leadership, and formula for success.”

If you are looking to value and sell your industrial machinery manufacturing business in 2023, the fundamentals remain.

Is Now A Good Time To Sell?

In a nutshell, now is the best time to exit and sell your industrial machinery manufacturer.

The equipment manufacturing industry is gearing up for a year of growth and innovation in 2023.

With technological advancements and an optimistic economic outlook, manufacturers are poised to make significant strides forward in the coming year.

Key players in the industry are focused on improving their supply chains, optimizing production processes, and investing in research and development to create cutting-edge equipment that meets the evolving needs of consumers.

From smart factories to renewable energy solutions, manufacturers are embracing new technologies and harnessing the power of data to drive growth and efficiency.

In addition to technological advancements, equipment manufacturers are also paying close attention to the changing landscape of global trade and supply chain disruptions.

By developing contingency plans and exploring new markets, manufacturers are positioning themselves for success in an uncertain economic climate.

As we move into 2023, the equipment manufacturing industry is primed for growth and innovation. With a focus on technology, efficiency, and adaptability, manufacturers are prepared to meet the challenges and opportunities of the coming year head-on.

If you're considering diving into the market of selling a manufacturing business, let Rogerson Business Services guide your way.

Our experienced advisors know how to get deals done quickly and safely for both motivated buyers and sellers through full disclosure.

Thanks to our expertise in 2022, we were able to successfully facilitate numerous successful sales in California's lower-middle market!

Don't wait any longer - reach out today so that together, we can make sure your sale is as smooth sailing as a $36 million manufacturing company was sold in 2021.

See the case study!

Positioning Your Manufacturer For An Acquisition

As a manufacturing company owner, you've invested blood, sweat, and tears into building your business.

But now, you're ready to take the next step: selling your company through a strategic acquisition. This can be a complex process, but with the right approach, you can set your business up for success and maximize its value.

It's understandable to feel overwhelmed at the thought of cleaning up your financials, streamlining operations, and making sure everything is in order. But fear not, because this step is crucial to ensuring that you get the best possible value for your life's work.

First and foremost, cleaning up your financials is a must. Potential buyers will scrutinize your financial records, so it's important to make sure everything is accurate and up to date.

This means organizing your records, reconciling accounts, and ensuring that your books are in order. If you're not a financial expert, it may be worth bringing in a professional to help you with this process.

In addition to financials, streamlining your operations is also critical. Take a hard look at your business processes and identify areas where you can improve efficiency. This may involve cutting unnecessary expenses, optimizing production, or implementing new technologies. By making your business more efficient, you'll be able to demonstrate its potential to potential buyers.

Finally, having a clear understanding of your business's value and potential is key to accurately presenting it to potential buyers. This means identifying your company's unique selling points, such as your intellectual property, customer base, or manufacturing capabilities. It's important to be honest about your business's strengths and weaknesses, as this will help potential buyers make informed decisions.

In summary, preparing your manufacturing company for a strategic acquisition is no small feat.

But by taking the time to:

- clean up your financials,

- streamline operations,

- and understand your business's value,

- you'll be setting yourself up for success.

Remember, this process can be emotional, as you're preparing to let go of a business you've poured your heart and soul into. But by focusing on the potential opportunities that lie ahead, you'll be able to find the motivation and drive to see it through.

As an industrial machinery manufacturer, you may be in growth mode, or perhaps you're reaping the rewards of a mature, established business. Whatever the case may be, it's crucial to take a holistic approach when considering the sale of your business.

The decisions you make now can have a significant impact on the value of your business in the future.

In the words of Warren Buffett, "Price is what you pay; value is what you get." This is particularly true when it comes to selling your manufacturing business.

To ensure that you maximize its value, it's essential to work with experts who have a proven track record of success.

That's where Rogerson Business Services comes in.

With years of experience helping lower-middle-market manufacturing businesses, we have the expertise to guide you on your journey toward getting your desired return on investment.

Whether you're just starting to consider selling your manufacturing business or you're ready to take the plunge, Rogerson Business Services is here to help.

And with the 2023 buy-sell industrial machinery manufacturing trading landscape looking particularly bullish, there's never been a better time to position yourself for success.

So why wait?

Contact Rogerson Business Services today and let them help you unlock the true value of your manufacturing business.

Articles and Videos Worth Checking Out:

1)

2023 Market Policy and Outlook

2) Baby Boomers Infrastructure & 2023 Outlook

3) California Manufacturing Facts

4) Occupational Employment and Wage Statistics

5) Equipment Manufacturers Plugged in for Growth in 2023

Final Take

If you are a retiring business owner looking to exit your lower middle market manufacturer in California, here are six tips to get you started:

1. Don't wait until the last minute to start planning your exit. The process of selling a lower middle market manufacturing business can take a long time, so it's important to start early.

2. Have a clear idea of what you want to get out of the sale. Know your goals and what you're willing to negotiate.

3. Know what's your company's worth. This is an essential step to take when planning to sell your manufacturing business in California.

4. Choose the right type of buyer. Not all buyers are created equal, so do your research and find the right one for your business.

5. Be prepared for a lot of due diligence. M&A buy-side due diligence is when buyers will want to know everything about your business, so be ready to provide documentation and answer questions.

6. Be flexible with the terms and conditions of the deal. It's important to be open to negotiation to get the best possible deal for your business.

Rogerson Business Services, also known as, California's lower middle market business broker is a sell-side M&A advisory firm that has closed hundreds of lower middle-market deals in California. We are dedicated to helping our clients maximize value and achieve their desired outcomes.

We have a deep understanding of the Californian market and an extensive network of buyers, which allows us to get the best possible price for our clients. We also provide comprehensive support throughout the entire process, from initial valuation to post-closing integration.

Our hands-on approach and commitment to our client's success set us apart from other firms in the industry. If you consider selling your lower middle market manufacturing business, we would be honored to help you navigate the process and realize your goals.

If you have decided to value and then sell your lower middle market manufacturing company or still not ready, get started here, or call toll-free 1-844-414-9600 and leave a voice message with your question and get it answered within 24 hours. The deal team is spearheaded by Andrew Rogerson, Certified M&A Advisor, he will personally review and understand your pain point/s and prioritize your inquiry with Rogerson Business Services, RBS Advisor

Part of tips to selling a manufacturing company in California series ->

Hey there! Can we send you a gift?

We just wanted to say hi and thanks for stopping by our little corner of the web. :) we'd love to offer you a cup of coffee/tea, but, alas, this is the Internet.

However, we think you'll love our email newsletter about building value and properly position your company before transition/exit your business ownership.

As a special welcome gift for subscribing, you'll also get our helping and educational guides, tips, tutorials, etc.. for free.

It's filled with the best practices for retiring serial business owners like Dan Gilbert, Larry Ellison, Warren Buffett, and many more.

Just sign up for our emails below.